FATCAHelp501Internal Revenue Service Form

Understanding the FATCA Declaration for Entities

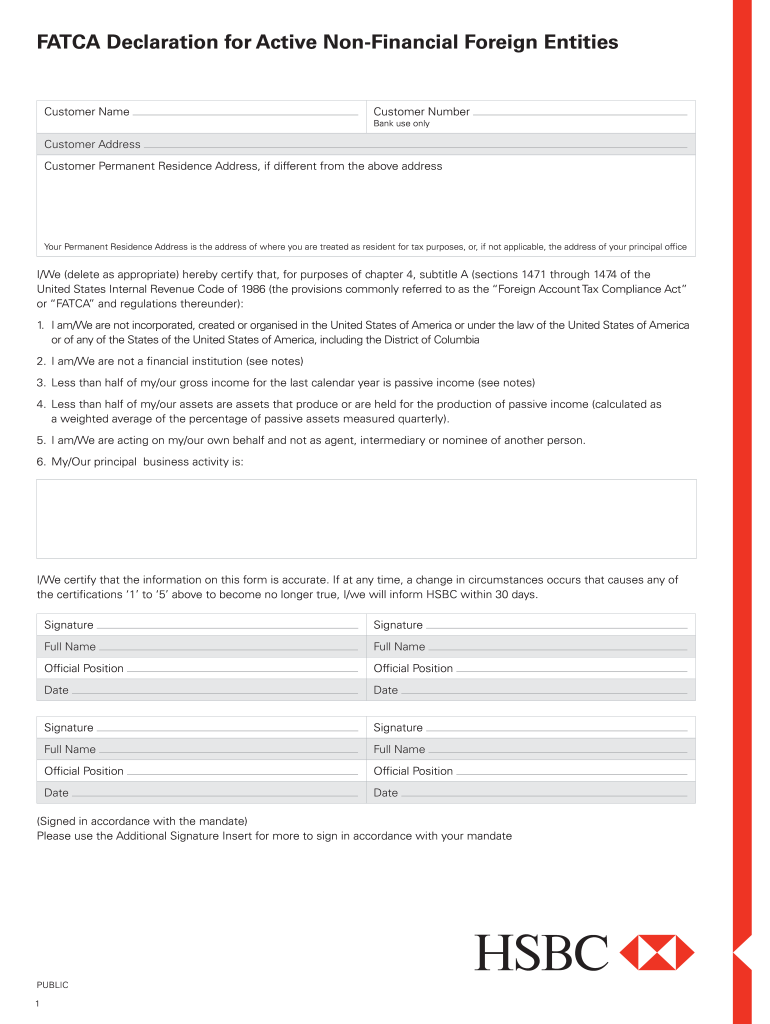

The FATCA declaration entities form is essential for foreign financial institutions and certain non-financial foreign entities. This form is used to report information regarding U.S. account holders to the Internal Revenue Service (IRS). Understanding the requirements of this form is crucial for compliance with U.S. tax laws. The form helps ensure that foreign entities disclose their U.S. account holders accurately, which is a key aspect of FATCA regulations.

Steps to Complete the FATCA Declaration for Entities

Completing the FATCA declaration entities form involves several important steps:

- Gather necessary information about the entity, including its legal name, address, and tax identification number.

- Identify all U.S. account holders associated with the entity and collect their relevant details.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form to the IRS by the specified deadline, ensuring to keep a copy for your records.

Required Documents for FATCA Declaration

When preparing to complete the FATCA declaration entities form, several documents are necessary:

- Proof of the entity's legal status, such as articles of incorporation or partnership agreements.

- Tax identification number or equivalent for the foreign entity.

- Documentation of U.S. account holders, including names, addresses, and taxpayer identification numbers.

- Any prior FATCA forms submitted, if applicable, to ensure consistency and compliance.

Legal Use of the FATCA Declaration for Entities

The FATCA declaration entities form must be used in accordance with U.S. law. It is important to understand that failure to comply with FATCA regulations can result in significant penalties. The form serves as a legal document that helps the IRS track foreign financial accounts held by U.S. citizens and residents. Entities must ensure that the information provided is accurate and complete to maintain compliance and avoid legal repercussions.

Filing Deadlines for FATCA Declaration

Entities must be aware of the filing deadlines associated with the FATCA declaration. Typically, the form must be submitted annually, with specific deadlines set by the IRS. Missing these deadlines can lead to penalties and additional scrutiny from tax authorities. It is advisable to check the IRS website or consult with a tax professional to stay informed about any changes to these deadlines.

Penalties for Non-Compliance with FATCA

Non-compliance with FATCA regulations can result in severe penalties for entities. These penalties may include:

- Fines for failing to file the FATCA declaration on time or for providing inaccurate information.

- Withholding taxes on certain payments made to non-compliant entities.

- Increased scrutiny and audits by the IRS or other tax authorities.

Entities should prioritize compliance to avoid these potential consequences.

Quick guide on how to complete fatcahelp501internal revenue service

Effortlessly complete FATCAHelp501Internal Revenue Service on any device

The management of online documents has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle FATCAHelp501Internal Revenue Service on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to edit and eSign FATCAHelp501Internal Revenue Service with ease

- Obtain FATCAHelp501Internal Revenue Service and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form navigation, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign FATCAHelp501Internal Revenue Service and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatcahelp501internal revenue service

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What are FATCA declaration entities?

FATCA declaration entities refer to organizations and financial institutions that are required to comply with the Foreign Account Tax Compliance Act (FATCA). These entities must declare their U.S. account holders and report certain financial information to the IRS. Understanding FATCA declaration entities is crucial for compliance and avoiding potential penalties.

-

How does airSlate SignNow help with FATCA declaration entities?

airSlate SignNow provides an efficient platform for FATCA declaration entities to securely send and eSign essential documents. Our solution streamlines the management of compliance documents, ensuring that businesses can adhere to FATCA requirements without hassle. By using airSlate SignNow, entities can maintain accurate records and facilitate smooth communication with stakeholders.

-

What pricing plans does airSlate SignNow offer for FATCA declaration entities?

airSlate SignNow offers flexible pricing plans tailored to the needs of FATCA declaration entities. Our cost-effective solutions allow businesses of all sizes to choose a plan that fits their budget and requirements. Each plan includes features designed for seamless eSigning and document management, ensuring compliance without overspending.

-

Are there specific features beneficial for FATCA declaration entities in airSlate SignNow?

Yes, airSlate SignNow includes several features that are particularly advantageous for FATCA declaration entities. These features include customizable templates for compliance documents, automated reminders for document completion, and secure storage for sensitive information. All these tools help ensure that your FATCA documentation processes are efficient and compliant.

-

Can airSlate SignNow integrate with other systems used by FATCA declaration entities?

Absolutely! airSlate SignNow supports integrations with various third-party applications commonly used by FATCA declaration entities. Whether it’s CRM systems, accounting software, or document management tools, our platform can easily connect to enhance workflow efficiency. This integration capability ensures all aspects of your compliance processes are synchronized.

-

What are the benefits of using airSlate SignNow for FATCA declaration entities?

Using airSlate SignNow offers numerous benefits for FATCA declaration entities, including increased efficiency, enhanced compliance, and cost savings. Our user-friendly platform simplifies the eSigning process, reducing the time spent on document management. Furthermore, our secure environment helps protect sensitive financial information from unauthorized access.

-

Is airSlate SignNow compliant with FATCA requirements?

Yes, airSlate SignNow is designed with compliance in mind, including adherence to FATCA requirements. Our platform enables FATCA declaration entities to ensure their eSigned documents meet legal standards while maintaining security and integrity. Utilizing our service helps businesses avoid compliance issues and regulatory penalties.

Get more for FATCAHelp501Internal Revenue Service

- Mississippi real estate form

- Release and cancellation of lease mississippi form

- Furnished apartment lease mississippi form

- Notice of dismissal mississippi form

- Complaint mississippi 497314492 form

- Mississippi malpractice form

- Interrogatories to defendant mississippi 497314496 form

- Order granting partial summary judgment mississippi form

Find out other FATCAHelp501Internal Revenue Service

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement