CONSUMER LOAN APPLICATION 2007-2026

What is the consumer loan application?

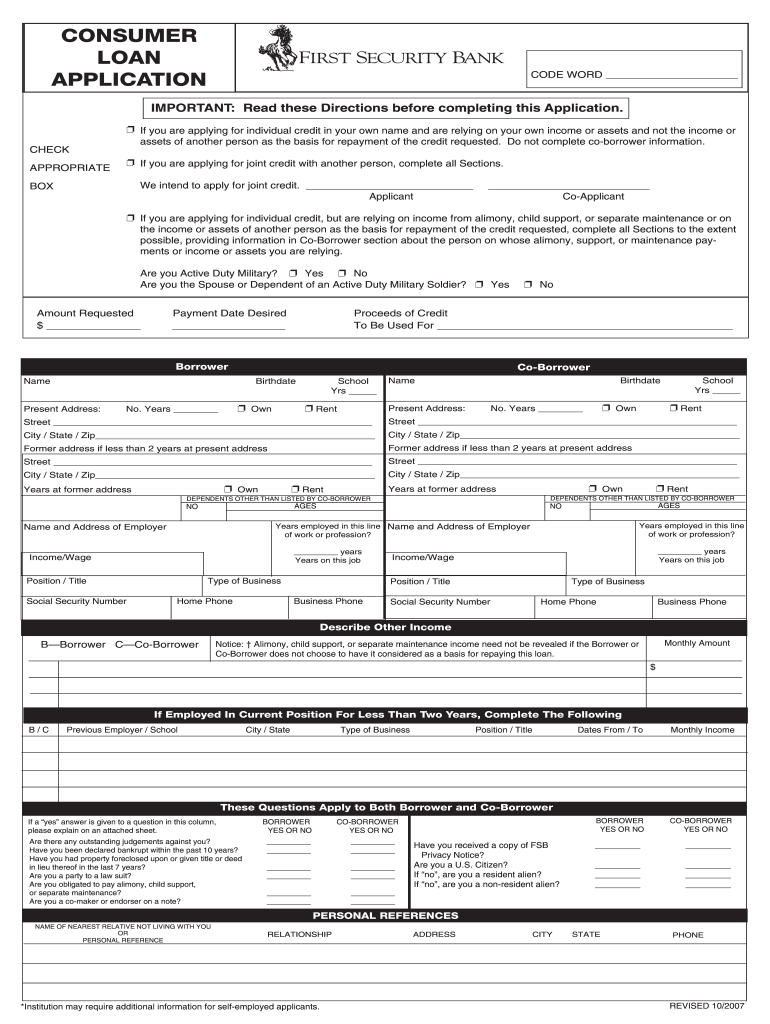

The consumer loan application is a formal document that individuals complete when seeking a loan from a financial institution. This form gathers essential information about the applicant's financial status, credit history, and personal details to assess eligibility for the loan. It typically includes sections for personal identification, employment information, income details, and the purpose of the loan. By providing this information, applicants enable lenders to evaluate their ability to repay the loan and determine the terms that may apply.

Steps to complete the consumer loan application

Completing the consumer loan application involves several key steps to ensure accuracy and completeness. Here is a straightforward process to follow:

- Gather necessary documents: Collect personal identification, proof of income, and any other relevant financial documents.

- Fill out personal information: Provide your name, address, social security number, and contact details.

- Detail employment history: Include your current employer, job title, and duration of employment.

- Disclose financial information: List your income sources, monthly expenses, and any existing debts.

- Specify loan details: Indicate the amount you wish to borrow and the purpose of the loan.

- Review and submit: Double-check all entries for accuracy before submitting the application.

Legal use of the consumer loan application

The consumer loan application must comply with various legal standards to ensure its validity. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, which means that completing the application digitally is legally binding, provided that certain criteria are met. These criteria include ensuring that the applicant has consented to use electronic records and that the application is accessible for future reference. Lenders must also adhere to fair lending laws to ensure that the application process is free from discrimination.

Key elements of the consumer loan application

Understanding the key elements of the consumer loan application can help applicants prepare effectively. Important components include:

- Personal information: This section requires basic details about the applicant, including name, address, and contact information.

- Employment and income details: Applicants must provide information about their job, salary, and any additional income sources.

- Financial obligations: This includes disclosing existing debts, monthly expenses, and any other financial commitments.

- Loan specifics: Applicants should specify the desired loan amount and its intended use, such as debt consolidation or home improvement.

Required documents

When completing a consumer loan application, certain documents are typically required to verify the information provided. Commonly requested documents include:

- Proof of identity: A government-issued ID, such as a driver's license or passport.

- Income verification: Recent pay stubs, tax returns, or bank statements to confirm income levels.

- Credit history: Lenders may request permission to access the applicant's credit report to assess creditworthiness.

- Additional documentation: Depending on the loan type, other documents may be required, such as proof of residence or asset statements.

Form submission methods

Applicants can submit the consumer loan application through various methods, depending on the lender's preferences. Common submission methods include:

- Online submission: Many lenders offer a digital platform for completing and submitting applications, making the process quick and convenient.

- Mail: Applicants may choose to print the application, fill it out by hand, and send it via postal service.

- In-person: Some lenders allow applicants to visit a branch location to complete the application with assistance from staff.

Quick guide on how to complete consumer loan application

Finalize CONSUMER LOAN APPLICATION seamlessly on any gadget

Digital document handling has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily locate the right template and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without delays. Manage CONSUMER LOAN APPLICATION on any device using airSlate SignNow's Android or iOS applications and simplify any document-reliant task today.

The simplest method to modify and eSign CONSUMER LOAN APPLICATION effortlessly

- Find CONSUMER LOAN APPLICATION and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign CONSUMER LOAN APPLICATION and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is an applicant form and how does airSlate SignNow facilitate its use?

An applicant form is a document used to collect necessary information from candidates during the hiring process. airSlate SignNow allows businesses to create, send, and eSign applicant forms easily, ensuring a smooth and efficient onboarding experience.

-

How does airSlate SignNow pricing work for using the applicant form feature?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a plan that includes features for managing applicant forms along with eSignature capabilities, without hidden fees.

-

Can I customize my applicant form with airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for applicant forms. You can add your branding, modify fields to collect specific information, and create a unique form that suits your hiring process.

-

What are the benefits of using airSlate SignNow for applicant forms?

Using airSlate SignNow for applicant forms streamlines the application process, reduces paperwork, and enhances efficiency. It ensures that forms are filled out correctly and signed, eliminating the hassle of traditional document management.

-

Does airSlate SignNow integrate with other hiring platforms for applicant forms?

Yes, airSlate SignNow seamlessly integrates with various HR and recruitment platforms. This allows you to manage your applicant forms and candidate data efficiently, enhancing your overall recruitment workflow.

-

Is it secure to send applicant forms via airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security of your documents. All applicant forms are transmitted with advanced encryption to protect sensitive candidate information and comply with data privacy regulations.

-

What types of businesses benefit from using applicant forms with airSlate SignNow?

Any business that hires employees can benefit from using applicant forms with airSlate SignNow, regardless of size or industry. From small startups to large enterprises, the platform supports efficient recruitment with easy-to-use applicant forms.

Get more for CONSUMER LOAN APPLICATION

- Ne incorporation form

- Ne corporation form

- Nebraska pre incorporation agreement shareholders agreement and confidentiality agreement nebraska form

- Nebraska domestic form

- Nebraska bylaws for corporation nebraska form

- Corporate records maintenance package for existing corporations nebraska form

- Nebraska articles of incorporation for professional corporation nebraska form

- Nebraska incorporation document form

Find out other CONSUMER LOAN APPLICATION

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe