Cibcinvestors Edge Com 2014-2026

Understanding the CIBC RESP

The CIBC RESP (Registered Education Savings Plan) is a tax-advantaged savings account designed to help families save for a child's post-secondary education. Contributions made to the RESP can grow tax-free until the funds are withdrawn for educational purposes. This plan is particularly beneficial as the Canadian government offers grants, such as the Canada Education Savings Grant (CESG), which can significantly enhance the savings accumulated within the RESP.

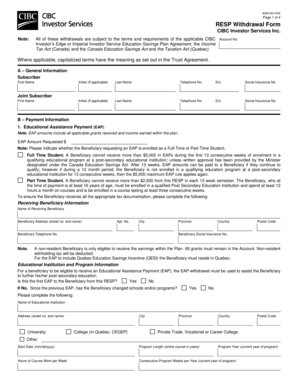

Steps to Complete the CIBC RESP Withdrawal Form

Filling out the CIBC RESP withdrawal form requires careful attention to detail to ensure compliance with regulations. Here are the key steps:

- Gather necessary documentation, including the child's identification and proof of enrollment in a qualifying educational institution.

- Access the CIBC RESP withdrawal form, which can typically be downloaded as a PDF.

- Complete the form by providing accurate information regarding the beneficiary and the amount to be withdrawn.

- Sign the form electronically or manually, ensuring that all required signatures are included.

- Submit the completed form to CIBC through the designated method, such as online submission or mailing it to the appropriate address.

Legal Use of the CIBC RESP Withdrawal Form

The CIBC RESP withdrawal form must be executed in accordance with legal standards to ensure its validity. Electronic signatures are legally binding under the ESIGN Act and UETA in the United States, provided that certain conditions are met. It is essential to use a trusted eSignature platform that complies with these legal frameworks to maintain the integrity of the form.

Required Documents for CIBC RESP Withdrawal

To successfully complete the CIBC RESP withdrawal process, specific documents are required. These typically include:

- The completed CIBC RESP withdrawal form.

- Proof of the beneficiary's enrollment in a post-secondary institution, such as an acceptance letter or registration confirmation.

- Identification documents for both the subscriber and the beneficiary, which may include government-issued IDs.

Form Submission Methods

The CIBC RESP withdrawal form can be submitted through various methods, depending on the preferences of the subscriber. Common submission options include:

- Online submission via the CIBC online banking platform.

- Mailing the completed form to the designated CIBC address.

- In-person submission at a local CIBC branch, where assistance can be provided if needed.

Examples of Using the CIBC RESP

There are various scenarios in which families might utilize the CIBC RESP for withdrawals. For instance:

- A student enrolled in a university may withdraw funds to cover tuition fees.

- A parent may use the RESP funds to pay for textbooks and other educational expenses.

- Withdrawals can also be made for part-time courses or vocational training that qualifies under RESP regulations.

Quick guide on how to complete cibcinvestors edge com

Complete Cibcinvestors Edge Com effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly without delays. Handle Cibcinvestors Edge Com on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Cibcinvestors Edge Com effortlessly

- Obtain Cibcinvestors Edge Com and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Alter and eSign Cibcinvestors Edge Com and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cibcinvestors edge com

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is CIBC RESP and how does it work?

CIBC RESP, or Registered Education Savings Plan, is a savings account designed to help families save for their children's post-secondary education. It allows you to contribute funds that grow tax-free until withdrawal for education expenses, coupled with government grants. Using CIBC RESP can make a signNow difference in financing higher education.

-

What are the benefits of using CIBC RESP?

The key benefits of CIBC RESP include tax-deferred growth on your contributions and access to government grants that boost your savings. Additionally, you can choose various investment options to suit your risk tolerance and saving goals. This makes CIBC RESP a powerful tool for ensuring your child's educational future.

-

How much can I contribute to a CIBC RESP?

You can contribute up to $50,000 per beneficiary to a CIBC RESP over its lifetime. There are also annual limits on government grants based on your contributions. It's essential to understand these limits to maximize your benefits and savings potential.

-

What fees are associated with CIBC RESP accounts?

CIBC RESP accounts come with various fee structures depending on the investment options you choose. While some plans may have annual administration fees, many options offer no fees if you meet specific conditions. Always check the terms of your CIBC RESP to be informed about potential costs.

-

Can I switch beneficiaries on a CIBC RESP?

Yes, you can switch beneficiaries on a CIBC RESP, allowing greater flexibility as your family's educational needs change. However, specific rules govern these transfers, and it’s essential to consult with your CIBC RESP advisor for guidance. This ensures compliance with regulations to continue enjoying the benefits of the account.

-

How does CIBC RESP compare to other education savings plans?

CIBC RESP offers unique advantages such as government grant benefits and tax-deferred growth, which may not be available with other education savings plans. Compared to non-registered options, CIBC RESP generally yields better long-term savings for education. Evaluating each option is crucial to finding the best fit for your financial goals.

-

What investment options are available with CIBC RESP?

With CIBC RESP, you can choose from a range of investment options, including GICs, mutual funds, or other investment portfolios. This flexibility allows you to tailor your investment strategy based on your risk tolerance and savings timeline. Making informed choices can signNowly enhance the growth potential of your CIBC RESP.

Get more for Cibcinvestors Edge Com

- Bill of sale with warranty by individual seller north dakota form

- Bill of sale with warranty for corporate seller north dakota form

- Bill of sale without warranty by individual seller north dakota form

- Bill of sale without warranty by corporate seller north dakota form

- North dakota agreement 497317663 form

- Verification of matrix pro se north dakota form

- Verification of creditors matrix north dakota form

- Correction statement and agreement north dakota form

Find out other Cibcinvestors Edge Com

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors