Profit and Loss Statement Form

What is the Profit and Loss Statement

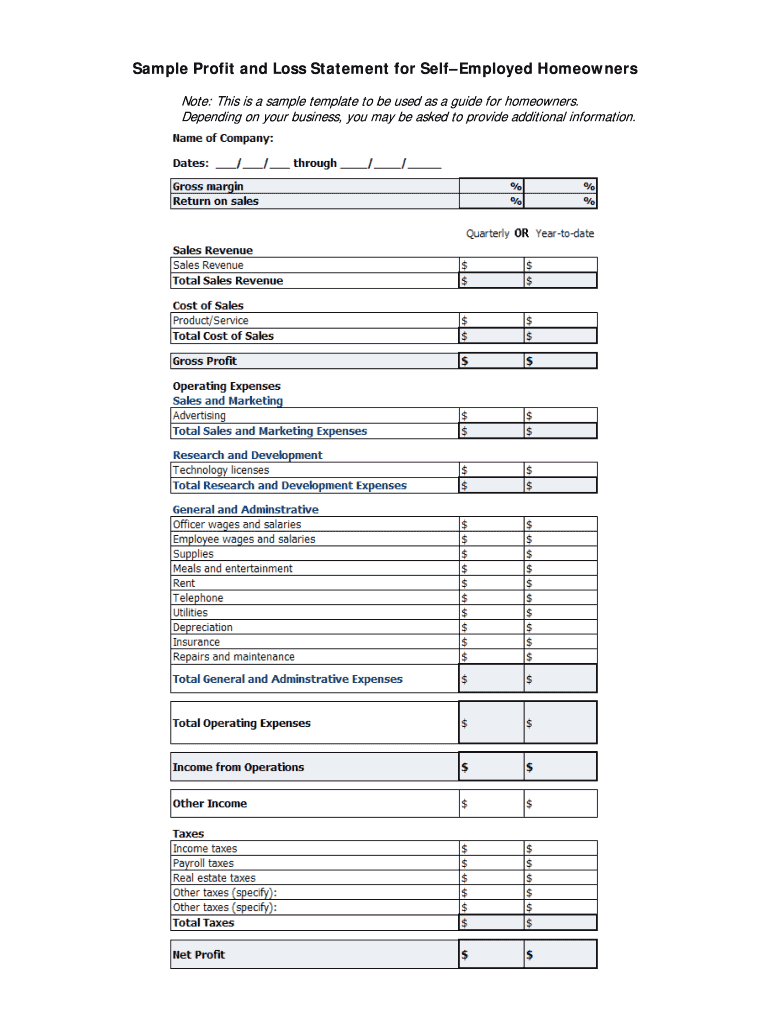

The profit and loss statement for self-employed individuals is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This statement provides a clear view of the profitability of a self-employed business, helping individuals understand whether they are operating at a profit or a loss. It is essential for assessing the financial health of a business and is often required for tax purposes.

Steps to Complete the Profit and Loss Statement

Completing a profit and loss statement involves several key steps:

- Gather all financial records, including income and expenses.

- Start with the total income generated from sales or services.

- Deduct the cost of goods sold to find the gross profit.

- List all operating expenses, such as marketing, administrative costs, and any other relevant expenditures.

- Calculate the total expenses and subtract them from the gross profit to determine the net profit or loss.

Having organized financial records makes this process easier and more accurate.

Key Elements of the Profit and Loss Statement

A comprehensive profit and loss statement includes several critical components:

- Total Income: The total revenue generated from sales or services.

- Cost of Goods Sold: Direct costs attributable to the production of goods sold.

- Gross Profit: Calculated as total income minus the cost of goods sold.

- Operating Expenses: All costs required to run the business, excluding the cost of goods sold.

- Net Profit: The final profit or loss after all expenses have been deducted from gross profit.

These elements provide a clear picture of the business's financial performance over a specified period.

How to Use the Profit and Loss Statement

The profit and loss statement serves multiple purposes for self-employed individuals:

- It helps track financial performance over time, allowing for better decision-making.

- It is a valuable tool for preparing tax returns, as it provides necessary income and expense details.

- It can be used to secure financing or investment by demonstrating the business's profitability.

- It aids in budgeting and forecasting future financial performance.

Utilizing this statement effectively can lead to improved financial management and business growth.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the profit and loss statement for self-employed individuals. This document is essential for reporting income on tax returns, particularly for those filing a Schedule C. The IRS requires accurate reporting of all income and expenses to ensure compliance with tax laws. Self-employed individuals should keep detailed records and receipts to support the figures reported on their profit and loss statement.

Examples of Using the Profit and Loss Statement

Real-world examples illustrate the application of the profit and loss statement:

- A freelance graphic designer uses the statement to track income from various projects and expenses related to software and marketing.

- A self-employed consultant analyzes the statement to identify trends in revenue and adjust pricing strategies accordingly.

- A small business owner prepares the statement to present to potential investors, showcasing profitability and growth potential.

These examples demonstrate the versatility and importance of the profit and loss statement in different self-employment scenarios.

Quick guide on how to complete profit and loss statement form

Discover how to effortlessly navigate the completion of the Profit And Loss Statement with this simple guide

Filing and completing paperwork online is becoming increasingly favored and is the preferred choice for a diverse array of clients. It presents numerous benefits over traditional printed documents, such as convenience, time savings, increased accuracy, and security.

With platforms like airSlate SignNow, you can locate, modify, sign, enhance, and transmit your Profit And Loss Statement without getting bogged down in continual printing and scanning. Follow this brief guide to begin and complete your form.

Apply these steps to obtain and complete Profit And Loss Statement

- Begin by clicking the Get Form button to open your document in our editor.

- Adhere to the green label on the left indicating necessary fields so you don’t miss them.

- Employ our advanced features to comment, alter, sign, secure, and refine your document.

- Safeguard your file or convert it into a fillable format using the tools in the right panel.

- Review the document and inspect it for mistakes or inconsistencies.

- Hit DONE to complete your edits.

- Rename your document or maintain its current title.

- Choose the storage solution you prefer to save your document, send it via USPS, or click the Download Now button to download your file.

If Profit And Loss Statement isn’t what you were searching for, you can explore our extensive library of pre-imported templates that you can complete with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

Need Help on Pnl: How to make profit and loss statement?

The main objective is to determine the company's profitability. Whether you are a lemonade stand or a billion dollar company, you likely have revenues and expenses. The profit and loss sheet lumps each revenue stream into a category. For example, product sales, advertising sales, and subscriptions might all be valid sources of revenue for a company, and the profit and loss sheet would provide an accounting for the amount of revenue generated from each of those sources over a predetermined period of time, typically month by month over the trailing twelve months. The process is generally the same for expenses, and aside from a few small nuances, once you've got a full accounting of revenue and expenses, you'll be able to define profitibility. If you want more inforomation, you can check out this comprehensive guide I recently wrote: How to Create a Profit and Loss Statement + Free Profit & Loss Template

-

What are the first steps to invest in the Indian stock market? How do you open a Demat account and start buying shares?

I am going to ignore your question and share 5 proven steps to get started investing.Starting your first investment is a lot like climbing a mountain.You’re starting from ground zero with a lot of enthusiasm, but when you realize you have to climb for days to get anywhere, that enthusiasm often turns into the feeling of being overwhelmed.But when it comes to your investing career, the weather conditions, metaphorically speaking, are terrible as well.Hold on! You have made a smart move to invest in Equity, popularly called as shares. Indian GDP is growing at 6%-7% per annum and as thumb-rule equities deliver return which is equal to GDP growth + Inflation. Equities are best investment vehicle used as a hedge against inflation.Hey! getting started with your first investments is not terribly difficult - Here's what I would do to start my first investment and build up to $1000, $2000, $10,000………permonth in "passive" income.SEBI regulated a tight charge over documents submission. So this makes it a most crucial step. Your names, dates, and signature should be identical on all of your submitted docs.Below are the exact 4 basic documents that one need to get registered as a stock trader with SEBI.PAN cardIdentity proof (Aadhar card, driving license etc)Bank statement (last 6 month)Cancelled chequeThese are the basic documents. However, in some rare case, additional documents are needed. Consult the broker for the same.In addition, you would also have to fill up the registration form to which the above documents would be attached (highlighted in next step).But where do you submit the damn documents?This is what I’m going to show you in step 2.Not only brokers help you to get your documents verified with SEBI, they also facilitate live trading in stock market. You can buy and sell stocks with just one call or one click (on trading app, platforms)What you’ve to do is contact a broker and deliver them registration form with above-attached documents.But still one should choose a broker with great attention. Some brokers charge so high that most of your profit is swallowed by their charges. An uncle of mine generated a brokerage of 1.5 lakh in 2 months on F&O trading. I was baffled after seeing his charge-sheet.When was the last time you read an investing book or an economic magazine article? Do your daily reading habits center around hot tips tweets, Facebook updates, or the directions on moneycontrol website? If you’re one of the countless people who doesn't make a habit of reading books and articles regularly, you might be missing out: reading has a signNow number of benefits on your investments and your market behavior.Step away from your computer stock screen for a little while, crack open a book, and replenish your soul for a little while.Below are 3 books which are highly recommended to beginners.Stocks to Riches: Insights on Investor Behavior (by Parag Parikh)My personal opinion: At my earlier days, I started reading highly suggested books but didn’t benefit more than this book. In my opinion, this book is a key to understanding other books. Just an extremely insightful book of great practical value that every investor, both beginners and the experienced, should read. No more words.Rich Dad Poor Dad (by Robert T. Kiyosaki)My personal opinion: This is my all time favorite. This book has also qualified for the Amazon Best Reads List – June’16. This book what made me understand the crux of value investing and spread a great message of how money makes money.The Little Book That Still Beats the Market (by Joel Greenblatt)Side Note: Still I’m finding this book to read. Also tried to buy this book on Amazon but not in stock. Contact me personally if you can endorse this book to me. I read summary and reviews of others on this book and find it interesting. He made the value investing simple by just following ROCE and ROE matrix.Edit: I finally got the book.However, when you’re done with above books. Try your luck on some more detailed books here - 11 books that will change the way you look at stock marketNow you’re all done. You got registered with a broker and learned about the stock market. The next step will show you how to stand out from everyone out there...What I like to do next is become a pro trader by tracking my performance, nearly daily.Well quoted by Anurag Bhatia in another answer of the same question.“Maintain a trading journal. Practice paper trading. Yes, you have to practice trading every day to be above average at it. Just like the world's best athletes practice every day”However, you don’t have to make a trading journal, if you’re registered with Zerodha. As they have an inbuilt Q platform to track daily, weekly, monthly……. performance. Get more of it here.This is the most important stage to make yourself a successful investor. Everyday tracks your profit and loss. You don’t have to give hours, 15 minutes will be enough.What you have to do is whenever you have a profit activate your flashback and figure out what made you invest in this share and mark that criterion as a good evaluator of share. And same applies to the loss position in opposite way.When you have traded for a couple of months, nearly daily and got great insights of the market, open up Q platform, track your past transaction and create an algorithm.…….and do whatever you need to cultivate maximum profit from stock market fluctuation.Create your strategy………Create your parameters……….Create your own disciples……….In-short, rely on yourself and trade like a boss. Don’t get influenced by other traders, instead, influence them by your moves.This is where the real money will be made. There are no shortcuts in this process...this is how it's done.Just remember one thing:Following others will not make you rich. Making others follow you will make you rich.Hit me up on my website if you need any help.Stay invested in Sensex or Nifty 50. Normally shares of this category don't tumble more than 5% per day. Exceptions are always there but it's better than mid or small cap stocks. Once you get some experience in the field, choose your stock by your own analysis and own strategy.Go for short term trading (although, I’m a great enemy of short term trading) but as a beginner, you’ll not invest much so you should try with a short run. If you invested for the long run, you’ll lose your interest in some time.Keep the volume of traded money equal to the money which will not make you unhappy, if you lost them.Don’t get trapped in the vicious circle of brokers, advisers…. If their advice are so much effective than they would have been trading shares, not selling their advice.Here’s the reality: You’re in a tough spot.Starting investment profitably for a layman is not easy, but if you’re willing to put in consistent effort, it can be done.I’ve shown you four of the most effective steps I know to get started investing for a newbie. I encourage you to just focus on above steps until you create a sound money making a portfolio.If you’re looking for a bigger guide (with an illustration of a stock), this might help you - How to start investing: A complete guide from "आहा..." to "oh! shit"If you’ve additional advice for newbies or have any sound investment strategy to share with others, I’d love to hear about them in the comments below.

-

How do I know which items from Balance Sheet and Profit and Loss Account forming the Cash Flow Statement?

Hi!I believe that a cash flow statement template will help you to understand how it gets formed. You can download a cash flow statement template absolutely for free from InvoiceBerry templates page. It already includes everything you should have in your cash flow statement, so you shouldn’t have any problems with understanding what you should include in it. It is available in .xlsx format and optimised for Microsoft Excel. Check it out to see if it helps!You can also download a free Balance Sheet template and a Profit and Loss Account template provided by InvoiceBerry in case you need them too.Regards,Krystsina

-

How do I fill out ITR 2, for capital profit/loss?

You can do Income Tax Return Filing in ITR-2 if you are an Individual or HUF having:Income from items in ITR 1 which is more than Rs. 50 lakhIncome from capital gainsForeign IncomeAgricultural Income more than Rs. 5,000Income from Business or Profession under a Partnership firmLegalraasta provides all the legal business services online. You can apply for ITR filing by going to their site.Hope it will help.Thanks

-

How can I file Form ITR 4 online?

Procedure to file Form ITR 4:Download ITR 4 from E filing website.Select the schedules applicable to you.Fill in the General details like Name,PAN,Dob etc.Go to Profit and loss account and fill the income and fill the expenses.Go to balance sheet fill the bank balance and fill the same amount in capital account.Retrieve previous return filed address.Cross check Form -16A with 26AS Statement.Enter Bank account no and Ifsc code properly.E Verify with Aadhar OTP or Send ITR-V Acknowledgement to CPC Banglore with in 120 days from the date of filing.Above Answer is for Educational purpose only as filing ITR 4 is complex procedure better approach CA or Tax Consultant.Trust this clarifies your queryIn case you need help signNow out to us: Dsssvtax[at]gmail[dot]com and we can try to help you on taxation matters.You can also call /whatsapp us : 9052535440.

-

How does one create a business plan?

Startups 101: How to Create a Business PlanThe first thing you need to do is create an executive summary and a mission statement. After that, you need to study your market, compare yourself to your competition, create a share structure, outline financials, and fill out the rest of the pertinent data like the other people suggest.Below is an example of the last executive summary and mission statement that I created for a company I was planning to launch earlier this year.Since I own the company, wrote this from scratch, and decided that I will not be launching this product, I decided to share. (Yes, it is heavily focused on marketing, but that's my primary expertise, if I'm even somewhat good at it... Who in the world knows...)I worked with a Product CEO and operated as the COO at this company and recruited a highly talented team, however the Product CEO decided to part ways so we scrapped the business.Also, you may not want to make a public benefit company unless you already have investors you can turn to for sure who don't care what kind of business you own. If you are seeking to raise money from venture capital, then it is highly unlikely that they will invest into your model. 1.0 EXECUTIVE SUMMARYCompany Name | Tagline | An American Public Benefit Company Founded in February of 2013, (“SE”) features contemporary women’s fashions specializing in comfort, fit and sexiness, established by a diverse group of individuals, led by the C.E.O. Ms. Lee. SE holds idealistic aspirations of giving back to the underprivileged, creates American Jobs and gives back to the community, while keeping the clientele engaged through social interactions SE provides: • A Philanthropic Vision. • Patriotism. • Quality Clothing. • Best Styles for women of the 21st Century. • Quality Content. • An Interactive Community. SE’s innovative design and marketing team constructs visionary product campaigns and strategies, designed to push SE to the forefront of the industry. Derived from the fictional character, Sophia Serrano, from the film Open Your Eyes, SE’s inspiration is characterized by Sophia’s radiant qualities of being: positive, down-to earth, original, mysterious, sexy, and guileless in a perfect world. Sophia is the “ideal” woman because not only is she divine in nature, she is able to cope through the greatest obstacles that obstruct her from her path. Simultaneously, Sophia is so unique, she makes a man follow her into the afterlife of his dreams. Not only did she (tagline) in the real world, she left him in need of her in the afterlife. SE wants other fashion brands and the world to know that everyone in this world matters, no matter your race, ethnicity, financial background or country of origin. SE empowers people to make a difference by: • Helping the Underprivileged Children of America. • Creating American Jobs. • Providing a more Eco-Friendly environment. All of SE’s products are made in the United States, providing more opportunities to influence economic growth. SE ensures no usable fabric goes to waste by collecting all the scraps of fabrics and donating the items to (charity), with the sole intent to create exclusive items, blankets, or articles of clothing for the less fortunate. In addition, SE donates 10% of all sales to (charity) , to help feed, clothe, and provide shelter for the less fortunate.SE plans to take a creative approach to branding and marketing the company. Not only will SE use traditional methods of marketing, such as mailing clothes to celebrities, look books to bloggers and editors, buying editorial spots, sponsoring events, and advertising online, SE will take grass root efforts to the next level in attracting hits to the website, along with social media to keep the clientele engaged. Sending celebrities, fashion editors and bloggers free gifts never guarantees the promotion of an item, so SE has decided to implement a revenue sharing program with its clothing. Each individual influencer will have a personalized URL to direct their clients to SE’s website. Each purchase made within thirty days by the referral of an “influencer” will generate an earnings check of $25 to the referrer. Checks will be cut once the accumulated balance signNowes $300, or can be exchanged to store credit. SE will seek out make up artists, photographers, stylists, and other professionals within the fashion industry to provide an opportunity to earn an extra source of income through its revenue sharing program. SE will also provide clothing to stylists, to have featured in editorial along with video content. SE’s grassroots efforts will take place in the form of carefully selected event sponsorships. Through event sponsorships, models will be showcased wearing the SE product through a trade booth. SE will take pictures of celebrities who try on the products and feature blog posts through social media efforts of the celebrities, while distributing the highly sought out images to fashion bloggers. SE will then pass out $10 SE Clothing Branded Gift Cards to people who fit the role of the target consumer of the brand at the event. Initially, 50,000 gift cards will be made for distribution within the first year, of which we expect at least 25,000 to visit the website URL. SE will implement a referral based program, where if a friend is referred to purchase an item through the SE website through their email or social media link within 30 days, the customer will have the choice to have one of the following occur: • $25 will be credited to the referrer’s account for Future Purchases. • $25 will be donated to the referrer’s Charity of Choice. The referee will also receive $10 credited off their first purchase. Studies indicate that 1 out of every 3 customers will refer their friends to a site that they trust and enjoy. SE will partner with publishers and affiliates such as Google Affiliate, Commission Junction, Avantlink, Affiliate Window, Webgains, Pepperjam, Integrate, Etc. to allow professionals to earn a profit by referring their clientele to purchase items from SE. In order to create better organic SEO (Search Engine Optimization) results to guide more online traffic to the website, SE will carry lines of both popular name brand and up-and-coming American Made products by other designers, such as Nasty Gal, Diesel, Ralph Lauren, Armani, Etc. In order to acquire the product necessary, SE will create a strategic partnership with its manufacturer to sell their excess inventory. Once new customers visit the SE site, they will be given an opportunity to register on the site to claim their $10 credit. Through registration, information such as the customer’s name, email address, phone number, address, and social media profiles will be gathered. Once the customer registers, they will be able to access the site. A welcome email will be sent to the customer within one day, welcoming them to the site. Within 5-7 business days, a letter stating SE’s appreciation of the customer with an outline of the brand’s philanthropic vision will be physically mailed to the customer on company letterhead and hand signed by the C.E.O., Ms. Lee. The customer will then be emailed, informing them that their gift card will expire in 30 days, 3 weeks, 15 days, 7 days, 3 days, 2 days, and a final offer email. This cycle will repeat for another 30 days for a total of 60 days, which will trigger a sense of urgency within purchasing an item within the allotted timeframe. SE will engage with customers by providing the first few sentences of educational content through email, while providing links to the blogging section of the website to read the full article, along with social media efforts on Pinterest, Facebook, Twitter, DeviantART, Tumblr, Google+, Polyvore, Wanelo, Quora, Lyst, Etc. to build trust with the clientele, and keep them engaged with the brand. SE will track user activity through analytic services provided by Kissmetrics to measure which campaigns work best, to better understand our audience. SE will influence increases in transaction sizes by donating one item to charity for every $300 spent in a single transaction. Not only would revenues increase, the philanthropic vision would accelerate to creating a bigger influence to society, which in turn will create a better image for the brand. SE will have a section on the site where users can upload images of their new purchases, how they pair their outfits, provide feedback to others, and like other consumer’s styles, creating an engaged society of buyers who become advocates and prosumers of the brand. SE will begin sales on the retail website, then slowly trickle into many online boutique stores, physical boutique stores, then into major department stores. Since bulk purchases from vendors decrease manufacturing costs, the business model is extremely scalable. As SE becomes a more established brand, price increases will be implemented in 10% increments per season, increasing profit margins while manufacturing costs decrease. SE will create separate databases for consumers who have at least purchased one item and another database for loyal consumers. In regard to the database of consumers who have purchased, collateral material providing a promo code for a promotional discount will physically be mailed to the clients two weeks prior to an anniversary or holiday sale, to provide exclusive access to the promotion. SE will randomly select users from the loyal consumer database to provide a free gift with purchase, expedited or free shipping, and various other promotional tools to reward brand loyalty. Once SE establishes a loyal client base, verticals will be integrated one product at a time in minimal quantities, initially to test the market to see how well the product does. Verticals will range from products such as cosmetics, shoes, handbags, hats, stockings, scarves, jewelry, and other womenswear based products. Led by C.E.O. Ms. Lee, SE has hand selected a managerial team of 8 creative unique individuals to grasp a portion of the $500+ billion dollar market by creating quality content, negotiating with vendors, managing finances, and laying out the long term growth of the company, all while creating beautiful product. 10 years from now, in the year 2023, SE plans to be acquired by LVMH, PPR, Richemont, Valentino Fashion Group, The Aeffe Group, Puig, Diesel, Phillips-Van Huesen, Hermes, Liz Claiborne, Inditex, The Arcadia Group, or Aurora Fashion for a strike price of $300 million. SE is currently seeking seed financing in the amount of $275,000 to be used to cover manufacturing, marketing, legal and operational expenses to establish the brand. MISSION STATEMENTUnited together, SE’s commitments to society are as follows:#1. To Mother Earth:We vow to make sure that no usable fabric is wasted. All usable scrap material will be recycled into specialty items, blankets or created into articles of clothing for the less fortunate.#2. To Our Nation:We vow to Shop American. We vow to only manufacture our product in America. We are creating American jobs and doing our part in rebuilding the American economy.#3. To Our World:We vow to take a stance against child labor. We take a stance against the Chinese sweatshops with hazardous work conditions.#4. To The Less Fortunate:We vow to provide food, clothing, and shelter for children who are unable to take care of themselves, especially the ones right here at home.#5. To Our Customers:We vow to make sure you feel beautiful and (tagline). We vow to create the sexiest, most reliable products made from the best material we can find. We will provide the best fit possible. We will listen to your opinions and make decisions based off of your feedback. Your voice will be heard. #6. To Our Design PartnersWe vow to provide our client base accessibility to your designs to increase your exposure in the market place. Whether you are a small designer who is just beginning or an established brand, there is a place here for you to showcase your items, as long as the product is manufactured here in America.#7. To Our Employees: We vow to bring the jobs back home and provide fair wages. We vow to provide a fun and friendly stress-free work environment.#8. To Our Shareholders:We vow to provide you a seat on our board. We vow to listen to your expertise. We vow to provide returns in a timely manner. We vow to fulfill your philanthropic vision.Oh, it might be in your best interest to include a mind map as well.The first five pages should include the following information:BUSINESS DEVELOPMENT PLAN MARCH 2013 ****** CONFIDENTIALITY & DISCLOSURE NOTICE ****** IMPORTANT: This document is for information purposes only and sent at your request and is covered by the Electronic Communications Privacy Act 18 U.S.C. 2510‐2521. This is neither a solicitation of investment nor an offer to sell and/or buy securities. This communication may contain non‐public, private, confidential or legally privileged information and documents intended for the sole use of the designated recipient(s). The unlawful interception, use or disclosure of such information is strictly prohibited under the applicable laws of the U.S.A. and the State of Nevada. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon this information by persons/entities other than the intended recipient is prohibited. If you received this document and / or a transmission of this document in error, delete any electronic copies of this document and / or return this document to (Name, Address) CONFIDENTIALITY & DISCLOSURE NOTICE IMPORTANT: This document is for information purposes only and sent at your request and is covered by the Electronic Communications Privacy Act 18 U.S.C. 2510-2521. This is neither a solicitation of investment nor an offer to sell and/or buy securities. This communication may contain non-public, private, confidential or legally privileged information and documents intended for the sole use of the designated recipient(s). The unlawful interception, use or disclosure of such information is strictly prohibited under the applicable laws of the U.S.A. and the State of California. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon this information by persons/entities other than the intended recipient is prohibited. If you received this document and / or a transmission of this document in error, delete any electronic copies of this document and / or return this document to (Name, Address) CONFIDENTIALITY AGREEMENT The undersigned reader acknowledges that the information provided within this Business Development Plan (“BDP”) is confidential; therefore, reader agrees not to disclose it without the express written permission of SE. It is acknowledged by reader that information to be furnished in this BDP is in all respects confidential in nature, other than information which is in the public domain through other means and that any disclosure or use of same by reader, may cause serious harm or damage to SE and other sources identified herein. The information, estimates and projections contained herein have been prepared by SE in good faith and on a basis believed to be reasonable; such estimates and projections involve signNow elements of subjective judgment and analysis. No representation or warranty, expressed or implied, can be made as to the accuracy or completeness of such information, and nothing contained in this BDP is, or shall be relied upon as, a promise or representation as to the past or the future. This BDP is submitted in connection with the evaluation of a potential transaction and may not be reproduced or used, in whole or in part, for any other purpose. Upon request, this document is to be immediately returned SE,. ___________________ Signature ___________________ Name (typed or printed) ___________________ Date This is a Business Development Plan. It does not imply an offering of securitiesFORWARD LOOKING STATEMENT This document may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, statements as to future operating results and plans that involve risks and uncertainties. We use words such as “expects”, “anticipates”, “believes”, “estimates”, the negative of these terms and similar expressions to identify forward looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. References herein to “the Company,” “we,” “our,” “us” and similar words or phrases are references to SE, and/or its subsidiaries, unless the context otherwise requires. CONTACT INFORMATION Inquiries may be directed to the appropriate party below:Leonard Kim COO SEAddress:Phone: Fax: Email:The Table of contents should include the following information that no one, aside from analysts read:TABLE OF CONTENTS 1.0 EXECUTIVE SUMMARY1.1 OBJECTIVES1.2 MISSION1.3 KEYS TO SUCCESS 2.0 COMPANY SUMMARY2.1 CAPITALIZATION SUMMARY2.2 COMPANY LOCATIONS AND FACILITIES.3.0 PRODUCTS AND SERVICES3.1 THE SE TECHNOLOGY3.2 COMPETITIVE COMPARISON3.3 MARKETING MATERIAL3.4 TECHNOLOGY FULFILLMENT3.5 FUTURE PRODUCTS AND SERVICES4.0 MARKET ANALYSIS SUMMARY 4.1 MARKET SEGMENTATION 4.2 TARGET MARKET SEGMENT STRATEGY4.2.1 MARKET NEEDS4.2.2 MARKET TRENDS 4.2.3 MARKET GROWTH4.3 SERVICE BUSINESS ANALYSIS 4.3.1 BUSINESS PARTICIPANTS 4.3.2 DISTRIBUTING A PRODUCT 4.3.3 MAIN COMPETITORS 5.0 WEB PLAN SUMMARY5.1 WEBSITE MARKETING STRATEGY5.2 DEVELOPMENT REQUIREMENTS6.0 STRATEGY AND IMPLEMENTATION SUMMARY6.1 SWOT ANALYSIS 6.1.1 STRENGTHS6.1.2 WEAKNESSES 6.1.3 OPPORTUNITIES6.1.4 THREATS6.2 STRATEGY PYRAMID 6.3 VALUE PROPOSITION6.4 COMPETITIVE EDGE 6.5 MARKETING STRATEGY SUMMARY6.5.1 POSITIONING STATEMENT 6.5.2 PRICING STRATEGY6.6 SALES STRATEGY 6.6.1 SALES FORECAST 6.7 MILESTONES7.0 MANAGEMENT SUMMARY 7.1 ORGANIZATIONAL STRUCTURE 7.2 MANAGEMENT TEAM 7.3 MANAGEMENT TEAM GAPS 7.4 PERSONNEL PLAN 8.0 FINANCIAL PLAN8.1 START-UP FUNDING 8.2 KEY FINANCIAL INDICATORS8.3 BREAK-EVEN ANALYSIS 8.4 PROJECTED PROFIT AND LOSS 8.5 PROJECTED CASH FLOW 8.6 PROJECTED BALANCE SHEET 8.7 BUSINESS RATIOS 8.8 THE INVESTMENT OFFERING8.9 VALUATION8.10 USE OF FUNDS9.0 APPENDICESTABLE: SALES FORECAST TABLE: PROFIT AND LOSS TABLE: PROFIT AND LOSS TABLE: CASH FLOWTABLE: CASH FLOWTABLE: BALANCE SHEETIf you're using a business plan to try to attain a loan for a small business... I took a different business plan for a nightlife company, brought a cofounder with a 680 credit score, and went to Long Beach SBDC and they helped me get approved for a loan from a credit union for $30,000 two years ago. The whole process took less than a week, since we already had our business plan finished prior to showing up. We ended up not taking the loan because our programmer ran off with the money we had paid him prior without delivering our technology.There are Small Business Development Centers, sponsored by the Small Business Association, all across the United States that will help you make a business plan for free, read it, and even shop it out for business loans.If you're using a business plan to attain financing from an Angel Investor or VC, then all that matters is your executive summary and your slideshow. I mean, you still need the other data filled in, but these are the only two areas of which they put their main focus on. However, a lot of investors use two financial analysts to carefully go over every detail within a business plan prior to investing their own cash. So, the fine details are pretty important regardless of what anyone else says. Also, if you need to know how to split equity with your startup, read more here: How much equity do you give early employees when the company is bootstrapped?Read more at my blog: Startups 101: How to Create a Business Plan

-

How useful is a profit and loss statement to different stakeholders?

Anyone who cares about the continued existence of a business should want to regularly review both the Profit or Loss statement and the Balance Sheet. One is not enough. The P/L will tell you if the business is making or losing money. The balance sheet will tell you if the business has enough cash to continue operating.For example, you have a business that deals with a small number of very large orders. With minimal expense you’ve just landed a huge sale that will make your business profitable for the next 12 months. Your Proft or Loss statement looks great. Unfortunately, you won’t be paid for that sale for 6 months and according to your Balance Sheet, you’ll have long since run out of cash by then.This is why stakeholders should be looking at both. And of course, they will also need to know what credit the business has available to it to cover the gaps for exactly the kind of circumstance I described above.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

Create this form in 5 minutes!

How to create an eSignature for the profit and loss statement form

How to generate an electronic signature for your Profit And Loss Statement Form online

How to create an electronic signature for your Profit And Loss Statement Form in Google Chrome

How to create an eSignature for putting it on the Profit And Loss Statement Form in Gmail

How to make an electronic signature for the Profit And Loss Statement Form right from your smartphone

How to create an eSignature for the Profit And Loss Statement Form on iOS devices

How to create an electronic signature for the Profit And Loss Statement Form on Android

People also ask

-

What is a Profit And Loss Statement, and why is it important for my business?

A Profit And Loss Statement (P&L) is a financial report that summarizes a company's revenues, costs, and expenses over a specific period. This document is crucial as it provides insights into the company's profitability, helping you make informed financial decisions. By understanding your P&L, you can identify areas for improvement and strategize effectively.

-

How can airSlate SignNow help me create a Profit And Loss Statement?

airSlate SignNow offers user-friendly templates and eSigning capabilities that simplify the process of creating a Profit And Loss Statement. You can easily customize templates to fit your business needs and ensure quick approval from stakeholders. This efficient workflow saves time and enhances accuracy in your financial reporting.

-

Is airSlate SignNow affordable for small businesses needing a Profit And Loss Statement template?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their Profit And Loss Statement efficiently. With various pricing plans available, you can choose one that fits your budget while accessing all the essential features. This affordability ensures you can maintain accurate financial records without breaking the bank.

-

What features does airSlate SignNow offer for managing a Profit And Loss Statement?

airSlate SignNow provides features such as document templates, electronic signatures, and cloud storage, which are ideal for managing a Profit And Loss Statement. These tools streamline the process of drafting, signing, and storing your financial documents securely. Additionally, easy integration with accounting software enhances your financial management capabilities.

-

Can I integrate airSlate SignNow with my existing accounting software for my Profit And Loss Statement?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to streamline your financial processes, including your Profit And Loss Statement. This integration ensures that your financial data is up-to-date and readily available for reporting, saving you valuable time and effort.

-

How does using airSlate SignNow improve the accuracy of my Profit And Loss Statement?

Using airSlate SignNow reduces human error through its automated features, ensuring your Profit And Loss Statement is accurate and reliable. The platform's templates guide you in entering data correctly, while electronic signatures facilitate timely approvals. This precision is crucial for maintaining trustworthy financial records.

-

What are the benefits of using airSlate SignNow for electronic signatures on my Profit And Loss Statement?

By using airSlate SignNow for electronic signatures on your Profit And Loss Statement, you enhance the speed and efficiency of document processing. Electronic signatures are legally binding and secure, ensuring that your financial documents are valid and protected. This convenience allows you to focus on your core business activities without delays.

Get more for Profit And Loss Statement

Find out other Profit And Loss Statement

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile