Where to Send Irs Form 8546

What is the IRS Form 8546?

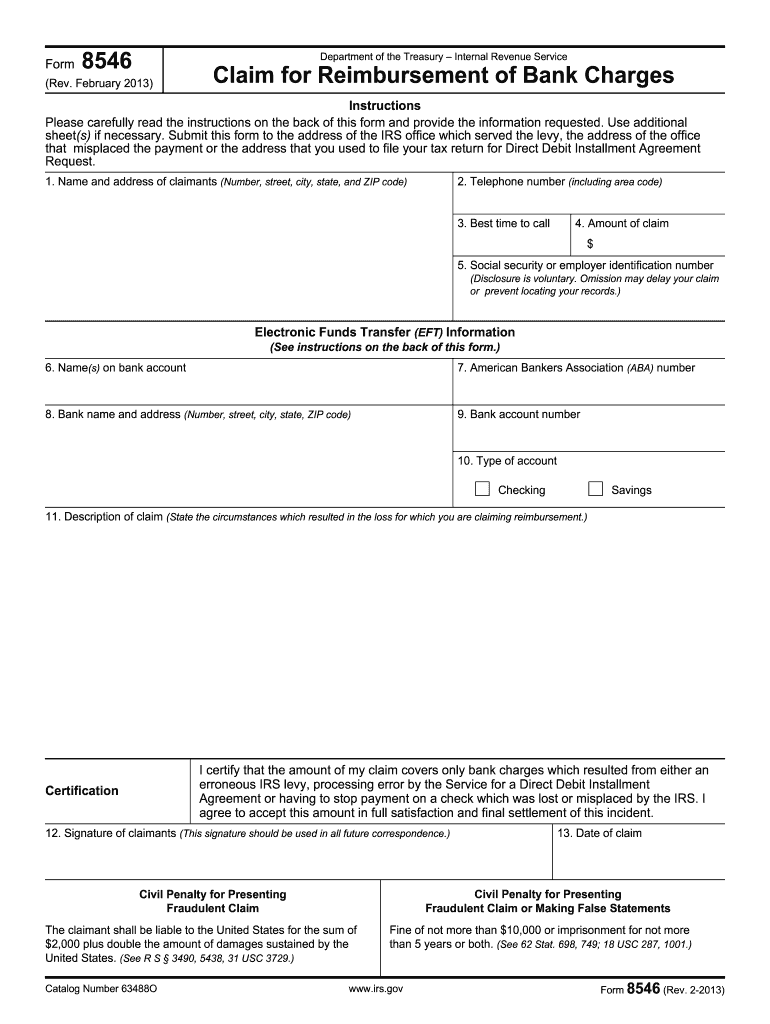

The IRS Form 8546 is a document used for specific tax-related purposes, primarily concerning the reporting of certain transactions or claims. It is essential for taxpayers to understand the form's function, as it helps ensure compliance with federal tax regulations. The form is utilized by individuals and businesses alike to report information that may affect their tax obligations or entitlements.

How to Obtain the IRS Form 8546

To obtain the IRS Form 8546, taxpayers can visit the official IRS website, where the form is available for download. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission. Additionally, local IRS offices may provide physical copies of the form upon request.

Steps to Complete the IRS Form 8546

Completing the IRS Form 8546 involves several key steps:

- Gather all necessary documentation related to the transactions or claims you are reporting.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form for any errors before submission.

Legal Use of the IRS Form 8546

The legal use of the IRS Form 8546 is governed by federal tax laws. It is crucial that taxpayers submit the form in accordance with IRS regulations to avoid penalties. The form must be signed and dated, and any supporting documents should be included to substantiate the claims made on the form. Compliance with all applicable laws ensures that the form is considered valid and enforceable.

Filing Deadlines for the IRS Form 8546

Filing deadlines for the IRS Form 8546 can vary depending on the specific circumstances surrounding the form's use. Generally, it is important to submit the form by the due date specified by the IRS to avoid late fees or penalties. Taxpayers should always check the latest IRS guidelines for the most accurate deadlines related to their situation.

Form Submission Methods

The IRS Form 8546 can be submitted through various methods:

- Online: Some taxpayers may have the option to submit the form electronically through the IRS e-file system.

- Mail: The form can be printed and mailed to the appropriate IRS address as indicated in the instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at a local IRS office.

Quick guide on how to complete where to send irs form 8546 2011

Complete Where To Send Irs Form 8546 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your files swiftly without delays. Manage Where To Send Irs Form 8546 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Where To Send Irs Form 8546 effortlessly

- Locate Where To Send Irs Form 8546 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you would like to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Where To Send Irs Form 8546 and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where to send irs form 8546 2011

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is form 8546 and how is it used?

Form 8546 is a critical document used in various compliance processes. With airSlate SignNow, you can easily create, send, and eSign form 8546, ensuring that your documents are processed efficiently and accurately.

-

How can airSlate SignNow help with the electronic signing of form 8546?

airSlate SignNow allows for quick electronic signing of form 8546, streamlining the signing process. Our intuitive platform enables users to sign from anywhere, on any device, ensuring timely completion of critical documents.

-

Is there a cost associated with using airSlate SignNow for form 8546?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can select a plan that fits your needs while ensuring you have all the necessary tools to manage form 8546 efficiently.

-

What features does airSlate SignNow offer for form 8546?

airSlate SignNow provides a range of features for managing form 8546, including templates, custom workflows, and real-time document tracking. These tools help enhance productivity and ensure compliance throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for form 8546 management?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, allowing you to manage form 8546 alongside your existing tools. This integration ensures a smooth workflow, enhancing the overall efficiency of your operations.

-

What are the benefits of using airSlate SignNow for form 8546?

Using airSlate SignNow for form 8546 offers numerous benefits, including reduced turnaround times and improved document security. Our platform also simplifies tracking and auditing, which is crucial for compliance purposes.

-

Is airSlate SignNow secure for handling sensitive information on form 8546?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive information on form 8546. You can confidently manage your documents knowing they are secure with our platform.

Get more for Where To Send Irs Form 8546

- Sd codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage south dakota

- Legal last will and testament form for married person with adult and minor children south dakota

- Mutual wills package with last wills and testaments for married couple with adult and minor children south dakota form

- Legal last will and testament form for a widow or widower with adult children south dakota

- Legal last will and testament form for widow or widower with minor children south dakota

- Legal last will form for a widow or widower with no children south dakota

- Legal last will and testament form for a widow or widower with adult and minor children south dakota

Find out other Where To Send Irs Form 8546

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter