Foreign Limited Partnership Application I Kansas Secretary of State Sos Ks 2010

What is the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

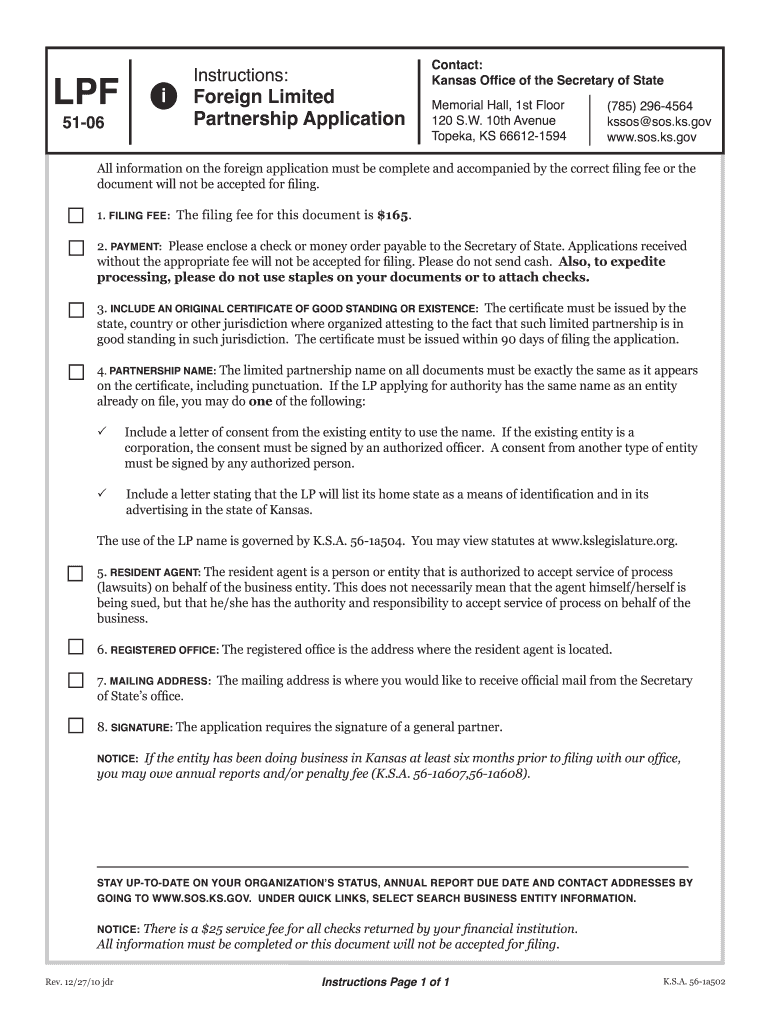

The Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks is a legal document that allows foreign entities to register as limited partnerships in the state of Kansas. This application is essential for businesses based outside of Kansas that wish to conduct business within the state. It ensures compliance with Kansas laws and regulations regarding foreign business operations.

Steps to complete the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

Completing the Foreign Limited Partnership Application involves several key steps:

- Gather necessary information about the foreign limited partnership, including its name, principal office address, and the state or country of formation.

- Designate a registered agent in Kansas who will accept legal documents on behalf of the partnership.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application along with the required filing fee to the Kansas Secretary of State.

Key elements of the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

Several key elements must be included in the Foreign Limited Partnership Application to ensure its validity:

- The name of the foreign limited partnership must be distinguishable from any existing entities registered in Kansas.

- The principal office address must be provided, along with the name and address of the registered agent.

- The date of formation and the jurisdiction where the partnership was formed should be specified.

- Any additional information required by the Kansas Secretary of State must be included.

Legal use of the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

This application serves a legal purpose by allowing foreign limited partnerships to operate within Kansas. It provides legal recognition and protection under state law, enabling businesses to engage in transactions and establish a presence in the state. Proper completion and submission of the application are crucial for compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Foreign Limited Partnership Application can be submitted through various methods:

- Online: The application can be completed and submitted electronically through the Kansas Secretary of State's website.

- Mail: Applicants may print the completed form and send it via postal service to the appropriate office.

- In-Person: The application can also be submitted in person at the Kansas Secretary of State's office.

Eligibility Criteria

To be eligible to file the Foreign Limited Partnership Application, the entity must be a legally formed limited partnership in its home jurisdiction. Additionally, it must comply with Kansas laws regarding business operations and must not have a name that conflicts with existing entities in the state.

Quick guide on how to complete foreign limited partnership application i kansas secretary of state sos ks

Handle Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks anytime, anywhere

Your everyday business activities may require extra attention when managing state-specific business documents. Reclaim your work hours and minimize the costs linked to document-based processes with airSlate SignNow. airSlate SignNow offers you a variety of pre-uploaded business documents, including Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks, that you can utilize and share with your associates. Handle your Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks seamlessly with robust editing and eSignature capabilities, and send it directly to your recipients.

How to obtain Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks in just a few clicks:

- Select a form pertinent to your state.

- Click Learn More to access the document and verify its accuracy.

- Select Get Form to start using it.

- Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks will open automatically in the editor. No further actions are required.

- Leverage airSlate SignNow’s sophisticated editing functionalities to complete or modify the form.

- Choose the Sign feature to create your personal signature and eSign your document.

- When finished, click Done, save changes, and access your document.

- Distribute the form via email or SMS, or use a link-to-fill option with your collaborators or have them download the documents.

airSlate SignNow signNowly reduces the time spent managing Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks and allows you to locate essential documents in one location. An extensive collection of forms is organized and crafted to support vital business processes necessary for your enterprise. The advanced editor minimizes the chance of errors, as you can swiftly correct mistakes and review your documents on any device before dispatching them. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

Find and fill out the correct foreign limited partnership application i kansas secretary of state sos ks

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How do I fill out the N-600 certificate of citizenship application if you already received a US passport from the state department and returned your Greencard as the questions seem to assume one is still on immigrant status?

In order to file N-600 to apply for a Certificate of Citizenship, you must already be a US citizen beforehand. (The same is true to apply for a US passport — you must already be a US citizen beforehand.) Whether you applied for a passport already is irrelevant; it is normal for a US citizen to apply for a US passport; applying for a passport never affects your immigration status, as you must already have been a US citizen before you applied for a passport.The form’s questions are indeed worded poorly. Just interpret the question to be asking about your status before you became a citizen, because otherwise the question would make no sense, as an applicant of N-600 must already be a US citizen at the time of filing the application.(By the way, why are you wasting more than a thousand dollars to apply for a Certificate of Citizenship anyway? It basically doesn’t serve any proof of citizenship purposes that a US passport doesn’t already serve as.)

Create this form in 5 minutes!

How to create an eSignature for the foreign limited partnership application i kansas secretary of state sos ks

How to make an electronic signature for your Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks online

How to make an eSignature for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks in Chrome

How to generate an electronic signature for signing the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks in Gmail

How to create an electronic signature for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks straight from your smartphone

How to create an eSignature for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks on iOS

How to make an electronic signature for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks on Android OS

People also ask

-

What is the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks process?

The Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks process involves submitting specific documentation to the Secretary of State's office. This application allows foreign entities to conduct business in Kansas legally. Ensure you have all required information and documents ready to facilitate a smooth submission.

-

How can airSlate SignNow assist with the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks?

airSlate SignNow streamlines the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks by enabling users to eSign and send necessary documents efficiently. Our platform provides templates and tools that simplify the document preparation process, ensuring compliance with state requirements.

-

What are the costs associated with the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks?

The costs for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks may vary depending on filing fees and additional service charges. Using airSlate SignNow can help you save on administrative costs by providing a cost-effective solution for document management and eSigning.

-

Does airSlate SignNow provide templates for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks?

Yes, airSlate SignNow offers customizable templates specifically designed for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks. These templates help ensure that all necessary information is included, reducing the risk of errors and delays in the application process.

-

What features does airSlate SignNow offer for managing the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks?

airSlate SignNow features an intuitive interface for managing the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks, including document tracking, reminders, and secure storage. These features enhance efficiency and keep your application organized throughout the submission process.

-

How secure is the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks submission via airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks. Our platform employs advanced encryption and compliance protocols to protect your sensitive information during the eSigning and submission process.

-

Can I integrate airSlate SignNow with other applications for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks?

Absolutely! airSlate SignNow offers integrations with various applications, making it easier to connect your workflow for the Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks. You can seamlessly integrate with accounting software, CRM systems, and more to streamline your business processes.

Get more for Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

- How do u find or get a med 9 form 2008

- Delaware sl 1905 form

- Medical certificate csu form

- Florida el2 form 2010

- Health studio registration bapplicationb florida department of bb form

- Visit us at wwwhumanacom or wwwhumanadentalcom humana form

- Apd consent form

- Florida medicaid authorization for the use and disclosure of protected health information 2012

Find out other Foreign Limited Partnership Application I Kansas Secretary Of State Sos Ks

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later