Form 1099 K Payment Card and Third Party Network Transactions

What is the Form 1099-K Payment Card and Third Party Network Transactions

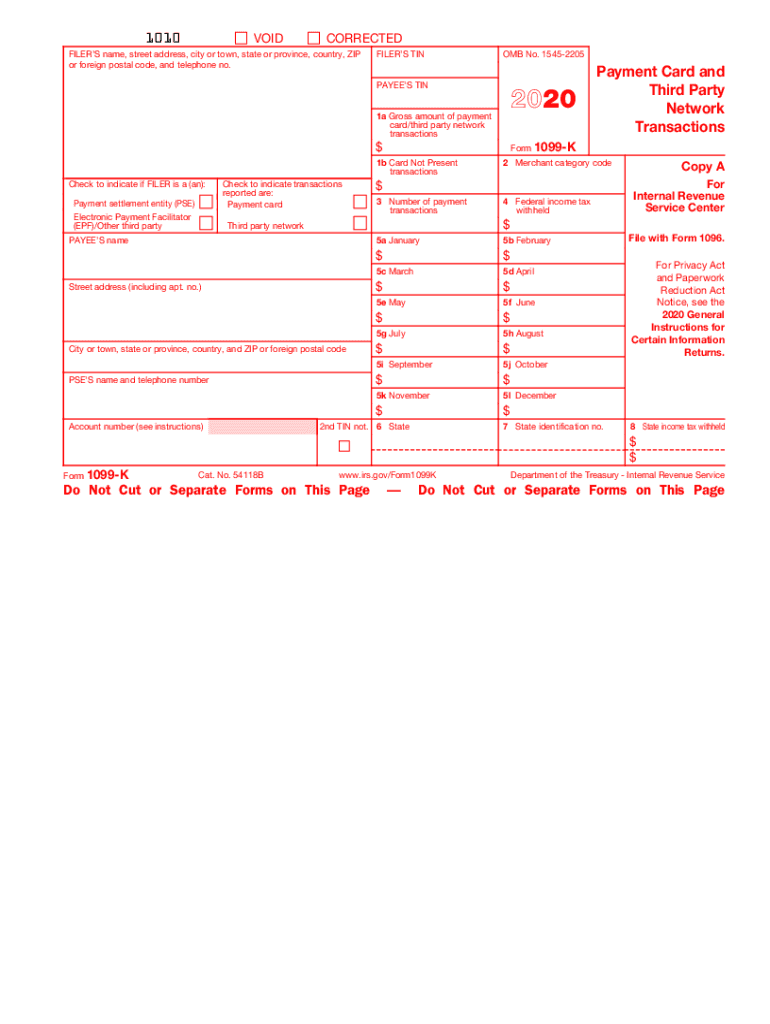

The Form 1099-K is an IRS tax form used to report payment card and third-party network transactions. It is primarily issued by payment settlement entities to report the gross amount of reportable transactions for a calendar year. This form is essential for individuals and businesses that receive payments through credit cards, debit cards, or third-party networks such as PayPal or Venmo. The IRS mandates this reporting to ensure that all income is accurately reported and taxed accordingly.

How to Obtain the Form 1099-K

To obtain the Form 1099-K, businesses and individuals should first check with their payment settlement entities. These entities are responsible for issuing the form and typically provide it electronically or by mail. If you have received payments through a third-party network, you may also be able to access the form through your account on their platform. Ensure that you have the correct tax year in mind, as forms are issued annually for the previous year’s transactions.

Steps to Complete the Form 1099-K

Completing the Form 1099-K involves several steps:

- Gather all relevant transaction data from your payment processing accounts.

- Ensure that you have the correct tax identification number (TIN) for yourself or your business.

- Fill in the gross payment amount received during the tax year.

- Include any necessary details regarding the payment settlement entity.

- Review the completed form for accuracy before submission.

It is important to keep a copy of the form for your records and to ensure that all information is consistent with your tax filings.

Legal Use of the Form 1099-K

The Form 1099-K must be used in compliance with IRS regulations. It is crucial for recipients to report the income shown on the form on their tax returns. Failure to accurately report this income can lead to penalties. Additionally, businesses should ensure that they issue the form to all eligible payees who meet the reporting thresholds, which generally include receiving more than twenty thousand dollars in payments and completing over two hundred transactions in a calendar year.

IRS Guidelines for Form 1099-K

The IRS has specific guidelines regarding the use and reporting of the Form 1099-K. These guidelines include:

- Payment settlement entities must report transactions that exceed the established thresholds.

- Forms must be issued to recipients by January thirty-first of the following year.

- Entities are required to file copies of the form with the IRS by the end of February if filing by paper, or by the end of March if filing electronically.

Understanding these guidelines helps ensure compliance and avoids potential issues with the IRS.

Filing Deadlines for Form 1099-K

Filing deadlines for the Form 1099-K are crucial for compliance. The payment settlement entity must provide the form to the recipient by January thirty-first of the year following the reporting year. Additionally, the form must be filed with the IRS by February twenty-eighth if submitted on paper or by March thirty-first if filed electronically. Adhering to these deadlines helps avoid penalties and ensures that all necessary tax information is reported timely.

Quick guide on how to complete 2020 form 1099 k payment card and third party network transactions

Complete Form 1099 K Payment Card And Third Party Network Transactions effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct document and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 1099 K Payment Card And Third Party Network Transactions on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Form 1099 K Payment Card And Third Party Network Transactions seamlessly

- Locate Form 1099 K Payment Card And Third Party Network Transactions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1099 K Payment Card And Third Party Network Transactions and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1099 k payment card and third party network transactions

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is a 1099 K download and why is it important?

A 1099 K download is a crucial tax document that reports payment card and third-party network transactions. It's important for accurately reporting income and ensuring compliance with IRS regulations. Businesses and freelancers should always keep their records in order to simplify tax filing.

-

How can I obtain my 1099 K download through airSlate SignNow?

You can easily obtain your 1099 K download by using the airSlate SignNow platform. Simply log in to your account, navigate to the document section, and select the 1099 K template to generate and download your report. This streamlined process saves you time and ensures accuracy.

-

Is there a fee associated with downloading the 1099 K?

There are no additional fees specifically for the 1099 K download when using airSlate SignNow. The service is designed to be cost-effective, allowing users to manage their documents without worrying about hidden costs. You only pay for the subscription plan that best fits your business needs.

-

What features does airSlate SignNow offer for managing my 1099 K downloads?

airSlate SignNow offers features such as secure e-signatures, cloud storage, and document tracking for managing your 1099 K downloads. This ensures that your important tax documents are both accessible and secure. Additionally, you can customize your documents to reflect your specific business requirements.

-

Can I integrate airSlate SignNow with my accounting software for 1099 K downloads?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage your 1099 K downloads. This integration facilitates smoother data transfer and ensures that all your financial documents are organized. Check our integrations page for more details on compatible software options.

-

What are the benefits of using airSlate SignNow for 1099 K downloads?

Using airSlate SignNow for 1099 K downloads provides several benefits, including user-friendly document management and a secure e-signing process. You'll find it reduces the time spent on paperwork and enhances your efficiency during tax season. This proactive approach helps you stay organized and compliant.

-

How does airSlate SignNow ensure the security of my 1099 K downloads?

airSlate SignNow employs advanced security protocols, including encryption and secure cloud storage, to protect your 1099 K downloads. This ensures that your sensitive financial information remains confidential and safe from unauthorized access. You can trust that your documents are in good hands.

Get more for Form 1099 K Payment Card And Third Party Network Transactions

Find out other Form 1099 K Payment Card And Third Party Network Transactions

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form