M 911 2019

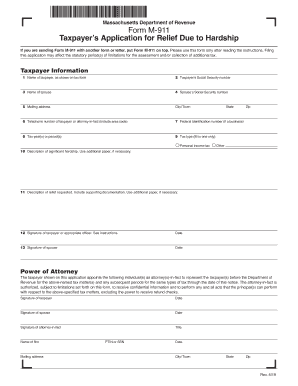

What is the M-911?

The M-911 is a form used in Massachusetts to request a hardship exemption for tax obligations. This form is particularly relevant for individuals facing financial difficulties that hinder their ability to meet tax requirements. The M-911 allows taxpayers to present their circumstances to the Massachusetts Department of Revenue (DOR), seeking relief from certain tax liabilities based on demonstrated hardship.

How to use the M-911

To utilize the M-911 effectively, individuals must complete the form accurately, providing detailed information about their financial situation. This includes income, expenses, and any other relevant factors that contribute to their hardship. Once completed, the form should be submitted to the Massachusetts DOR for consideration. It is essential to ensure that all information is truthful and comprehensive, as this will impact the outcome of the request.

Steps to complete the M-911

Completing the M-911 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the M-911 form, providing accurate and detailed information about your financial situation.

- Review the form to ensure all information is correct and complete.

- Submit the form to the Massachusetts DOR, either online or via mail, as per the submission guidelines.

Required Documents

When completing the M-911, certain documents are typically required to support your claim of hardship. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of expenses, including bills and receipts.

- Any additional information that demonstrates your financial difficulties.

Eligibility Criteria

To qualify for a hardship exemption using the M-911, applicants must meet specific eligibility criteria. Generally, this includes demonstrating a significant financial burden that impacts the ability to pay taxes. Factors considered may include income level, family size, and other financial obligations. It is crucial to review the criteria set forth by the Massachusetts DOR to ensure compliance.

Form Submission Methods

The M-911 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to:

- Submit the form online through the Massachusetts DOR's official website.

- Mail the completed form to the appropriate DOR office.

- Deliver the form in person at designated DOR locations.

Quick guide on how to complete m 911

Complete M 911 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without any delays. Manage M 911 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign M 911 with ease

- Obtain M 911 and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Alter and eSign M 911 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m 911

Create this form in 5 minutes!

How to create an eSignature for the m 911

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a letter of hardship to MA DOR for tax, and when should I use it?

A letter of hardship to MA DOR for tax is a formal request for relief from tax obligations due to financial difficulties. You should use it when you cannot meet your tax liabilities because of unexpected hardships. Using airSlate SignNow, you can easily create and eSign this document to expedite your relief process.

-

How can airSlate SignNow help me prepare a letter of hardship to MA DOR for tax?

airSlate SignNow provides templates and tools that simplify the creation of a letter of hardship to MA DOR for tax. With our user-friendly platform, you can customize your letter and eSign it securely, ensuring it meets all necessary legal requirements.

-

Is there a cost associated with using airSlate SignNow for my letter of hardship to MA DOR for tax?

Yes, airSlate SignNow offers various pricing plans catering to different needs. While you can find a cost-effective solution for creating your letter of hardship to MA DOR for tax, our subscription includes access to all features, making it a worthy investment for businesses.

-

What features does airSlate SignNow offer for managing tax-related documents like the letter of hardship to MA DOR?

airSlate SignNow includes features such as document templates, eSignature capabilities, secure cloud storage, and team collaboration tools. These features streamline the creation, signing, and management of your letter of hardship to MA DOR for tax, making the process faster and more efficient.

-

Can I integrate airSlate SignNow with other applications for my tax documents?

Absolutely! airSlate SignNow offers seamless integrations with popular apps and platforms, enhancing your workflow when preparing a letter of hardship to MA DOR for tax. This allows you to easily import data and share documents across your existing software solutions.

-

How secure is my information when using airSlate SignNow for tax-related letters?

Your security is our priority at airSlate SignNow. We use advanced encryption and security measures to protect your personal and financial information while you prepare your letter of hardship to MA DOR for tax. You can trust that your data is safe with us.

-

Are there any resources available to help me write an effective letter of hardship to MA DOR for tax?

Yes, airSlate SignNow provides various resources such as guides and tips for writing an effective letter of hardship to MA DOR for tax. These resources help you understand the key elements to include, ensuring that your letter is compelling and increases your chances of approval.

Get more for M 911

Find out other M 911

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed