Maximum Millage Levy Calculation Florida Department of 2018

What is the Maximum Millage Levy Calculation?

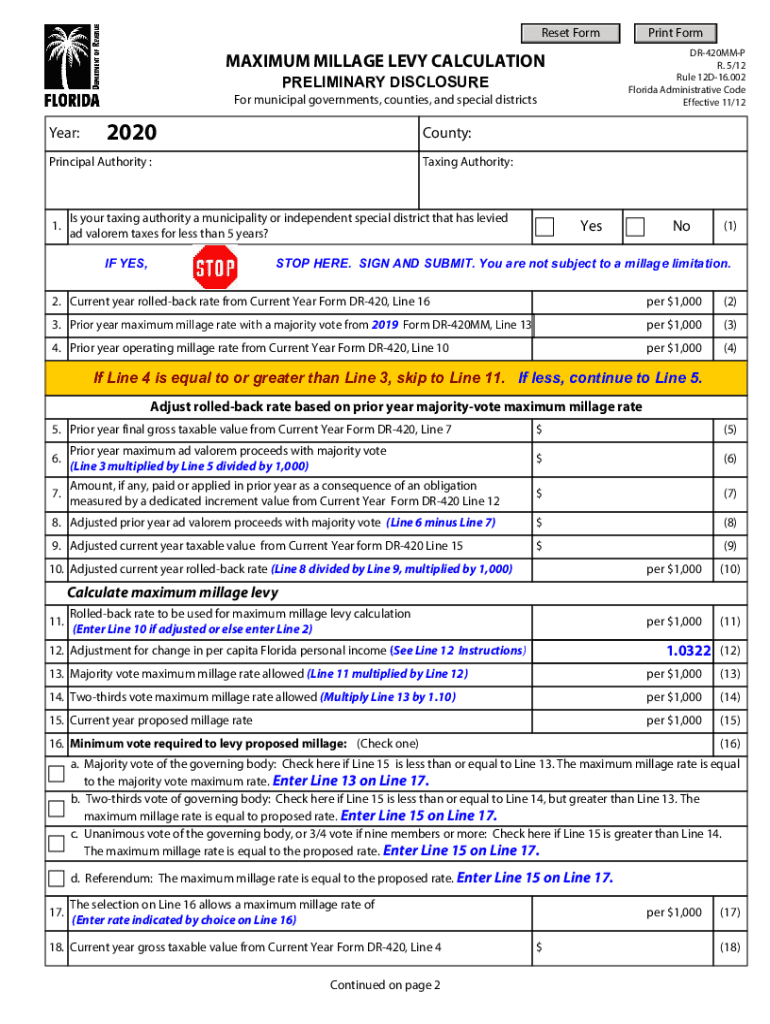

The maximum millage levy calculation is a method used to determine the highest property tax rate that local governments can impose. This calculation is essential for municipalities and counties to establish their budgetary needs while adhering to state regulations. In Florida, the calculation is based on the assessed value of properties within a jurisdiction and is expressed in mills, where one mill equals one dollar of tax for every one thousand dollars of assessed value. Understanding this calculation is crucial for property owners as it directly impacts their tax obligations.

Steps to Complete the Maximum Millage Levy Calculation

Completing the maximum millage levy calculation involves several key steps:

- Determine the total assessed value of properties within the jurisdiction.

- Identify the budgetary needs of the local government, including essential services and infrastructure.

- Calculate the required revenue by dividing the total budget by the total assessed value.

- Convert this figure into mills by multiplying by one thousand.

- Ensure compliance with state regulations regarding maximum allowable rates.

Following these steps ensures that the calculation is accurate and legally compliant, providing transparency to taxpayers.

Legal Use of the Maximum Millage Levy Calculation

The legal use of the maximum millage levy calculation is governed by Florida state law. Local governments must adhere to specific guidelines to ensure that their tax rates remain within allowable limits. This includes conducting public hearings and providing notice to taxpayers about proposed rates. Failure to comply with these regulations can result in legal challenges and penalties. Therefore, understanding the legal framework surrounding this calculation is vital for local officials and taxpayers alike.

Key Elements of the Maximum Millage Levy Calculation

Several key elements are crucial to the maximum millage levy calculation:

- Assessed Value: The total value of properties as determined by the property appraiser.

- Budgetary Needs: The financial requirements of the local government for the upcoming fiscal year.

- Millage Rate: The calculated rate expressed in mills that determines the amount of tax owed.

- Compliance Requirements: Adherence to state laws and regulations regarding tax levies.

These elements work together to ensure that the maximum millage levy calculation is both accurate and compliant with legal standards.

How to Obtain the Maximum Millage Levy Calculation

Obtaining the maximum millage levy calculation typically involves accessing public records from the local property appraiser's office or the county tax collector. These offices provide detailed information regarding assessed property values and the current millage rates. Additionally, local government websites often publish budget documents that outline the proposed millage rates for upcoming fiscal years. Engaging with these resources can provide property owners with a clear understanding of their tax obligations.

Examples of Using the Maximum Millage Levy Calculation

Examples of the maximum millage levy calculation in practice include:

- A county calculating its maximum millage rate to fund public schools, ensuring that the rate meets educational needs while remaining within legal limits.

- A city determining its millage rate to support infrastructure projects, such as road repairs and public safety enhancements.

- A local government adjusting its millage rate in response to changes in property values or budgetary requirements, ensuring fiscal responsibility.

These examples illustrate how the calculation is applied in real-world scenarios, impacting community services and taxpayer obligations.

Quick guide on how to complete maximum millage levy calculation florida department of

Prepare Maximum Millage Levy Calculation Florida Department Of seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the required form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Maximum Millage Levy Calculation Florida Department Of on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Maximum Millage Levy Calculation Florida Department Of effortlessly

- Find Maximum Millage Levy Calculation Florida Department Of and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Alter and eSign Maximum Millage Levy Calculation Florida Department Of and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maximum millage levy calculation florida department of

Create this form in 5 minutes!

How to create an eSignature for the maximum millage levy calculation florida department of

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the maximum millage allowed for documents signed through airSlate SignNow?

The maximum millage is not a standard metric related to document signing; however, airSlate SignNow allows users to send and eSign documents without limits on the type or number of documents. You can manage and track all your documents efficiently, ensuring compliance with your specific regulatory needs.

-

How does airSlate SignNow help optimize maximum millage for business processes?

By utilizing airSlate SignNow, businesses can streamline their document signing processes, reducing the time and manual effort associated with traditional methods. This leads to maximum millage in workflow efficiency, allowing teams to focus on core business activities.

-

What are the pricing options for airSlate SignNow, and how do they relate to maximizing cost efficiency?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By choosing the right plan, you can maximize millage in your budget, ensuring you have access to essential features without overspending.

-

Can I integrate airSlate SignNow with other applications to enhance maximum millage?

Yes, airSlate SignNow offers seamless integrations with numerous applications, including CRM tools and productivity software. This facilitates maximum millage by centralizing processes and promoting collaboration across platforms.

-

What features of airSlate SignNow contribute to achieving maximum millage in document management?

Key features such as templates, mobile access, and automated reminders contribute to maximizing millage in your document management process. These tools enhance productivity and ensure timely completion of eSignatures.

-

How does airSlate SignNow support remote work while maximizing millage?

In today's remote work environment, airSlate SignNow provides a user-friendly eSigning solution that ensures documents can be signed from anywhere. This flexibility optimizes maximum millage by keeping projects moving forward despite physical distances.

-

Is there a free trial option for airSlate SignNow to evaluate its maximum millage benefits?

Yes, airSlate SignNow offers a free trial period for new users to explore its features and see how it can maximize millage in their document workflows. This is an excellent opportunity for businesses to witness the potential cost savings and efficiency improvements.

Get more for Maximum Millage Levy Calculation Florida Department Of

Find out other Maximum Millage Levy Calculation Florida Department Of

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease