Registration Forms South Carolina Department of Revenue 2020-2026

What is the sales tax exemption certificate in South Carolina?

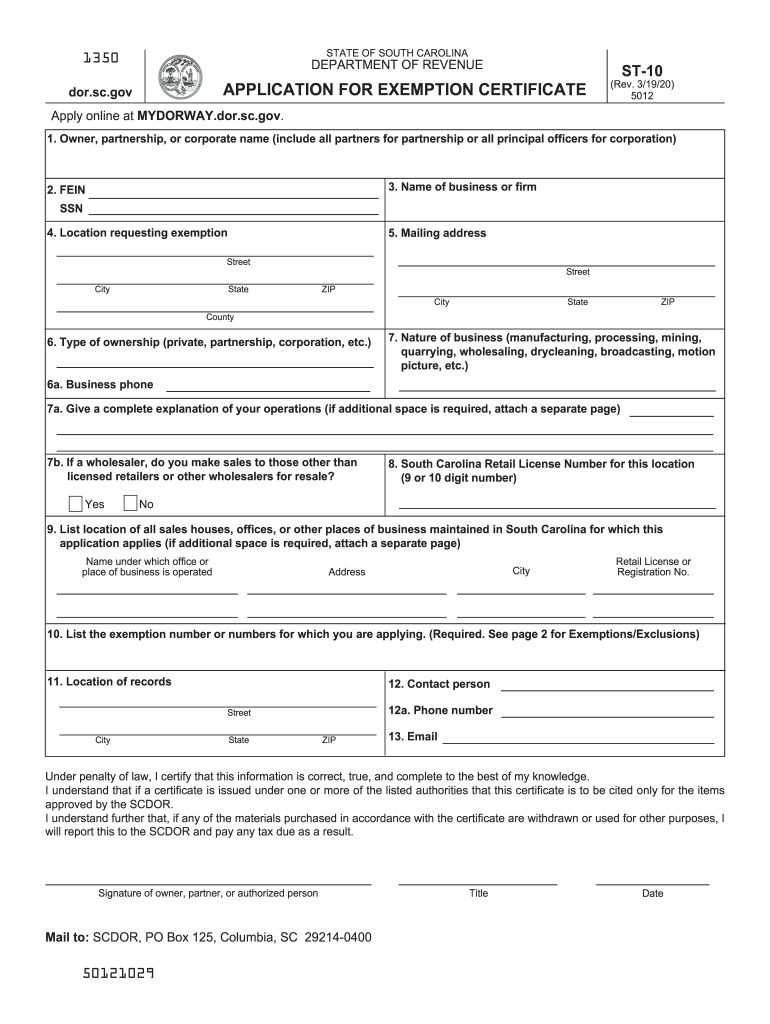

The sales tax exemption certificate in South Carolina, commonly referred to as the SC Form ST-10, is a vital document that allows eligible purchasers to buy goods and services without paying sales tax. This certificate is primarily used by businesses and organizations that qualify for tax-exempt status, including non-profit entities, government agencies, and certain educational institutions. By presenting this certificate to vendors, exempt purchasers can ensure that they are not charged sales tax on qualifying purchases.

Eligibility criteria for the sales tax exemption certificate

To qualify for the sales tax exemption certificate in South Carolina, applicants must meet specific criteria. Generally, the following entities are eligible:

- Non-profit organizations recognized under Section 501(c)(3) of the Internal Revenue Code.

- Government agencies at the federal, state, or local level.

- Certain educational institutions that are accredited and recognized by the state.

- Religious organizations that meet the necessary requirements.

Each applicant must ensure they have the proper documentation to support their tax-exempt status when applying for the SC Form ST-10.

Steps to complete the sales tax exemption certificate

Filling out the sales tax exemption certificate in South Carolina involves several straightforward steps:

- Obtain the SC Form ST-10 from the South Carolina Department of Revenue website or through authorized channels.

- Fill in the required information, including the name of the purchaser, address, and the reason for exemption.

- Provide details about the vendor from whom the goods or services are being purchased.

- Sign and date the certificate to validate it.

Once completed, the certificate should be presented to the vendor at the time of purchase to ensure sales tax is not applied.

Legal use of the sales tax exemption certificate

The sales tax exemption certificate must be used in accordance with South Carolina tax laws. It is essential that the certificate is only presented for purchases that genuinely qualify for tax exemption. Misuse of the certificate can lead to penalties, including fines and back taxes owed. Vendors are responsible for ensuring that the certificate is valid and that the purchaser meets the eligibility criteria before accepting it.

Form submission methods for the sales tax exemption certificate

While the SC Form ST-10 is typically presented directly to vendors at the time of purchase, it is also important for purchasers to keep a copy for their records. The certificate does not need to be submitted to the South Carolina Department of Revenue unless specifically requested during an audit or review. Maintaining accurate records of all transactions involving the exemption certificate is crucial for compliance.

Key elements of the sales tax exemption certificate

Several key elements must be included in the sales tax exemption certificate to ensure its validity:

- The name and address of the purchaser.

- The name and address of the vendor.

- A clear statement of the reason for the exemption.

- The signature of the purchaser or an authorized representative.

- The date of the transaction.

Completing these elements accurately helps to prevent disputes and ensures compliance with state tax regulations.

Quick guide on how to complete registration forms south carolina department of revenue

Execute Registration Forms South Carolina Department Of Revenue easily on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly without delays. Manage Registration Forms South Carolina Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient method to modify and electronically sign Registration Forms South Carolina Department Of Revenue effortlessly

- Find Registration Forms South Carolina Department Of Revenue and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Registration Forms South Carolina Department Of Revenue and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct registration forms south carolina department of revenue

Create this form in 5 minutes!

How to create an eSignature for the registration forms south carolina department of revenue

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a South Carolina tax exemption certificate?

A South Carolina tax exemption certificate is a document issued by the South Carolina Department of Revenue that allows qualifying organizations to make purchases without paying sales tax. This certificate is essential for nonprofits, government entities, and certain businesses that need to operate tax-exempt for specific purchases.

-

How can I obtain a South Carolina tax exemption certificate?

To obtain a South Carolina tax exemption certificate, you must apply through the South Carolina Department of Revenue. You'll need to complete the appropriate application form and provide documentation of your organization's tax-exempt status. Once approved, you will receive your certificate, which can be used for tax-exempt purchases.

-

What are the benefits of using airSlate SignNow for managing my South Carolina tax exemption certificate?

Using airSlate SignNow streamlines the process of managing your South Carolina tax exemption certificate by allowing you to securely sign, send, and store documents electronically. This not only saves time but also reduces paperwork and helps ensure that your certificate is easily accessible for audits or vendor requests.

-

Are there costs associated with using airSlate SignNow for South Carolina tax exemption certificate transactions?

airSlate SignNow provides a cost-effective solution for managing your South Carolina tax exemption certificate transactions. The pricing is competitive, and you can choose from various plans tailored to different business needs, ensuring you only pay for what you require while keeping your document flow efficient.

-

Can I integrate airSlate SignNow with other platforms for managing my South Carolina tax exemption certificate?

Yes, airSlate SignNow integrates with various platforms, enabling seamless management of your South Carolina tax exemption certificate. You can connect it with popular tools such as Google Workspace, Salesforce, and more, ensuring that your document management process is cohesive and efficient across all your business applications.

-

Is airSlate SignNow compliant with South Carolina tax laws when handling tax exemption certificates?

Absolutely, airSlate SignNow is designed to comply with South Carolina tax laws, including those governing the handling of tax exemption certificates. Using our platform ensures that your documents are securely stored and properly managed, minimizing the risk of compliance issues associated with tax regulations.

-

How does electronic signing of the South Carolina tax exemption certificate work with airSlate SignNow?

The electronic signing process for your South Carolina tax exemption certificate with airSlate SignNow is straightforward and secure. You can easily upload your certificate, invite signers via email, and track the signing progress in real-time, ensuring a quick turnaround on your document workflows.

Get more for Registration Forms South Carolina Department Of Revenue

- Warranty deed from individual to corporation virginia form

- Quitclaim deed from individual to llc virginia form

- Warranty deed from individual to llc virginia form

- Va 4 form

- Virginia husband wife 497428063 form

- Warranty deed from husband and wife to corporation virginia form

- Virginia death deed form

- Virginia divorce contested form

Find out other Registration Forms South Carolina Department Of Revenue

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself