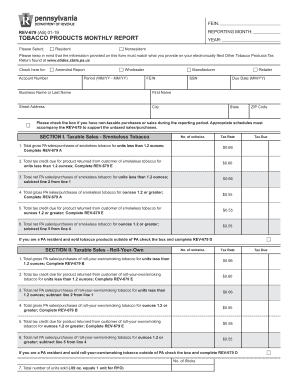

Rev 679 2020

What is the Rev 679

The Rev 679 is a Pennsylvania Department of Revenue form used primarily for tax purposes. This form is essential for individuals and businesses that need to report specific tax information to the state. It serves as a formal declaration of tax-related data, ensuring compliance with state tax regulations. Understanding the purpose and requirements of the Rev 679 is crucial for accurate filing and avoiding potential penalties.

How to use the Rev 679

Using the Rev 679 involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the tax period in question. Next, carefully fill out the form, ensuring that all sections are completed according to the instructions provided. It is important to double-check for any errors or omissions before submission, as inaccuracies can lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements set by the Pennsylvania Department of Revenue.

Steps to complete the Rev 679

Completing the Rev 679 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the Rev 679 form from the Pennsylvania Department of Revenue website.

- Fill out the form, ensuring all fields are completed with accurate information.

- Review the form for any errors or missing information.

- Submit the completed form either electronically through the online portal or by mailing it to the appropriate address.

Legal use of the Rev 679

The Rev 679 is legally binding when filled out correctly and submitted in accordance with Pennsylvania state law. It is essential to understand the legal implications of the information provided on the form. Any inaccuracies or fraudulent information can lead to legal penalties, including fines or audits. Therefore, ensuring that all data reported is truthful and complete is vital for maintaining compliance with tax regulations.

Required Documents

To accurately complete the Rev 679, several documents are required. These typically include:

- Income statements for the reporting period.

- Previous tax returns for reference.

- Any supporting documentation relevant to deductions or credits claimed.

- Identification information, such as Social Security numbers or Employer Identification Numbers (EIN).

Having these documents on hand will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Form Submission Methods

The Rev 679 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Pennsylvania Department of Revenue's electronic filing system.

- Mailing a printed copy of the completed form to the designated address provided in the instructions.

- In-person submission at local Department of Revenue offices, if applicable.

Choosing the right submission method can streamline the filing process and ensure timely processing of your form.

Quick guide on how to complete rev 679

Effortlessly Prepare Rev 679 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Rev 679 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and eSign Rev 679 with Ease

- Locate Rev 679 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools designed specifically for that task by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Rev 679 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 679

Create this form in 5 minutes!

How to create an eSignature for the rev 679

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is PA Rev 679?

PA Rev 679 refers to a Pennsylvania revenue law that incorporates digital signatures for legal documents. This allows businesses to efficiently manage and sign documents electronically, ensuring compliance with state regulations. By utilizing airSlate SignNow, organizations can easily navigate PA Rev 679 and streamline their document workflows.

-

How does airSlate SignNow support PA Rev 679 compliance?

airSlate SignNow is designed to comply with PA Rev 679 by offering secure electronic signatures. Our platform ensures that all signed documents are legally binding and protect user authentication and data integrity. This compliance provides businesses peace of mind when sending and signing documents electronically.

-

What features does airSlate SignNow offer related to PA Rev 679?

airSlate SignNow includes essential features such as customizable templates, automated workflows, and mobile access to ensure compliance with PA Rev 679. With these tools, businesses can efficiently manage and track their document signing processes. Additionally, our user-friendly interface makes it easier to navigate these features.

-

Is airSlate SignNow cost-effective for businesses looking to comply with PA Rev 679?

Yes, airSlate SignNow offers pricing plans that cater to various business needs, making it a cost-effective solution for compliance with PA Rev 679. With our flexible plans, businesses can choose the features that fit their budget without sacrificing quality or functionality. This affordability helps companies effectively manage their document signing processes.

-

Can airSlate SignNow integrate with other tools to support PA Rev 679?

Absolutely! airSlate SignNow integrates seamlessly with various tools like CRMs, cloud storage, and productivity platforms to enhance compliance with PA Rev 679. These integrations allow businesses to automate their workflows and maintain consistency across their operations. This flexibility improves overall efficiency and document management.

-

What are the benefits of using airSlate SignNow for PA Rev 679 compliance?

Using airSlate SignNow for PA Rev 679 compliance provides numerous benefits, including reduced turnaround times for document signing and enhanced security. Our solution streamlines the entire signing process, enabling businesses to operate more efficiently. Additionally, it minimizes paper usage, aligning with green business practices.

-

How easy is it to implement airSlate SignNow to comply with PA Rev 679?

Implementing airSlate SignNow to comply with PA Rev 679 is straightforward and user-friendly. Our intuitive platform ensures that users can get started quickly without a steep learning curve. Additionally, our customer support team is available to assist during the onboarding process, ensuring a smooth transition.

Get more for Rev 679

- Va sale form

- Quitclaim deed from individual to corporation virginia form

- Warranty deed from individual to corporation virginia form

- Quitclaim deed from individual to llc virginia form

- Warranty deed from individual to llc virginia form

- Va 4 form

- Virginia husband wife 497428063 form

- Warranty deed from husband and wife to corporation virginia form

Find out other Rev 679

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now