Business Tax Forms Division of Revenue State of 2019

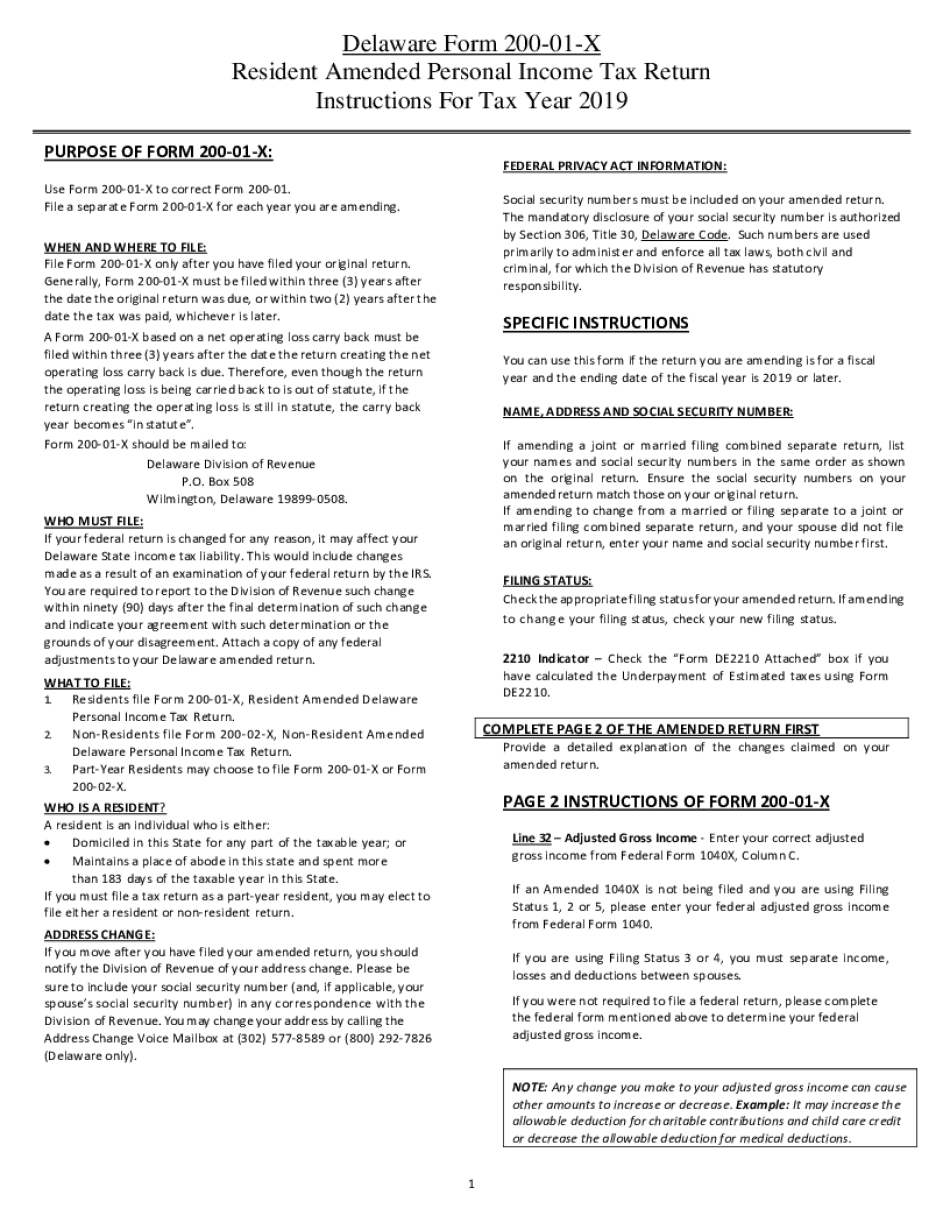

What is the Delaware Form 200 01 X?

The Delaware Form 200 01 X is a tax document used by businesses to report their income and calculate their tax liability in the state of Delaware. This form is essential for corporations and other business entities operating within the state, as it provides the necessary information for the Division of Revenue to assess taxes accurately. Understanding the purpose and requirements of this form is crucial for compliance with Delaware tax laws.

Steps to Complete the Delaware Form 200 01 X

Completing the Delaware Form 200 01 X involves several key steps that ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering your business's income, deductions, and credits as required. Be sure to review the instructions carefully to avoid common mistakes. After completing the form, double-check all entries for accuracy before submission.

Filing Deadlines for the Delaware Form 200 01 X

It is important to be aware of the filing deadlines associated with the Delaware Form 200 01 X. Typically, the form must be filed by the 15th day of the fourth month following the close of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties, so timely filing is essential.

Form Submission Methods for the Delaware Form 200 01 X

Businesses have several options for submitting the Delaware Form 200 01 X. The form can be filed electronically through the Delaware Division of Revenue's online portal, which is a convenient option for many. Alternatively, businesses may choose to mail a paper copy of the form to the Division of Revenue. In-person submissions are also accepted at designated locations. Each method has its own processing times, so choose the one that best fits your needs.

Legal Use of the Delaware Form 200 01 X

The Delaware Form 200 01 X is legally binding once it is properly completed and submitted. This means that the information provided must be accurate and truthful, as any discrepancies may lead to audits or penalties. It is crucial for businesses to understand the legal implications of their submissions and to maintain records that support the data reported on the form.

Required Documents for the Delaware Form 200 01 X

To complete the Delaware Form 200 01 X, certain documents are required. These typically include financial statements, tax identification numbers, and any relevant schedules or supporting documentation that detail income and expenses. Having these documents ready will streamline the completion process and ensure compliance with state regulations.

Penalties for Non-Compliance with the Delaware Form 200 01 X

Failing to comply with the requirements associated with the Delaware Form 200 01 X can result in significant penalties. Businesses may face fines for late submissions, inaccuracies, or failure to file altogether. Understanding these penalties is important for maintaining compliance and avoiding unnecessary costs.

Quick guide on how to complete business tax forms 2018 division of revenue state of

Complete Business Tax Forms Division Of Revenue State Of effortlessly on every device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any interruptions. Handle Business Tax Forms Division Of Revenue State Of on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related processes today.

The easiest way to modify and eSign Business Tax Forms Division Of Revenue State Of effortlessly

- Find Business Tax Forms Division Of Revenue State Of and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or blackout sensitive information using the tools airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign Business Tax Forms Division Of Revenue State Of to ensure effective communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax forms 2018 division of revenue state of

Create this form in 5 minutes!

How to create an eSignature for the business tax forms 2018 division of revenue state of

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Delaware Form 200 01 X?

Delaware Form 200 01 X is a crucial document used for various business filings in the state of Delaware. It is primarily utilized by businesses to ensure compliance with state regulations. Understanding this form can help streamline your submission process.

-

How can airSlate SignNow help with Delaware Form 200 01 X?

airSlate SignNow simplifies the process of filling and eSigning Delaware Form 200 01 X. With its user-friendly interface, you can easily complete and send this document securely. Our platform ensures that your submissions are both efficient and compliant.

-

What are the pricing options for airSlate SignNow when dealing with Delaware Form 200 01 X?

airSlate SignNow offers competitive pricing plans tailored for businesses managing documents like Delaware Form 200 01 X. Our plans include various features to cater to different organizational needs. You can choose a plan that best fits your workflow and budget.

-

Are there any integrations available for managing Delaware Form 200 01 X?

Yes, airSlate SignNow supports various integrations that can assist in managing Delaware Form 200 01 X more effectively. You can integrate it with several popular apps, streamlining your document management process. This ensures your team can work seamlessly across platforms.

-

What are the key features of airSlate SignNow for handling forms like Delaware Form 200 01 X?

Key features of airSlate SignNow include customizable templates, easy document sharing, and secure eSigning capabilities. These features are particularly useful when dealing with Delaware Form 200 01 X, ensuring you can manage and complete the form efficiently. Our platform is built to enhance your document workflow.

-

Can I track the status of Delaware Form 200 01 X with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Delaware Form 200 01 X in real time. You'll receive notifications when the document is viewed and signed, giving you peace of mind during the submission process. This feature helps you stay organized and informed.

-

Is airSlate SignNow secure for sending Delaware Form 200 01 X?

Yes, security is a priority at airSlate SignNow. We employ advanced encryption and security measures to protect your Delaware Form 200 01 X and other documents. You can trust that your sensitive information remains confidential and secure throughout the process.

Get more for Business Tax Forms Division Of Revenue State Of

- Legal last will and testament form for married person with adult and minor children from prior marriage virginia

- Legal last will and testament form for married person with adult and minor children virginia

- Mutual wills package with last wills and testaments for married couple with adult and minor children virginia form

- Va widow form

- Legal last will and testament form for widow or widower with minor children virginia

- Legal last will form for a widow or widower with no children virginia

- Legal last will and testament form for a widow or widower with adult and minor children virginia

- Legal last will and testament form for divorced and remarried person with mine yours and ours children virginia

Find out other Business Tax Forms Division Of Revenue State Of

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast