Form 89 224, Request for Waiver of Penalty for Late Report 2020-2026

What is the Form 89 224, Request For Waiver Of Penalty For Late Report

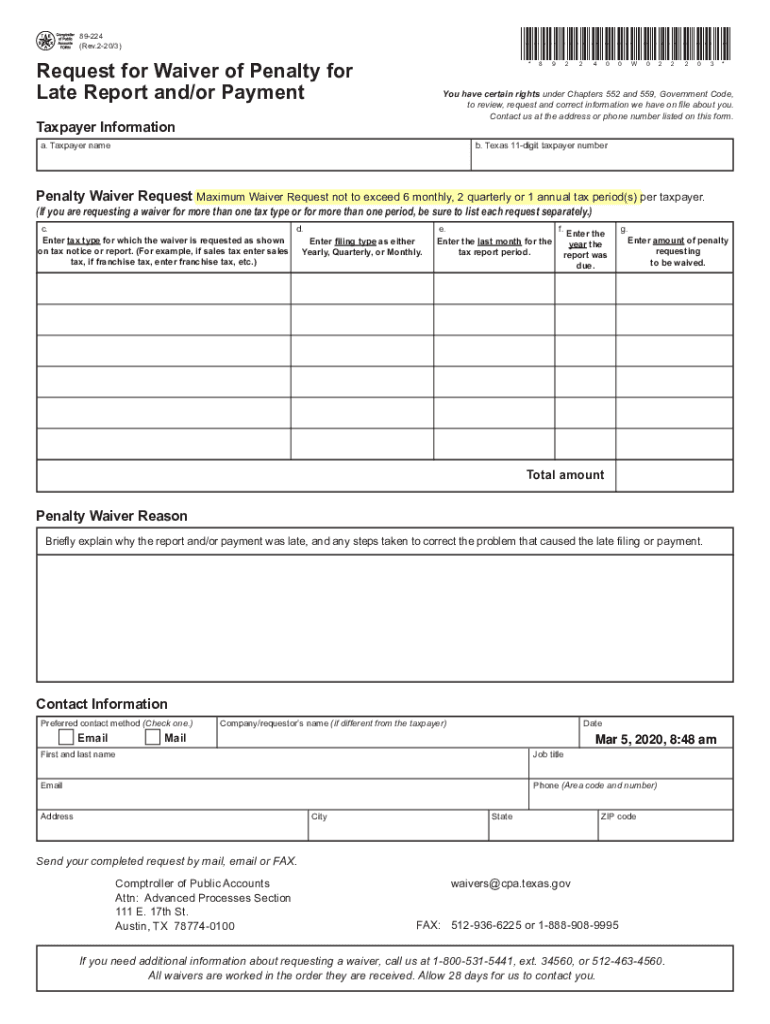

The Form 89 224 is a document used by taxpayers in Texas to request a waiver of penalties associated with the late filing of certain reports. This form is particularly relevant for businesses that may have missed deadlines for submitting their tax reports. By submitting the form, taxpayers can explain their circumstances and request relief from penalties that may have been imposed due to late submissions. Understanding the purpose and implications of the 89 224 waiver is essential for managing compliance and avoiding unnecessary financial burdens.

How to use the Form 89 224, Request For Waiver Of Penalty For Late Report

Using the Form 89 224 involves several key steps. First, ensure that you have the correct version of the form, which can typically be obtained from the Texas Comptroller's website or other official sources. Next, fill out the form with accurate details, including your business information and the specific reasons for your request. It is important to be clear and concise in your explanations to improve the chances of approval. Once completed, the form can be submitted online or via mail, depending on your preference and the specific instructions provided by the Texas Comptroller.

Steps to complete the Form 89 224, Request For Waiver Of Penalty For Late Report

Completing the Form 89 224 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including your business name, address, and tax identification number.

- Clearly state the reason for your late report submission, providing any relevant details that support your case.

- Review the form for completeness, ensuring all required fields are filled in correctly.

- Sign and date the form to validate your request.

- Submit the form according to the guidelines provided, either online or by mailing it to the appropriate office.

Key elements of the Form 89 224, Request For Waiver Of Penalty For Late Report

The Form 89 224 includes several key elements that are crucial for its effectiveness. These elements typically consist of:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Reason for Waiver Request: A detailed explanation of why the report was submitted late, including any extenuating circumstances.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the request.

- Date of Submission: The date on which the form is submitted is important for tracking and compliance purposes.

Eligibility Criteria for the Form 89 224, Request For Waiver Of Penalty For Late Report

To be eligible for a waiver using the Form 89 224, certain criteria must be met. Taxpayers should demonstrate that the late filing was due to reasonable cause rather than willful neglect. Common acceptable reasons include:

- Natural disasters that impacted the ability to file on time.

- Serious illness or incapacitation of the taxpayer or responsible personnel.

- Unforeseen circumstances that hindered timely reporting, such as technical issues or sudden business emergencies.

Form Submission Methods for the 89 224, Request For Waiver Of Penalty For Late Report

The Form 89 224 can be submitted through various methods, allowing flexibility for taxpayers. These methods include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Texas Comptroller's online portal, which often allows for quicker processing.

- Mail Submission: Taxpayers can print the completed form and send it via postal mail to the designated office of the Texas Comptroller.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local Comptroller office is also an option.

Quick guide on how to complete form 89 224 request for waiver of penalty for late report

Effortlessly prepare Form 89 224, Request For Waiver Of Penalty For Late Report on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 89 224, Request For Waiver Of Penalty For Late Report seamlessly on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Effortlessly edit and eSign Form 89 224, Request For Waiver Of Penalty For Late Report

- Locate Form 89 224, Request For Waiver Of Penalty For Late Report and click Get Form to initiate.

- Use the tools available to complete your document.

- Point out important sections of the documents or redact confidential information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form—via email, SMS, or invite link—or download it to your computer.

Eliminate the risk of lost or misplaced documents, tedious searches for forms, and the hassle of reprinting documents due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 89 224, Request For Waiver Of Penalty For Late Report to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 89 224 request for waiver of penalty for late report

Create this form in 5 minutes!

How to create an eSignature for the form 89 224 request for waiver of penalty for late report

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 89 224 waiver and how does it work?

The 89 224 waiver refers to a specific provision allowing qualified entities to bypass certain regulatory requirements. With airSlate SignNow, businesses can easily utilize the 89 224 waiver for document processing, making it quicker and more efficient to handle compliance matters.

-

How can airSlate SignNow help with the 89 224 waiver process?

airSlate SignNow streamlines the entire 89 224 waiver process by providing tools for electronic signatures and document management. Our platform ensures that all documents required for the 89 224 waiver are handled securely, allowing for faster approvals and enhanced compliance.

-

What are the pricing options for using airSlate SignNow for the 89 224 waiver?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those specifically interested in the 89 224 waiver. We provide competitive rates that ensure you get the best value while utilizing our efficient electronic signature and document management features.

-

Are there any specific features in airSlate SignNow that support the 89 224 waiver?

Absolutely! airSlate SignNow includes features like customizable templates, audit trails, and secure cloud storage, all of which enhance the 89 224 waiver experience. These tools ensure your documents are compliant, accessible, and therefore exceptionally well-suited for handling waivers.

-

How does airSlate SignNow ensure compliance with the 89 224 waiver?

airSlate SignNow prioritizes compliance through secure encryption and robust security protocols. By adhering to industry standards and legal regulations for the 89 224 waiver, our platform ensures that every document is securely managed and processed, reducing the risk of non-compliance.

-

Can I integrate airSlate SignNow with other tools for managing the 89 224 waiver?

Yes, airSlate SignNow offers various integration options that allow seamless connectivity with other business tools. This means you can easily manage workflows related to the 89 224 waiver alongside your existing applications, enhancing productivity and document handling efficiency.

-

What benefits does airSlate SignNow provide for businesses dealing with the 89 224 waiver?

Using airSlate SignNow for the 89 224 waiver simplifies the documentation process, saving you time and reducing administrative burdens. Our solution not only accelerates the approval process but also increases accuracy and accountability in your waiver submissions.

Get more for Form 89 224, Request For Waiver Of Penalty For Late Report

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services vermont form

- Temporary lease agreement to prospective buyer of residence prior to closing vermont form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497428803 form

- Letter from landlord to tenant returning security deposit less deductions vermont form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return vermont form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return vermont form

- Letter from tenant to landlord containing request for permission to sublease vermont form

- Vermont damages form

Find out other Form 89 224, Request For Waiver Of Penalty For Late Report

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple