Form NJ CBT 100S Fill Online, Printable, Fillable 2018-2026

Understanding the NJ CBT 100 Form

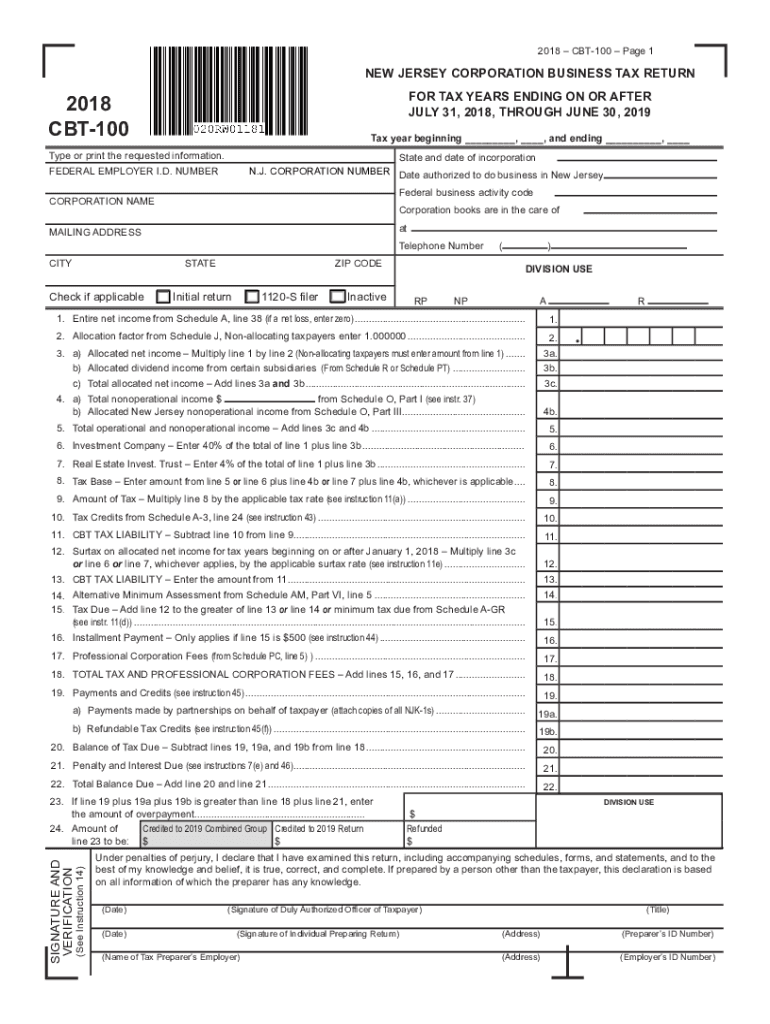

The NJ CBT 100 form, also known as the Corporation Business Tax (CBT) return, is a crucial document for corporations operating in New Jersey. It is used to report income, calculate tax liability, and ensure compliance with state tax regulations. This form is essential for both domestic and foreign corporations doing business in New Jersey, and it must be filed annually. Understanding the structure and requirements of the NJ CBT 100 is vital for accurate reporting and avoiding penalties.

Steps to Complete the NJ CBT 100 Form

Completing the NJ CBT 100 form involves several steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and expense reports. Next, complete the form by providing required information such as business identification details, income, and deductions. It is important to review the form for any errors before submission. Finally, ensure that the form is signed and dated by an authorized individual within the corporation.

Filing Deadlines for the NJ CBT 100 Form

The NJ CBT 100 form must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this typically means the form is due by April 15. Timely filing is crucial to avoid late fees and penalties. Additionally, corporations should be aware of estimated tax payment deadlines throughout the year to maintain compliance.

Legal Use of the NJ CBT 100 Form

The NJ CBT 100 form is legally binding and must be completed in accordance with New Jersey tax laws. The information provided on the form is used to determine the corporation's tax liability and compliance status. Failure to accurately complete and submit the form can result in legal penalties, including fines and interest on unpaid taxes. It is advisable for corporations to consult with a tax professional to ensure compliance with all legal requirements.

Required Documents for the NJ CBT 100 Form

When preparing to file the NJ CBT 100 form, corporations must gather several key documents. These include financial statements, federal tax returns, and any supporting documentation for deductions or credits claimed. Additionally, corporations should have their business identification number and any prior year returns available for reference. Having these documents organized will facilitate a smoother filing process.

Form Submission Methods for the NJ CBT 100

The NJ CBT 100 form can be submitted through various methods to accommodate different preferences. Corporations may file the form electronically through the New Jersey Division of Taxation's online portal. Alternatively, the form can be mailed to the appropriate tax office. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so corporations should choose the option that best suits their needs.

Penalties for Non-Compliance with the NJ CBT 100 Form

Non-compliance with the NJ CBT 100 form requirements can lead to significant penalties for corporations. These penalties may include late filing fees, interest on unpaid taxes, and potential legal action. To mitigate these risks, it is essential for corporations to file their forms accurately and on time. Regular review of compliance requirements can help avoid costly mistakes and ensure adherence to New Jersey tax laws.

Quick guide on how to complete 2019 form nj cbt 100s fill online printable fillable

Effortlessly complete Form NJ CBT 100S Fill Online, Printable, Fillable on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly option to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage Form NJ CBT 100S Fill Online, Printable, Fillable on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest way to modify and electronically sign Form NJ CBT 100S Fill Online, Printable, Fillable effortlessly

- Find Form NJ CBT 100S Fill Online, Printable, Fillable and select Get Form to initiate the process.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just a few seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form NJ CBT 100S Fill Online, Printable, Fillable to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form nj cbt 100s fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2019 form nj cbt 100s fill online printable fillable

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is an NJ CBT 100 amended return?

An NJ CBT 100 amended return is a modified version of the original corporate business tax return filed in New Jersey. Businesses are required to submit an amended return to correct any mistakes or omissions found after the initial filing. Making changes through an NJ CBT 100 amended return can help ensure compliance with state tax laws and avoid penalties.

-

How do I file an NJ CBT 100 amended return?

To file an NJ CBT 100 amended return, you need to obtain the appropriate forms from the New Jersey Division of Taxation. You should fill out the amended return with the corrected information and any necessary explanations for the changes. Once completed, submit the form as per the state's guidelines to ensure proper processing.

-

What are the benefits of using airSlate SignNow for filing the NJ CBT 100 amended return?

Using airSlate SignNow simplifies the process of filing an NJ CBT 100 amended return by allowing users to electronically sign and send documents securely. This efficient and cost-effective solution minimizes delays and ensures that your amended return is submitted swiftly. Additionally, the platform's user-friendly interface makes it easy to manage all document workflows.

-

Is there a cost associated with filing an NJ CBT 100 amended return using airSlate SignNow?

While the cost to file an NJ CBT 100 amended return primarily depends on New Jersey state fees, airSlate SignNow offers affordable plans to access its eSignature and document management features. Investing in SignNow can help save time and reduce errors, providing excellent value for businesses of all sizes. Check our pricing page for detailed information on subscription options.

-

Can I track the status of my NJ CBT 100 amended return with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow users to monitor the status of their NJ CBT 100 amended return. You can receive real-time notifications about document viewing and signing, ensuring you're always updated on your filing process. This feature enhances transparency and helps you stay organized.

-

What types of integrations does airSlate SignNow support for filing tax documents?

airSlate SignNow supports various integrations with popular accounting and tax software, enhancing the efficiency of filing tax documents, including the NJ CBT 100 amended return. These integrations enable smooth data transfer, allowing users to manage their tax filings directly within their existing systems. Connecting these tools can streamline your workflow and reduce manual entry errors.

-

How can airSlate SignNow improve the efficiency of my business’s tax filing process?

Implementing airSlate SignNow can greatly improve the efficiency of your business's tax filing process by automating document workflows, including the NJ CBT 100 amended return. The platform minimizes the need for physical paperwork and reduces turnaround times through eSignature capabilities. This allows your team to focus more on strategic tasks rather than administrative duties.

Get more for Form NJ CBT 100S Fill Online, Printable, Fillable

- Vermont partial form

- Notice of dishonored check civil keywords bad check bounced check vermont form

- Mutual wills containing last will and testaments for man and woman living together not married with no children vermont form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children vermont form

- Mutual wills or last will and testaments for man and woman living together not married with minor children vermont form

- Non marital cohabitation living together agreement vermont form

- Paternity law and procedure handbook vermont form

- Bill of sale in connection with sale of business by individual or corporate seller vermont form

Find out other Form NJ CBT 100S Fill Online, Printable, Fillable

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation