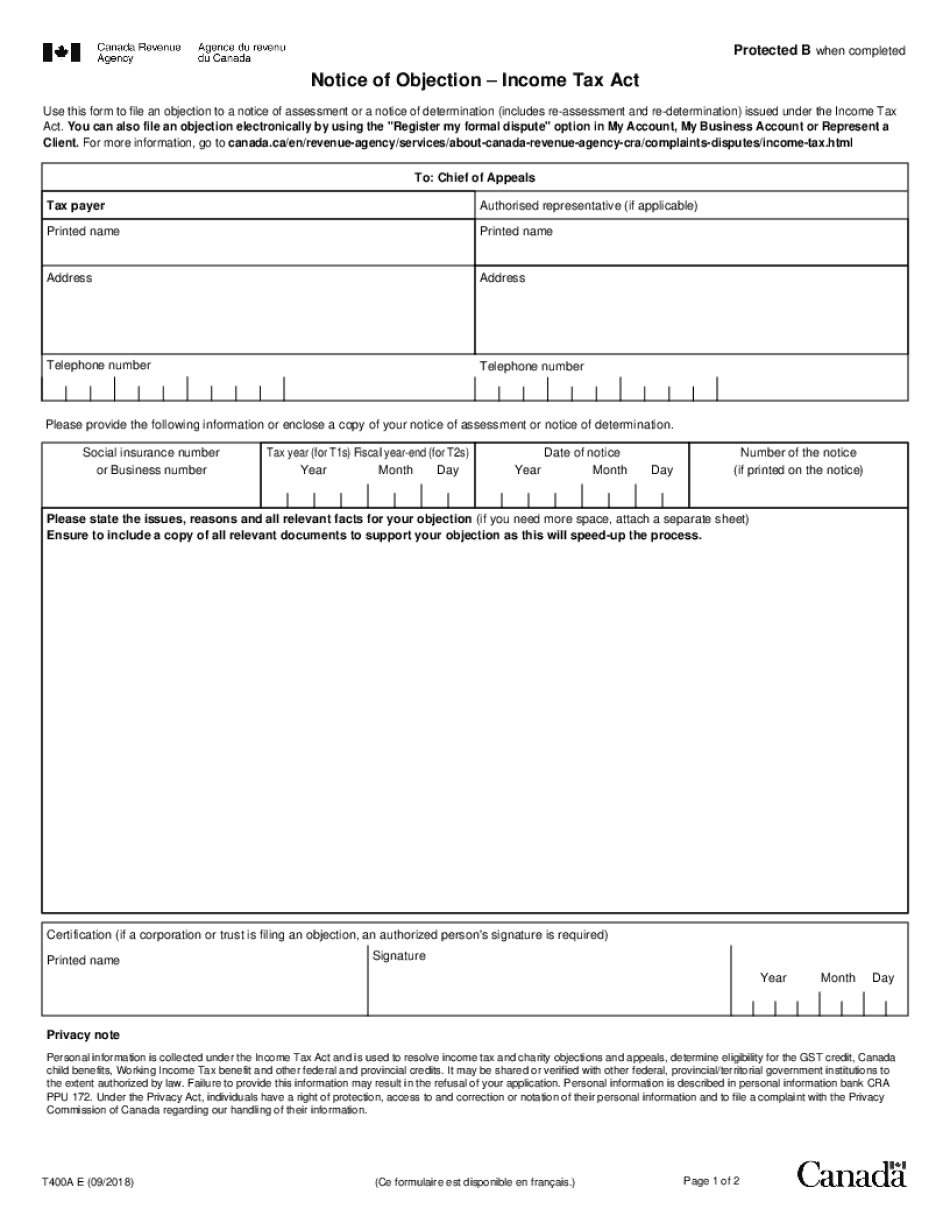

Notice of Objection Income Tax Act 2018-2026

Understanding the T400A Form

The T400A form, also known as the Notice of Objection Income Tax Act, is a crucial document for taxpayers in the United States who wish to contest a tax assessment. This form allows individuals to formally disagree with the tax assessment issued by the Internal Revenue Service (IRS). By submitting the T400A form, taxpayers can initiate a review process of their tax situation, which may lead to adjustments or corrections in their tax obligations.

Steps to Complete the T400A Form

Filling out the T400A form requires careful attention to detail to ensure compliance with IRS regulations. Here are the essential steps to complete the form:

- Gather Required Information: Collect all relevant documentation, including your original tax return, the notice of assessment, and any supporting evidence for your objection.

- Fill Out the Form: Clearly provide your personal information, including your name, address, and Social Security number. Specify the tax year in question and the reasons for your objection.

- Attach Supporting Documents: Include any evidence that supports your claim, such as receipts, statements, or other relevant paperwork.

- Review the Form: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the Form: Send the completed T400A form to the appropriate IRS address, ensuring it is postmarked by the deadline.

Key Elements of the T400A Form

Understanding the key elements of the T400A form is vital for effective completion. The form typically includes the following components:

- Taxpayer Information: Your name, address, and Social Security number.

- Tax Year: The specific year for which you are contesting the assessment.

- Reason for Objection: A detailed explanation of why you disagree with the assessment, supported by evidence.

- Signature: Your signature is required to validate the submission of the form.

Filing Deadlines for the T400A Form

Timeliness is crucial when submitting the T400A form. The IRS typically requires that the form be filed within a specific timeframe following the receipt of the notice of assessment. Generally, taxpayers have thirty days from the date of the notice to submit their objection. Missing this deadline may result in the loss of the right to contest the assessment, making it essential to adhere to these timelines.

Required Documents for the T400A Form

When completing the T400A form, several documents are necessary to support your objection effectively. These may include:

- Your original tax return for the year in question.

- The notice of assessment received from the IRS.

- Any additional documentation that substantiates your claim, such as financial statements or receipts.

Submission Methods for the T400A Form

The T400A form can be submitted through various methods, depending on your preference and convenience. Taxpayers can choose to file the form:

- By Mail: Send the completed form along with any required documents to the designated IRS address.

- Online: Some taxpayers may have the option to submit the form electronically through the IRS website, depending on their circumstances.

- In-Person: Visit a local IRS office to submit the form directly, although this may require an appointment.

Quick guide on how to complete notice of objection income tax act

Complete Notice Of Objection Income Tax Act with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents promptly without any holdups. Handle Notice Of Objection Income Tax Act on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The easiest method to edit and eSign Notice Of Objection Income Tax Act effortlessly

- Find Notice Of Objection Income Tax Act and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just moments and carries the same legal weight as a conventional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside any worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Notice Of Objection Income Tax Act to facilitate excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice of objection income tax act

Create this form in 5 minutes!

How to create an eSignature for the notice of objection income tax act

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the t400a form and why is it important for businesses?

The t400a form is a crucial document used for reporting income and deductions for various Canadian tax purposes. Businesses need to understand its requirements to ensure compliance with tax regulations. Properly managing the t400a form can enhance financial accuracy and prevent potential penalties from tax authorities.

-

How can airSlate SignNow help with the t400a form process?

airSlate SignNow simplifies the t400a form process by allowing businesses to easily create, send, and eSign necessary documents. With its user-friendly interface, you can manage workflows efficiently and reduce paperwork hassle. This streamlines your tax preparation and filing, ensuring that your t400a form is completed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the t400a form?

Yes, airSlate SignNow offers various pricing plans, making it a cost-effective solution for businesses of all sizes. Depending on the features you need for managing the t400a form, you can choose a plan that fits your budget. The value you receive from reducing paperwork and ensuring compliance far outweighs the costs.

-

What features do airSlate SignNow offer for managing the t400a form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated reminders that are perfect for handling the t400a form. These tools help streamline document management, enhance collaboration, and ensure that all necessary signatures are obtained quickly. This way, you can focus on your business while ensuring your t400a form is accurate.

-

Can I integrate airSlate SignNow with other tools to manage the t400a form?

Absolutely! airSlate SignNow provides seamless integrations with popular applications like Google Drive, Dropbox, and CRMs. This means you can easily store, share, and manage your t400a form alongside other business documents. The efficient integration allows for a cohesive workflow, enhancing productivity and keeping everything organized.

-

What are the benefits of using airSlate SignNow for the t400a form compared to traditional methods?

Using airSlate SignNow for the t400a form offers numerous benefits over traditional methods, including faster processing times, reduced paper usage, and secure electronic storage. Additionally, the eSigning feature speeds up the approval process, which is particularly advantageous during tax season. This modern approach saves time and reduces the chance of errors that can occur with physical paperwork.

-

Is airSlate SignNow secure for handling sensitive t400a form information?

Yes, airSlate SignNow prioritizes security and compliance when managing sensitive information like the t400a form. The platform utilizes advanced encryption protocols to protect your documents and signatures, ensuring that your data is safe. You can trust airSlate SignNow to keep your information secure while allowing easy access and management.

Get more for Notice Of Objection Income Tax Act

- Ju 100210 order regarding correction or destruction of improperly retained records washington form

- Records juvenile form

- Washington juvenile form

- Order motion records form

- Ju 110100 notice of hearing washington form

- Wa declaration blank form

- Ju 110300 subpoena washington form

- Washington subpoena form

Find out other Notice Of Objection Income Tax Act

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form