Notice of Default on Promissory Note Sample Form

Understanding the Notice of Default on Promissory Note

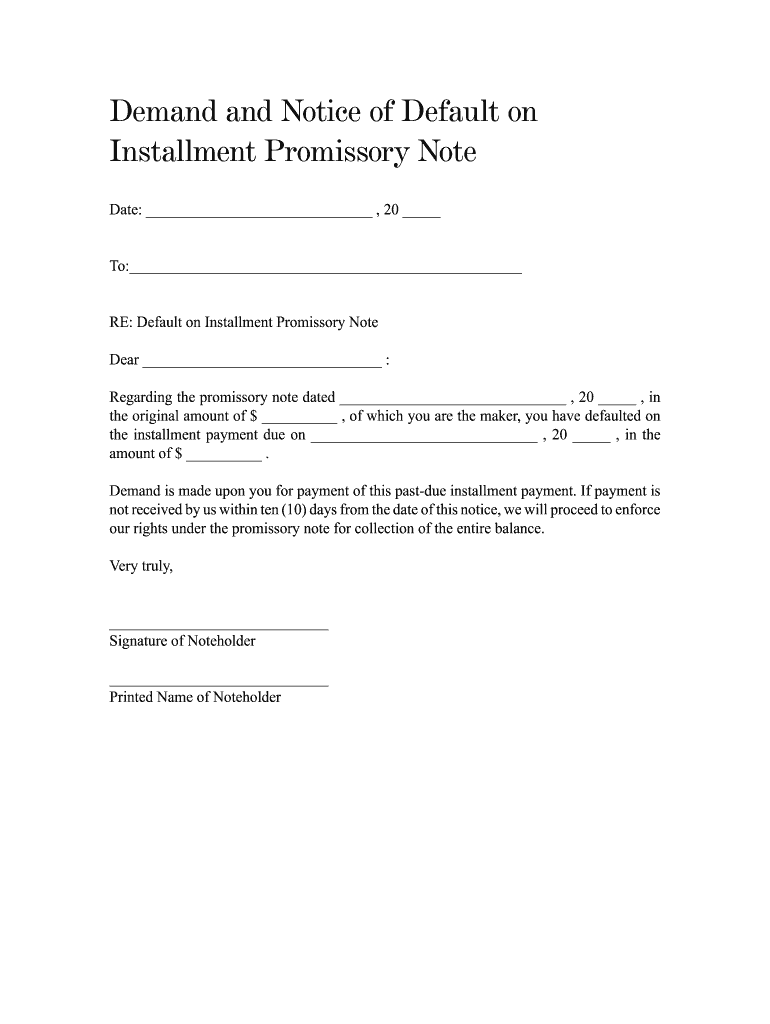

The notice of default on a promissory note serves as a formal notification that a borrower has failed to meet the payment obligations outlined in the promissory note. This document is crucial for both lenders and borrowers, as it initiates the process of addressing the missed payments. Typically, this notice will include details such as the amount due, the due date, and the consequences of continued non-payment. Understanding this notice is essential for borrowers to take corrective action and for lenders to protect their interests.

Key Elements of the Notice of Default on Promissory Note

A well-structured notice of default should contain several key elements to ensure clarity and legal compliance. These elements include:

- Borrower Information: Full name and address of the borrower.

- Lender Information: Full name and address of the lender.

- Loan Details: The original loan amount, interest rate, and payment terms.

- Default Information: Specific details about the missed payments, including dates and amounts.

- Consequences of Default: Information on potential actions the lender may take, such as initiating foreclosure or legal proceedings.

- Remedy Period: A timeframe for the borrower to rectify the default before further actions are taken.

Steps to Complete the Notice of Default on Promissory Note

Completing a notice of default involves several important steps to ensure its effectiveness and legal standing. Follow these steps:

- Gather Information: Collect all relevant details about the loan, including payment history and borrower information.

- Draft the Notice: Use clear and concise language to outline the default and include all key elements.

- Review for Accuracy: Ensure all information is correct and complies with applicable state laws.

- Send the Notice: Deliver the notice to the borrower through a method that provides proof of receipt, such as certified mail.

- Document the Process: Keep a record of the notice and any communications with the borrower for future reference.

Legal Use of the Notice of Default on Promissory Note

The legal use of a notice of default is vital for lenders to enforce their rights under the promissory note. This document acts as a formal step in the legal process, allowing lenders to pursue remedies such as foreclosure or legal action if the borrower does not rectify the default. It is essential to ensure that the notice complies with state laws regarding notifications and defaults, as improper handling can lead to legal challenges.

Examples of Using the Notice of Default on Promissory Note

Understanding practical applications of the notice of default can help both borrowers and lenders. Here are a few examples:

- Mortgage Defaults: A lender may issue a notice of default when a homeowner misses multiple mortgage payments.

- Personal Loans: If a borrower fails to make payments on a personal loan, the lender can send a notice detailing the default.

- Business Loans: A business that does not meet its repayment schedule may receive a notice from its lender, outlining the default and potential consequences.

State-Specific Rules for the Notice of Default on Promissory Note

Each state in the U.S. has specific laws governing the issuance and content of a notice of default. It is important for lenders to familiarize themselves with these regulations to ensure compliance. For example, some states may require additional information or a specific format, while others may have different timelines for notifying borrowers. Understanding these nuances can help avoid legal pitfalls and ensure that the notice is enforceable.

Quick guide on how to complete demand and notice of default on installment promissory note carrolllibrary

Complete Notice Of Default On Promissory Note Sample effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Notice Of Default On Promissory Note Sample on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to edit and eSign Notice Of Default On Promissory Note Sample with ease

- Locate Notice Of Default On Promissory Note Sample and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mishandled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Notice Of Default On Promissory Note Sample and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the demand and notice of default on installment promissory note carrolllibrary

How to generate an eSignature for your Demand And Notice Of Default On Installment Promissory Note Carrolllibrary online

How to create an eSignature for the Demand And Notice Of Default On Installment Promissory Note Carrolllibrary in Google Chrome

How to make an electronic signature for signing the Demand And Notice Of Default On Installment Promissory Note Carrolllibrary in Gmail

How to make an eSignature for the Demand And Notice Of Default On Installment Promissory Note Carrolllibrary from your smartphone

How to create an eSignature for the Demand And Notice Of Default On Installment Promissory Note Carrolllibrary on iOS devices

How to create an eSignature for the Demand And Notice Of Default On Installment Promissory Note Carrolllibrary on Android

People also ask

-

What is a sample promissory note for installment payment?

A sample promissory note for installment payment is a legal document that outlines the terms under which one party agrees to repay a loan in installments. This document typically includes details such as the payment schedule, interest rate, and any penalties for late payments. Using a template can simplify this process and ensure all key elements are covered.

-

How can I create a sample promissory note for installment payment using airSlate SignNow?

With airSlate SignNow, you can easily create a sample promissory note for installment payment by using our customizable templates. Simply log in, select the promissory note template, and fill in the required details. Our platform makes it easy to personalize the document to fit your specific needs.

-

Is there a cost associated with using airSlate SignNow to manage my sample promissory note for installment payment?

Yes, airSlate SignNow offers a variety of pricing plans suitable for different business needs. Each plan provides access to features that can streamline the process of creating and managing a sample promissory note for installment payment. Consider reviewing our pricing page for detailed information.

-

What features does airSlate SignNow provide for handling a sample promissory note for installment payment?

airSlate SignNow provides a range of features designed to enhance the management of your sample promissory note for installment payment, including electronic signatures, document storage, and real-time tracking. These features help ensure your loan documentation is secure, organized, and easily accessible.

-

Can I integrate airSlate SignNow with other applications for my sample promissory note for installment payment?

Absolutely! airSlate SignNow offers integration capabilities with various applications, making it easier to manage your sample promissory note for installment payment alongside your existing workflows. You can connect with CRMs, payment processors, and more to streamline document management.

-

What benefits can I expect from using airSlate SignNow for my sample promissory note for installment payment?

Using airSlate SignNow for your sample promissory note for installment payment offers numerous benefits, including enhanced security, efficiency, and convenience. The ability to eSign documents from anywhere saves time and simplifies the loan agreement process while maintaining legal compliance.

-

Is a sample promissory note for installment payment legally binding?

Yes, a properly executed sample promissory note for installment payment is a legally binding document as long as it meets your local laws and regulations. When created using airSlate SignNow, the document gains additional validity through our secure eSignature process, ensuring its enforceability.

Get more for Notice Of Default On Promissory Note Sample

- Etsu readmission form

- Faqssouth state bank form

- Commutingform18 19doc

- Employment of relatives approval form uf human resources

- Genetics 4 dominant and recessive alleles flashcardsquizlet form

- Travel forms forms travel office texas state university

- Preliminary technology assessment report volume ii c form

- Mail code l453 form

Find out other Notice Of Default On Promissory Note Sample

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast