St 101 Form 2020

What is the St 101 Form

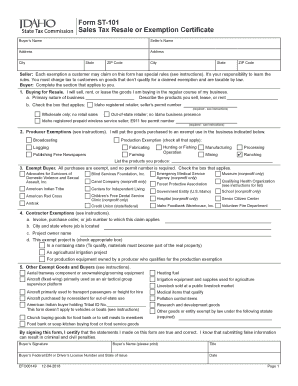

The St 101 form, also known as the Idaho sales tax exemption form, is a crucial document used by businesses and individuals in Idaho to claim sales tax exemptions. This form allows eligible purchasers to buy goods and services without paying sales tax, provided they meet specific criteria outlined by the state. The St 101 form is particularly important for non-profit organizations, government entities, and certain types of businesses that qualify for tax exemption under Idaho law.

How to use the St 101 Form

To use the St 101 form effectively, individuals or businesses must first determine their eligibility for sales tax exemption. Once eligibility is confirmed, the form must be filled out accurately, including all required information such as the purchaser's name, address, and the nature of the exemption. After completing the form, it should be presented to the seller at the time of purchase. The seller will retain a copy for their records, ensuring compliance with tax regulations.

Steps to complete the St 101 Form

Completing the St 101 form involves several key steps:

- Gather necessary information, including your business details and the reason for the exemption.

- Fill out the form with accurate and complete information.

- Review the form for any errors or omissions.

- Sign and date the form to validate it.

- Provide the completed form to the seller when making a purchase.

Legal use of the St 101 Form

The legal use of the St 101 form is governed by Idaho state tax laws. To be considered valid, the form must be properly completed and signed. It is essential that the purchaser meets the criteria for exemption, as misuse of the form can lead to penalties. The Idaho State Tax Commission may audit transactions to ensure compliance, so maintaining accurate records is crucial for both buyers and sellers.

Key elements of the St 101 Form

Several key elements must be included on the St 101 form to ensure its validity:

- The name and address of the purchaser.

- The reason for the exemption, clearly stated.

- A description of the items being purchased.

- The signature of the purchaser or an authorized representative.

- The date of the transaction.

Eligibility Criteria

Eligibility for using the St 101 form varies based on the type of purchaser and the nature of the goods or services being purchased. Common eligible entities include non-profit organizations, government agencies, and certain educational institutions. Each category has specific criteria that must be met, so it is advisable to consult the Idaho State Tax Commission for detailed information on eligibility requirements.

Quick guide on how to complete st 101 form 2020

Effortlessly prepare St 101 Form on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to effortlessly locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without obstacles. Manage St 101 Form on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to modify and eSign St 101 Form effortlessly

- Find St 101 Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using the tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your modifications.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or missing files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow caters to your document management needs with just a few clicks from your preferred device. Alter and eSign St 101 Form and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 101 form 2020

Create this form in 5 minutes!

How to create an eSignature for the st 101 form 2020

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the ST 101 form Idaho?

The ST 101 form Idaho is a sales tax exemption certificate that allows qualifying organizations to make tax-exempt purchases in the state of Idaho. It is essential for nonprofit organizations and certain governmental entities to save on costs. Proper completion of the ST 101 form Idaho ensures compliance with state tax regulations, facilitating budget management.

-

How can airSlate SignNow help with the ST 101 form Idaho?

airSlate SignNow streamlines the process of sending and eSigning the ST 101 form Idaho, ensuring that you can manage tax-exempt documentation efficiently. With its user-friendly interface, you can fill out, sign, and share the form digitally, reducing paperwork and saving time. This cost-effective solution is ideal for organizations that require regular submissions of the ST 101 form Idaho.

-

Is there a cost associated with using airSlate SignNow for the ST 101 form Idaho?

Yes, airSlate SignNow offers various pricing plans to accommodate different organizational needs, making it easy to choose the right fit. Costs depend on the number of users and features selected, but the value provided for managing documents like the ST 101 form Idaho is signNow. Users often find that the efficiency gained offsets the costs associated with the service.

-

What features does airSlate SignNow offer for managing the ST 101 form Idaho?

airSlate SignNow provides features such as eSigning, document templates, and audit trails specifically beneficial for the ST 101 form Idaho. The platform also enables users to collaborate on documents in real-time, simplifying approvals and tracking. These features ensure your organization remains compliant while managing exemption certificates conveniently.

-

Can I integrate airSlate SignNow with other applications to manage the ST 101 form Idaho?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the ST 101 form Idaho among other documents. Popular integrations with CRM tools and cloud storage services facilitate streamlined workflows, allowing for quick access and sharing of your exemption certificates. This adds to the agility of managing essential documents.

-

How secure is airSlate SignNow for processing the ST 101 form Idaho?

airSlate SignNow prioritizes security for all documents, including the ST 101 form Idaho, employing advanced encryption protocols and compliance with industry standards. This ensures that your sensitive tax exemption information is protected throughout the signing process. Users can have peace of mind knowing their data is safe and secure with airSlate SignNow.

-

What benefits can organizations expect from using airSlate SignNow for the ST 101 form Idaho?

Organizations can expect numerous benefits from using airSlate SignNow for the ST 101 form Idaho, including faster processing times and reduced paperwork. The ease of sending, signing, and storing documents digitally helps organizations streamline operations. Moreover, efficient management of tax exemption forms can lead to signNow cost savings over time.

Get more for St 101 Form

- Quitclaim deed from individual to corporation wisconsin form

- Warranty deed from individual to corporation wisconsin form

- Transfer on death deed or tod beneficiary deed from individual to four 4 individuals does not include alternate beneficiary form

- Prime contractors notice of lien rights by corporation or llc wisconsin form

- Quitclaim deed from individual to llc wisconsin form

- Warranty deed from individual to llc wisconsin form

- Wisconsin deed tod form

- Prime contractors claim of lien by individual wisconsin form

Find out other St 101 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors