Form ST 101, Sales Tax Resale or Exemption Certificate 2020-2026

What is the Form ST 101, Sales Tax Resale or Exemption Certificate

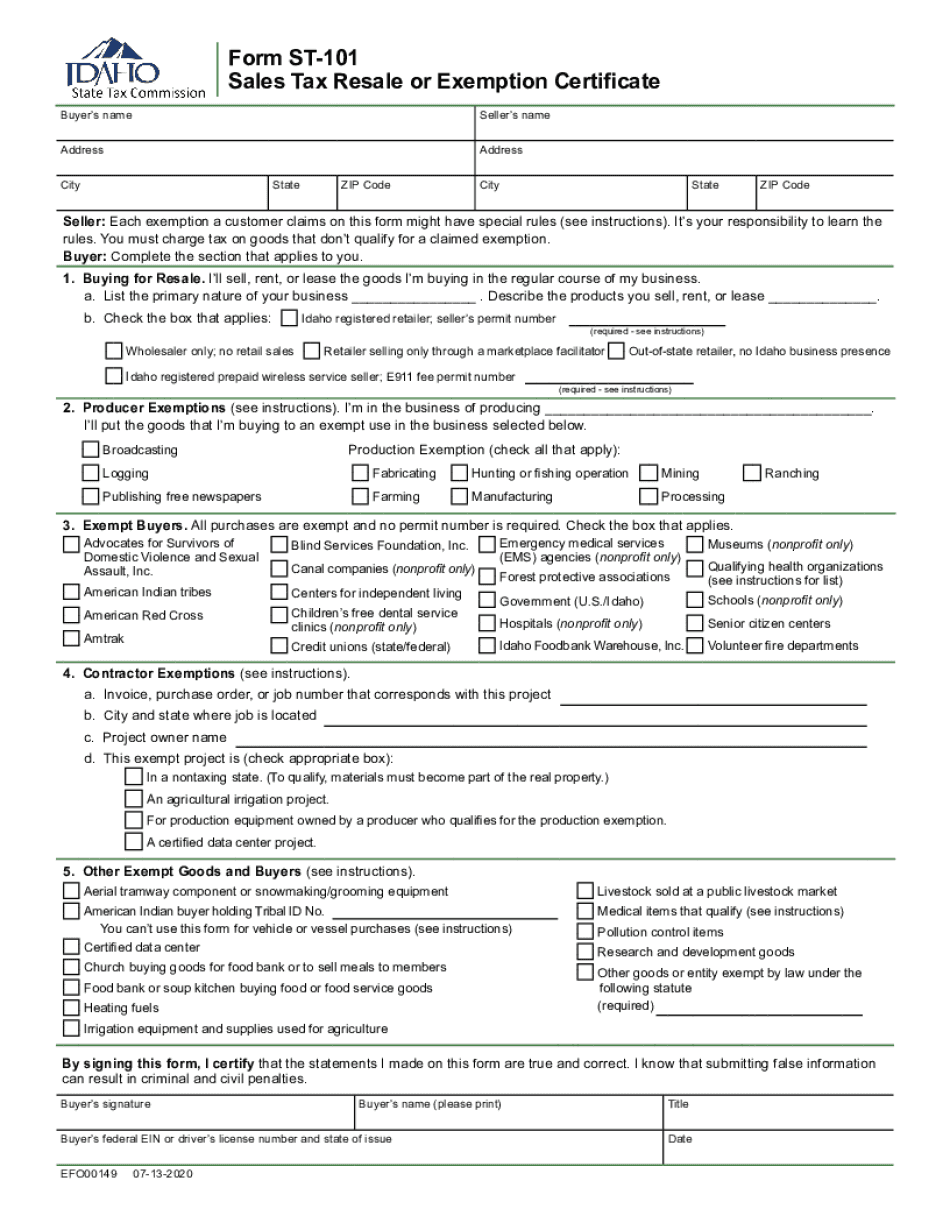

The Form ST 101 is a Sales Tax Resale or Exemption Certificate used in Idaho to allow businesses to purchase goods without paying sales tax. This form is essential for retailers and wholesalers who intend to resell products rather than consume them. By providing this certificate to suppliers, businesses can avoid the upfront sales tax costs, which they will collect from their customers upon resale. The ST 101 form is recognized as a legal document that verifies the purchaser's intent to resell the items, ensuring compliance with Idaho's sales tax regulations.

Steps to Complete the Form ST 101

Completing the Form ST 101 involves several important steps to ensure accuracy and compliance. First, the purchaser must fill in their name, address, and the type of business they operate. Next, they should provide the seller's name and address, along with a description of the property being purchased. It is crucial to indicate the reason for the exemption clearly, typically stating that the goods will be resold. Finally, the form must be signed and dated by an authorized representative of the purchasing business. This completed form should then be presented to the seller at the time of purchase.

Legal Use of the Form ST 101

The legal use of the Form ST 101 is governed by Idaho sales tax laws. This form serves as a declaration that the purchaser is exempt from paying sales tax on items intended for resale. To ensure its validity, the form must be accurately completed and signed. Misuse of the ST 101, such as using it for personal purchases or failing to provide it when required, can lead to penalties. Businesses must maintain copies of the completed forms for their records, as they may be requested during audits by tax authorities.

State-Specific Rules for the Form ST 101

Idaho has specific rules regarding the use of the Form ST 101. Only businesses registered with the Idaho State Tax Commission can utilize this form. Additionally, the form must be presented to the seller at the time of purchase to be considered valid. Each state may have its own version of a resale certificate, so it is important for businesses operating in multiple states to understand the differences and comply with local regulations. The Idaho ST 101 is specifically tailored to meet the requirements set forth by the Idaho State Tax Commission.

Examples of Using the Form ST 101

There are various scenarios in which the Form ST 101 can be utilized. For instance, a retail store purchasing clothing from a wholesaler would present the ST 101 to avoid paying sales tax on the items intended for resale. Similarly, a contractor buying materials for a construction project that will be billed to a client can use this form to purchase those materials tax-free. These examples illustrate how the ST 101 facilitates business operations by allowing businesses to manage their cash flow more effectively while ensuring compliance with tax laws.

Eligibility Criteria for Using the Form ST 101

To be eligible to use the Form ST 101, a business must be registered with the Idaho State Tax Commission. The business must also be engaged in the sale of tangible personal property or taxable services. Additionally, the items purchased using this form must be intended for resale in the regular course of business. It is important for businesses to ensure they meet these criteria before using the ST 101 to avoid potential legal issues and penalties.

Quick guide on how to complete form st 101 sales tax resale or exemption certificate

Complete Form ST 101, Sales Tax Resale Or Exemption Certificate effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form ST 101, Sales Tax Resale Or Exemption Certificate on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric activity today.

How to modify and eSign Form ST 101, Sales Tax Resale Or Exemption Certificate with ease

- Locate Form ST 101, Sales Tax Resale Or Exemption Certificate and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Choose your preferred method to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your device of choice. Edit and eSign Form ST 101, Sales Tax Resale Or Exemption Certificate and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 101 sales tax resale or exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the form st 101 sales tax resale or exemption certificate

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the ST 101 form 2025 and how is it used?

The ST 101 form 2025 is a sales tax exemption form used by businesses to claim exemption from sales tax on certain purchases. By completing the ST 101 form 2025, businesses can streamline their transactions and focus on growth while managing tax regulations effectively.

-

How can airSlate SignNow help me manage the ST 101 form 2025?

AirSlate SignNow provides an intuitive platform to create, send, and eSign the ST 101 form 2025 efficiently. This allows users to manage their tax-exempt transactions electronically, reducing errors and saving valuable time.

-

Is there a cost associated with using airSlate SignNow for the ST 101 form 2025?

Yes, airSlate SignNow offers various pricing plans that suit different business needs for managing documents, including the ST 101 form 2025. You can choose a plan based on the volume of documents you manage and the features you require, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for the ST 101 form 2025?

AirSlate SignNow offers numerous features for managing the ST 101 form 2025, such as customizable templates, electronic signature capabilities, and document tracking. These features enhance collaboration and facilitate compliance with tax regulations.

-

Can airSlate SignNow integrate with other tools for handling the ST 101 form 2025?

Absolutely! AirSlate SignNow can integrate seamlessly with various business applications such as CRMs and accounting software. This integration enables users to import data directly into the ST 101 form 2025, ensuring accuracy and efficiency.

-

What are the benefits of eSigning the ST 101 form 2025 with airSlate SignNow?

eSigning the ST 101 form 2025 with airSlate SignNow is faster and more secure than traditional methods. It helps businesses to reduce turnaround time for approvals and enhances the overall document management process in compliance with tax regulations.

-

How does airSlate SignNow ensure the security of the ST 101 form 2025?

AirSlate SignNow employs advanced encryption and security protocols to safeguard your documents, including the ST 101 form 2025. This ensures that sensitive information remains confidential and protected from unauthorized access.

Get more for Form ST 101, Sales Tax Resale Or Exemption Certificate

- Tree surgeon agreement self employed independent contractor form

- Self employed independent sales contractor agreement form

- Welder form

- Accounting agreement self employed independent contractor form

- Interior contract 497337224 form

- Self employed lifeguard services contract form

- Self employed contract form

- Mechanic contract 497337227 form

Find out other Form ST 101, Sales Tax Resale Or Exemption Certificate

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed