DOR Individual Income Tax Forms in Gov 2020-2026

Understanding the Indiana Earned Income Credit Worksheet

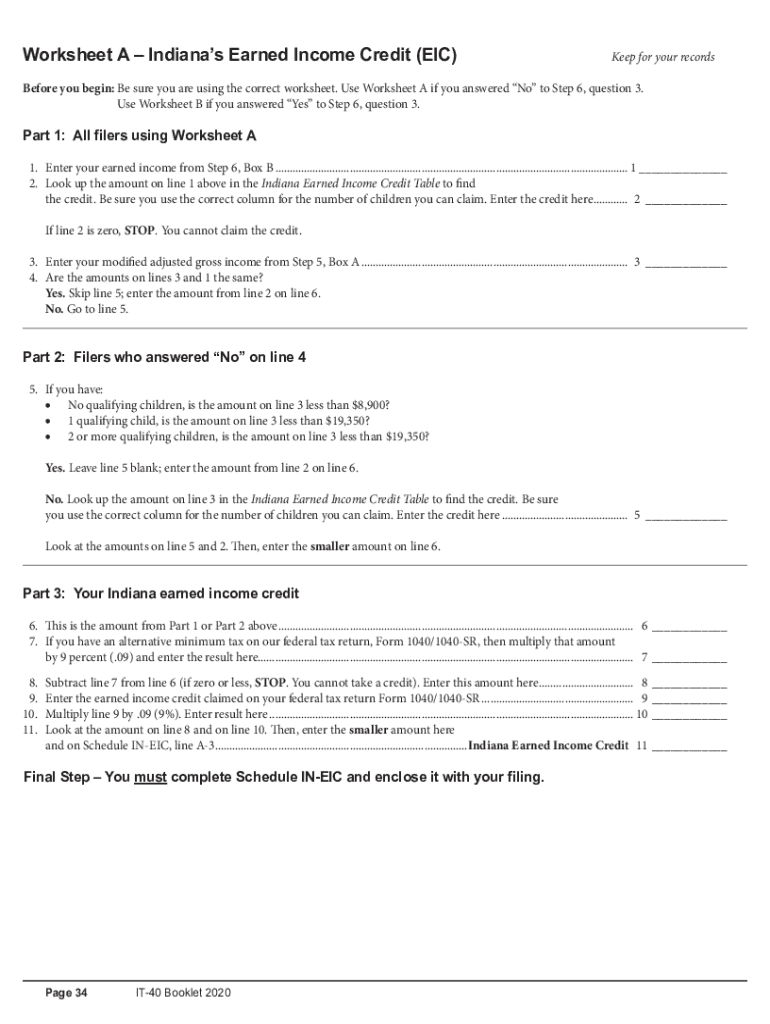

The Indiana Earned Income Credit (EIC) worksheet is a vital document for individuals and families looking to claim their earned income credit on their state tax returns. This worksheet is designed to help taxpayers calculate their eligibility and the amount of credit they may receive. The EIC is a refundable tax credit aimed at low to moderate-income workers, providing significant financial relief. Understanding how to accurately fill out this worksheet can lead to beneficial tax outcomes.

Steps to Complete the Indiana Earned Income Credit Worksheet

Completing the Indiana EIC worksheet involves several key steps:

- Gather Required Information: Collect all necessary documents, including your income statements, Social Security numbers for you and your qualifying children, and any other relevant financial information.

- Determine Eligibility: Review the eligibility criteria for the EIC, which includes income limits and filing status. Ensure you meet the requirements before proceeding.

- Fill Out the Worksheet: Carefully enter your income details and any qualifying child information on the worksheet. Follow the instructions provided to ensure accurate calculations.

- Calculate the Credit: Use the EIC table to determine the amount of credit you qualify for based on your income and the number of qualifying children.

- Review and Sign: Double-check all entries for accuracy. Once confirmed, sign the worksheet to validate your claim.

Eligibility Criteria for the Indiana Earned Income Credit

To qualify for the Indiana Earned Income Credit, taxpayers must meet specific eligibility criteria:

- Income Limits: Your earned income and adjusted gross income must fall below certain thresholds, which vary based on your filing status and the number of qualifying children.

- Filing Status: You must file your Indiana state tax return as either single, married filing jointly, or head of household.

- Qualifying Children: You may claim the credit for qualifying children who meet age, relationship, and residency requirements.

Legal Use of the Indiana Earned Income Credit Worksheet

The Indiana EIC worksheet is legally recognized for tax filing purposes. To ensure its legal validity:

- Compliance with State Regulations: Ensure that you comply with all Indiana Department of Revenue guidelines when completing the worksheet.

- Accurate Representation: Provide truthful and accurate information to avoid penalties or audits.

- Secure Submission: Submit the worksheet through approved methods, ensuring it is signed and dated appropriately.

Form Submission Methods for the Indiana Earned Income Credit Worksheet

You can submit the Indiana EIC worksheet through various methods:

- Online Submission: Utilize the Indiana Department of Revenue's online tax filing system for a quick and efficient submission process.

- Mail: Print the completed worksheet and mail it to the designated address provided by the Indiana Department of Revenue.

- In-Person: Visit a local tax office to submit your worksheet directly, if preferred.

Quick guide on how to complete dor 2020 individual income tax forms ingov

Complete DOR Individual Income Tax Forms IN gov effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage DOR Individual Income Tax Forms IN gov on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign DOR Individual Income Tax Forms IN gov without hassle

- Obtain DOR Individual Income Tax Forms IN gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign DOR Individual Income Tax Forms IN gov and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor 2020 individual income tax forms ingov

Create this form in 5 minutes!

How to create an eSignature for the dor 2020 individual income tax forms ingov

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Indiana earned income credit worksheet?

The Indiana earned income credit worksheet is a formal document that helps taxpayers calculate their eligibility for the Indiana earned income credit when filing their taxes. Completing this worksheet allows you to determine the amount of credit you can claim, making it a vital step in the tax preparation process in Indiana.

-

How can airSlate SignNow help with the Indiana earned income credit worksheet?

airSlate SignNow simplifies the process of completing the Indiana earned income credit worksheet by allowing you to eSign and share documents easily. You can collaborate with tax professionals or family members in real-time to ensure the worksheet is accurately filled out.

-

Is there a fee for using airSlate SignNow for my Indiana earned income credit worksheet?

Yes, airSlate SignNow offers competitive pricing options for its eSignature solutions. While there is a fee associated with its services, you gain access to a range of features that can make handling your Indiana earned income credit worksheet more efficient and secure.

-

What features does airSlate SignNow offer for managing the Indiana earned income credit worksheet?

airSlate SignNow provides a comprehensive suite of features for managing the Indiana earned income credit worksheet, including template creation, automated reminders, and document tracking. These tools streamline the eSignature process and make collaboration seamless.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software providers, enabling you to incorporate the Indiana earned income credit worksheet into your existing workflows. This integration helps maintain organization and efficiency in your tax preparation.

-

What are the benefits of using airSlate SignNow for my Indiana earned income credit worksheet?

Using airSlate SignNow for your Indiana earned income credit worksheet brings numerous benefits, including ease of use, enhanced security, and faster processing times. By digitally signing and sending your documents, you can signNowly expedite tax filing and reduce errors.

-

Is airSlate SignNow secure for processing sensitive tax documents like the Indiana earned income credit worksheet?

Yes, airSlate SignNow takes the security of your documents seriously. It employs robust encryption methods and complies with data protection regulations, ensuring that your Indiana earned income credit worksheet and associated information remain secure.

Get more for DOR Individual Income Tax Forms IN gov

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings west virginia form

- Tenant garbage form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles west virginia form

- Letter from tenant to landlord about landlords failure to make repairs west virginia form

- West virginia notice form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession west virginia form

- Letter from tenant to landlord about illegal entry by landlord west virginia form

- Letter from landlord to tenant about time of intent to enter premises west virginia form

Find out other DOR Individual Income Tax Forms IN gov

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement