Tda Withdrawal Form

What is the TDA Withdrawal?

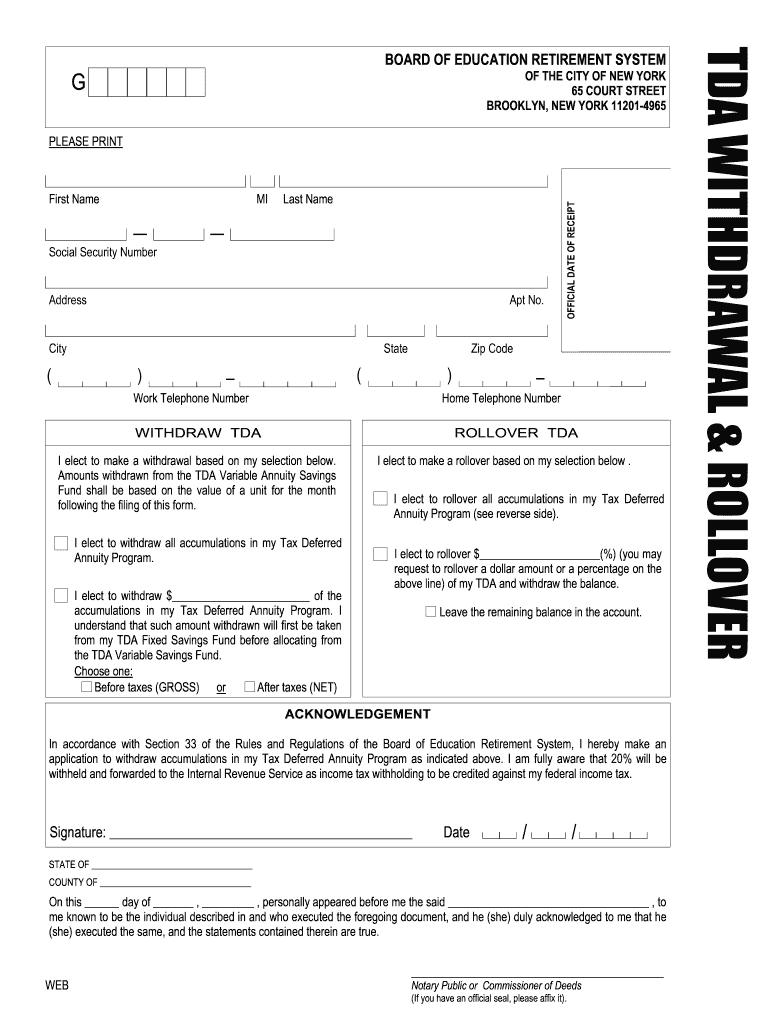

The TDA withdrawal refers to the process of withdrawing funds from a Tax Deferred Annuity (TDA) account. This type of account is primarily used for retirement savings, allowing individuals to defer taxes on their contributions until they withdraw the funds. The TDA withdrawal is often utilized by employees of public service organizations, including teachers and government workers, who wish to access their savings upon retirement or for other financial needs. Understanding the rules and regulations surrounding TDA withdrawals is crucial for ensuring compliance and maximizing the benefits of the account.

How to Obtain the TDA Withdrawal

To initiate a TDA withdrawal, individuals must first complete the necessary application form, which is typically available through their employer or the TDA plan administrator. The TDA withdrawal application may require personal information, account details, and the specific amount to be withdrawn. It is important to review the eligibility criteria and any potential penalties associated with early withdrawals before submitting the application. Once the form is completed, it can be submitted online, by mail, or in person, depending on the options provided by the TDA plan.

Steps to Complete the TDA Withdrawal

Completing a TDA withdrawal involves several key steps:

- Review your TDA account balance and determine the amount you wish to withdraw.

- Obtain the TDA withdrawal application form from your employer or the TDA plan administrator.

- Fill out the application form with accurate personal and account information.

- Submit the completed form through the designated method (online, by mail, or in person).

- Await confirmation of your withdrawal request from the TDA plan administrator.

Following these steps ensures a smooth withdrawal process and helps avoid potential delays.

Legal Use of the TDA Withdrawal

The legal use of TDA withdrawals is governed by specific regulations set forth by the Internal Revenue Service (IRS) and the TDA plan itself. Generally, withdrawals can be made without penalty after reaching a certain age, typically 59 and a half years. However, early withdrawals may incur penalties and tax implications. It is essential to understand the legal framework surrounding TDA withdrawals to ensure compliance and avoid unexpected costs. Consulting with a tax professional can provide guidance tailored to individual circumstances.

Required Documents for TDA Withdrawal

When applying for a TDA withdrawal, several documents may be required to process the application efficiently. These documents typically include:

- A completed TDA withdrawal application form.

- Proof of identity, such as a government-issued ID.

- Any additional documentation requested by the TDA plan administrator, which may vary by organization.

Having these documents ready can expedite the withdrawal process and help ensure that all requirements are met.

Eligibility Criteria for TDA Withdrawal

Eligibility for a TDA withdrawal generally depends on several factors, including age, employment status, and the specific terms of the TDA plan. Common eligibility criteria include:

- Reaching the minimum age requirement, usually 59 and a half years.

- Being separated from service or retired.

- Meeting any specific conditions outlined in the TDA plan documentation.

Understanding these criteria is vital for individuals considering a TDA withdrawal, as it affects their ability to access funds without penalties.

Quick guide on how to complete online tda withdrawal form

Your assistance manual on how to prepare your Tda Withdrawal

If you’re wondering how to finalize and submit your Tda Withdrawal, here are some brief guidelines on how to simplify tax declaration.

To start, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that allows you to edit, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and revisit to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Tda Withdrawal in just a few minutes:

- Set up your account and begin working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Tda Withdrawal in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to input your legally-binding electronic signature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper may increase return errors and postpone reimbursements. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the online form on Mymoneysage?

Hi…If you are referring to eCAN form, then please find the below details for your reference.The CAN is a new mutual fund investment identification number using which investor can hold schemes from different AMCs. To utilise the services of Mymoneysage (Client)for investing in direct plans of mutual funds, you require a CAN. If you want to invest as a single holder in some schemes and as joint holders in others, then you will need two CANs to do so.For eCAN, you need to provide some basic details in the form like1) CAN holder type2) Demographic Details3) Bank details (in which you want to transact with)4) And Nominee details.Applying eCAN is completely Free.To apply one please visit Log In

-

How can we fill out an online ATM form?

Have you asked your bank? I am unsure of what you want to accomplish. If you have an acount you can transfer funds online; from savings to checking via bill pay. Otherwise I can not tell you how to solve your problem. Sorry that I am unable to help, perhaps someone else can.

Create this form in 5 minutes!

How to create an eSignature for the online tda withdrawal form

How to create an eSignature for your Online Tda Withdrawal Form online

How to make an electronic signature for the Online Tda Withdrawal Form in Google Chrome

How to make an electronic signature for signing the Online Tda Withdrawal Form in Gmail

How to create an eSignature for the Online Tda Withdrawal Form from your smart phone

How to make an electronic signature for the Online Tda Withdrawal Form on iOS devices

How to generate an eSignature for the Online Tda Withdrawal Form on Android devices

People also ask

-

What is a Tda Withdrawal in airSlate SignNow?

A Tda Withdrawal is a feature in airSlate SignNow that allows users to manage transaction disputes and withdrawals efficiently. This feature ensures that all document signings and transactions are secure and verifiable, providing peace of mind for users in financial dealings.

-

How does airSlate SignNow handle Tda Withdrawal requests?

airSlate SignNow simplifies the Tda Withdrawal process by providing a user-friendly interface for submitting requests. Once initiated, the platform tracks the status of the withdrawal, ensuring that users are informed every step of the way.

-

Are there any fees associated with Tda Withdrawal in airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, it's essential to review the pricing structure for Tda Withdrawal requests. Generally, the service aims to minimize additional fees, making it accessible for all users.

-

What features support Tda Withdrawal in airSlate SignNow?

airSlate SignNow provides several features that enhance the Tda Withdrawal experience, including secure document storage, customizable templates, and real-time tracking of withdrawal requests. These features work together to streamline the process and improve user satisfaction.

-

Can I integrate Tda Withdrawal with other applications in airSlate SignNow?

Yes, airSlate SignNow supports various integrations that facilitate Tda Withdrawal processes. By connecting with CRM systems or financial software, users can enhance their workflow and manage withdrawals more effectively.

-

What are the benefits of using airSlate SignNow for Tda Withdrawal?

Using airSlate SignNow for Tda Withdrawal offers numerous benefits, including increased security, ease of use, and efficient tracking of document transactions. These advantages help businesses maintain compliance and improve overall operational efficiency.

-

Is airSlate SignNow suitable for businesses of all sizes for Tda Withdrawal?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes looking to streamline their Tda Withdrawal processes. Its scalable solutions allow small startups and large enterprises to utilize the platform effectively.

Get more for Tda Withdrawal

Find out other Tda Withdrawal

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy