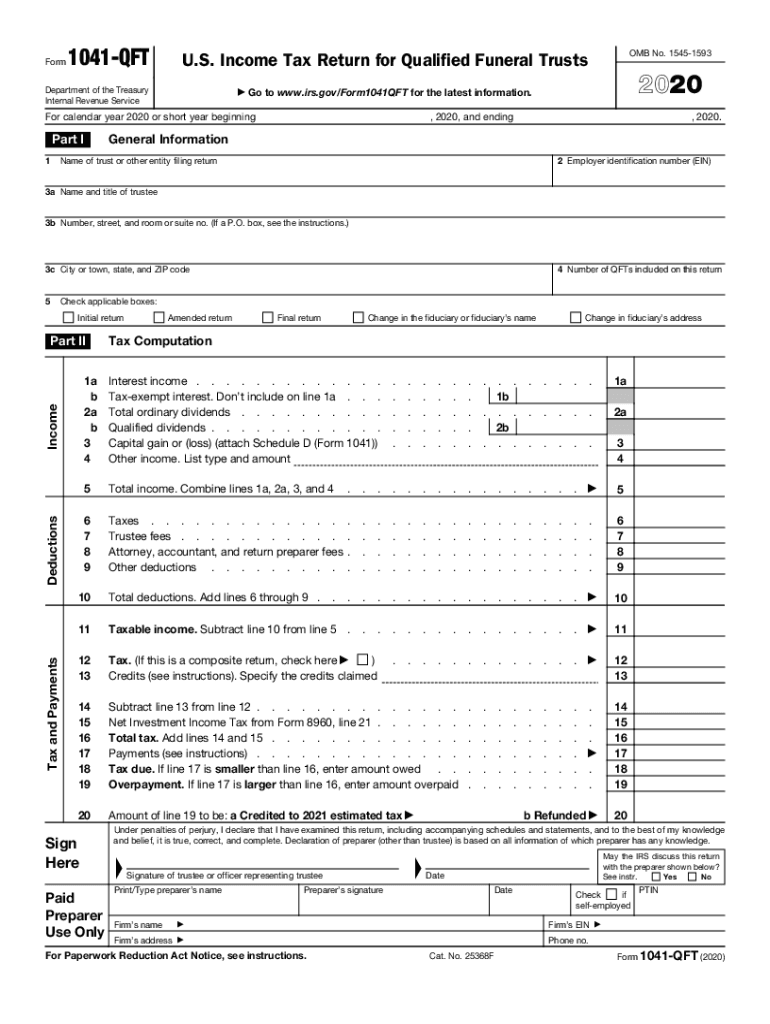

Form 1041 QFT U S Income Tax Return for Qualified Funeral Trusts

What is the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

The Form 1041 QFT is specifically designed for reporting income generated by qualified funeral trusts. These trusts are established to hold funds for future funeral expenses, ensuring that the necessary funds are available when needed. The IRS allows these trusts to accumulate income without immediate taxation, provided they meet specific requirements. Understanding the purpose of this form is essential for trustees and beneficiaries to ensure compliance with tax regulations.

How to use the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Using the Form 1041 QFT involves several steps. First, the trustee must gather all necessary financial information related to the trust. This includes income generated, distributions made, and any expenses incurred. The form must be filled out accurately to reflect the trust's financial activities during the tax year. Once completed, it should be submitted to the IRS by the specified deadline, typically on the fifteenth day of the fourth month following the end of the trust's tax year.

Steps to complete the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Completing the Form 1041 QFT requires careful attention to detail. Here are the steps involved:

- Gather financial records, including income statements and expense receipts.

- Fill out the form, ensuring all sections are completed accurately.

- Report any income earned by the trust, including interest and dividends.

- Document any distributions made to beneficiaries during the year.

- Review the form for accuracy before submission.

- File the form with the IRS by the deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 1041 QFT. These guidelines outline eligibility criteria for qualified funeral trusts, the types of income that must be reported, and the necessary documentation required for compliance. Familiarizing oneself with these guidelines is crucial for trustees to ensure that the trust remains in good standing with the IRS and avoids any potential legal issues.

Required Documents

When completing the Form 1041 QFT, several documents are required to support the information reported. These documents typically include:

- Trust agreement outlining the terms and conditions of the funeral trust.

- Financial statements showing income generated by the trust.

- Receipts for funeral expenses incurred, if applicable.

- Records of any distributions made to beneficiaries.

Filing Deadlines / Important Dates

Timely filing of the Form 1041 QFT is essential to avoid penalties. The standard deadline for submission is the fifteenth day of the fourth month following the end of the tax year. For trusts that operate on a calendar year, this typically falls on April fifteenth. If additional time is needed, trustees may file for an extension, but they must ensure that any tax owed is paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete 2020 form 1041 qft us income tax return for qualified funeral trusts

Complete Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents quickly and without delays. Manage Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts on any platform with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest way to edit and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts with ease

- Locate Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you’d like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1041 qft us income tax return for qualified funeral trusts

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

Are funeral expenses tax deductible on form 1041?

Yes, funeral expenses can be considered tax deductible on form 1041 under certain circumstances. When the deceased's estate is filing for taxes, legitimate funeral expenses may reduce the taxable income of the estate. Ensure to keep detailed records and receipts to substantiate these deductions.

-

How does airSlate SignNow help with estate tax documentation?

airSlate SignNow streamlines the process of managing estate documentation, making it easy to send, sign, and archive relevant forms. This includes tax documents that determine if funeral expenses are tax deductible on form 1041. Our eSigning feature ensures all documents are legally binding and secure.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit your budget, whether you’re an individual or a business. Our plans provide different levels of access to features, including document templates that can help clarify whether funeral expenses are tax deductible on form 1041. Visit our pricing page to find the best option for your needs.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integration with numerous applications such as Google Drive and Dropbox. This allows you to easily manage your documentation, including whether funeral expenses are tax deductible on form 1041, from various platforms without any hassle.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a comprehensive suite of features including eSigning, document templates, and workflow automation. These tools simplify the documentation process, ensuring that important forms, like those questioning if funeral expenses are tax deductible on form 1041, are efficiently handled.

-

How secure is my information with airSlate SignNow?

Your data's security is our top priority at airSlate SignNow. We use advanced encryption methods and secure cloud storage to protect your documents, including those that pertain to tax deductions like funeral expenses on form 1041. You can trust that your sensitive information is always safeguarded.

-

Is there customer support available if I have questions?

Yes, airSlate SignNow offers dedicated customer support to assist you with any inquiries you may have. If you're unsure about processes, like verifying if funeral expenses are tax deductible on form 1041, our knowledgeable team is here to help you through it.

Get more for Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Subcontractors agreement wyoming form

- Option to purchase addendum to residential lease lease or rent to own wyoming form

- Wy prenuptial agreement form

- Wyoming prenuptial premarital agreement without financial statements wyoming form

- Amendment to prenuptial or premarital agreement wyoming form

- Financial statements only in connection with prenuptial premarital agreement wyoming form

- Revocation of premarital or prenuptial agreement wyoming form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497432105 form

Find out other Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy