it APP InvestmentTaxCreditApplication2010 10 14 PG 1 2020

What is the IT APP Investment Tax Credit Application?

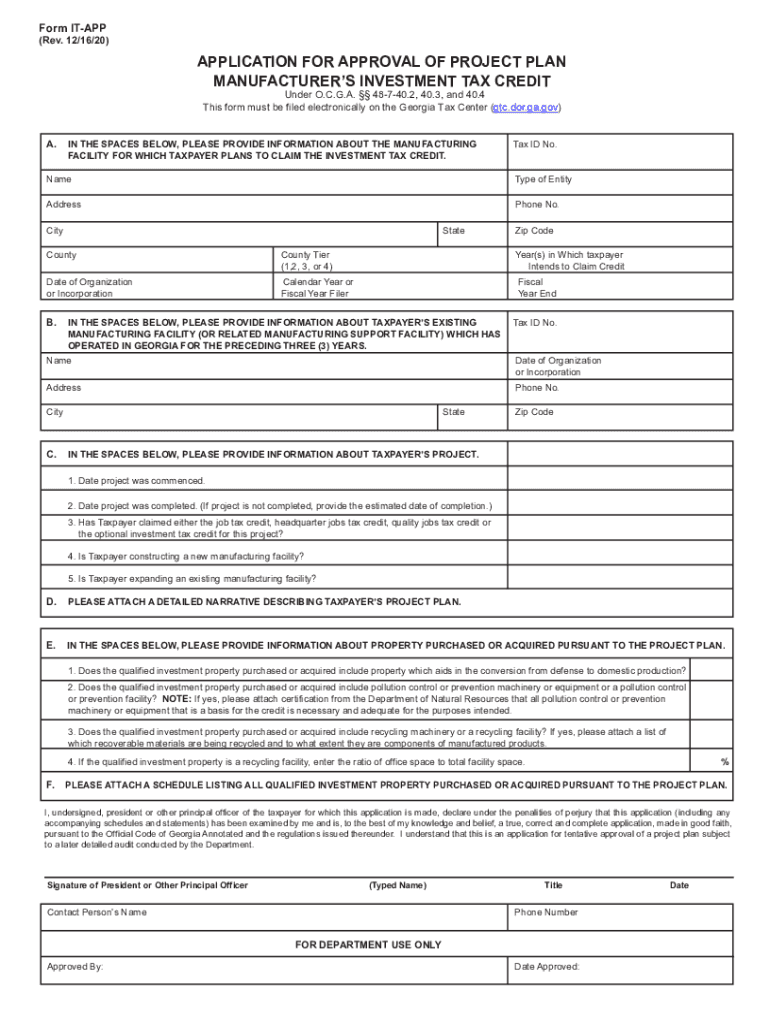

The IT APP Investment Tax Credit Application is a crucial document designed for businesses seeking to claim tax credits for qualified investments. This form allows eligible entities to report their investment activities and calculate the appropriate tax credits they may be entitled to under U.S. tax law. The application is particularly relevant for businesses in sectors that contribute to economic growth and development, providing financial incentives to encourage investment in specific areas.

Steps to Complete the IT APP Investment Tax Credit Application

Completing the IT APP Investment Tax Credit Application involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your investments, including receipts and financial statements. Next, accurately fill out the application form, ensuring that all required fields are completed. It is essential to double-check your calculations to avoid errors that could delay processing. Once completed, review the form for completeness and clarity before submission.

Eligibility Criteria for the IT APP Investment Tax Credit Application

To qualify for the tax credits available through the IT APP Investment Tax Credit Application, businesses must meet specific eligibility criteria. Generally, the applicant must be a registered business entity in the United States, actively engaged in qualifying investment activities. Additionally, the investments must align with the guidelines set forth by the IRS, which may include requirements related to the type of property acquired or improvements made. Understanding these criteria is vital to ensure that your application is valid and that you receive the benefits you seek.

Legal Use of the IT APP Investment Tax Credit Application

The legal use of the IT APP Investment Tax Credit Application hinges on compliance with federal and state tax regulations. The form must be filled out accurately and submitted within the designated filing periods. It is important to maintain thorough records of all investments and related documentation, as these may be requested during audits or reviews by tax authorities. Utilizing a reliable digital tool, such as signNow, can enhance the security and legitimacy of your application process, ensuring that your eSignatures and documents meet legal standards.

Form Submission Methods

Submitting the IT APP Investment Tax Credit Application can be done through various methods to accommodate different preferences. Businesses can choose to file the application online, which often provides quicker processing times and confirmation of receipt. Alternatively, the form can be submitted via traditional mail or in person at designated tax offices. Each submission method has its own advantages, and it is advisable to select the one that best fits your operational needs and timelines.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical when submitting the IT APP Investment Tax Credit Application. Typically, applications must be filed by specific dates set by the IRS, often coinciding with annual tax filing deadlines. Missing these deadlines can result in penalties or the loss of potential tax credits. Keeping a calendar of important dates and reminders can help ensure timely submission and compliance with all regulatory requirements.

Required Documents for the IT APP Investment Tax Credit Application

When preparing to submit the IT APP Investment Tax Credit Application, it is essential to gather all required documents to support your claims. Commonly needed documents include financial statements, proof of investments, and any relevant correspondence with tax authorities. These documents not only substantiate your application but also facilitate a smoother review process. Ensuring that all paperwork is organized and readily accessible can significantly enhance the efficiency of your application submission.

Quick guide on how to complete it app investment_tax_credit_application_2010 10 14 2010 pg 1

Complete IT APP InvestmentTaxCreditApplication2010 10 14 PG 1 with ease on any device

Managing documents online has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can access the necessary template and securely keep it online. airSlate SignNow equips you with all the tools you require to create, amend, and electronically sign your documents quickly without delays. Handle IT APP InvestmentTaxCreditApplication2010 10 14 PG 1 on any system with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign IT APP InvestmentTaxCreditApplication2010 10 14 PG 1 effortlessly

- Locate IT APP InvestmentTaxCreditApplication2010 10 14 PG 1 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that intent.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your document, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign IT APP InvestmentTaxCreditApplication2010 10 14 PG 1 and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it app investment_tax_credit_application_2010 10 14 2010 pg 1

Create this form in 5 minutes!

How to create an eSignature for the it app investment_tax_credit_application_2010 10 14 2010 pg 1

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the form it app by airSlate SignNow?

The form it app by airSlate SignNow is a powerful tool designed to streamline the document signing process. It allows users to create, send, and eSign documents effortlessly, enhancing productivity and communication within teams.

-

How much does the form it app cost?

The form it app offers flexible pricing plans to cater to different business needs. With affordable monthly subscriptions, businesses can access a wide range of features without breaking the bank, making it a cost-effective solution for document management.

-

What features does the form it app include?

The form it app includes essential features such as custom templates, automated workflows, and secure eSigning capabilities. Users can easily manage documents and collaborate with others, ensuring a seamless workflow for any business process.

-

Is the form it app easy to use?

Yes, the form it app is designed with user-friendliness in mind. Its intuitive interface allows users of all skill levels to navigate the platform easily, enabling them to send and receive documents quickly and efficiently.

-

Can the form it app integrate with other tools?

The form it app integrates seamlessly with various business applications, including CRM systems and cloud storage solutions. This interoperability enhances your workflow, allowing you to keep all your essential tools connected and efficient.

-

What benefits does the form it app provide for businesses?

The form it app offers numerous benefits, such as reduced turnaround time for document signing, increased accuracy, and improved compliance. By digitizing the signing process, businesses can save time and resources, ultimately boosting overall productivity.

-

Is the form it app secure for sensitive documents?

Absolutely, the form it app prioritizes security with advanced encryption and authentication protocols. Sensitive documents remain protected throughout the signing process, ensuring that your business complies with regulatory standards.

Get more for IT APP InvestmentTaxCreditApplication2010 10 14 PG 1

Find out other IT APP InvestmentTaxCreditApplication2010 10 14 PG 1

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF