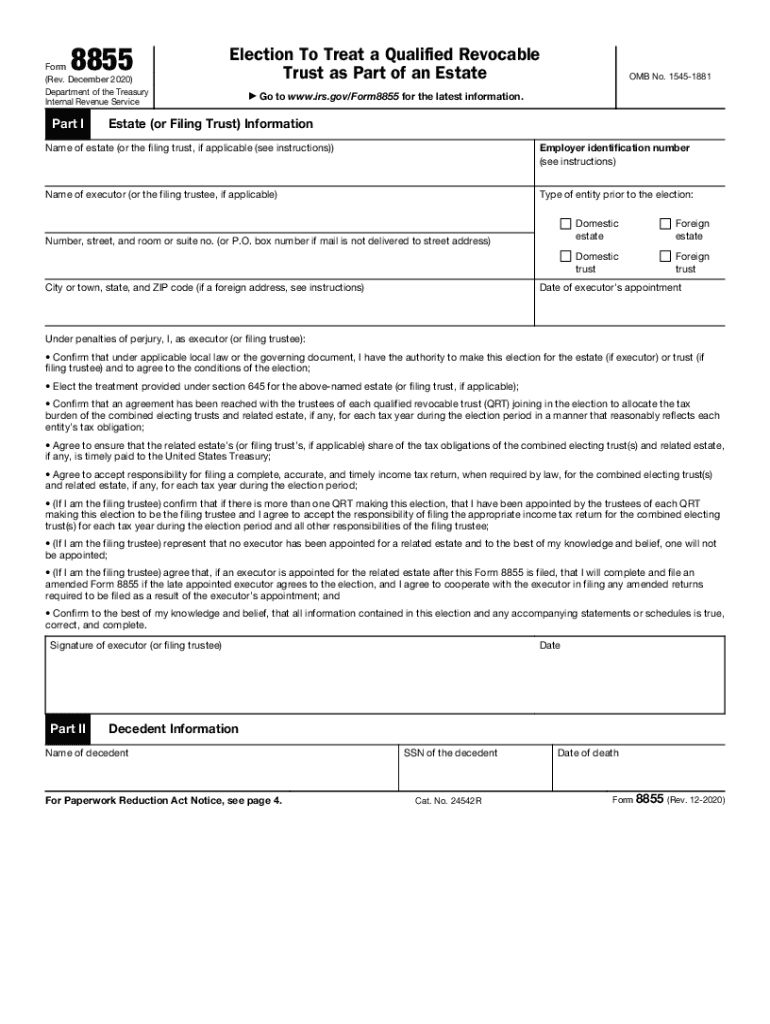

Form 8855 Rev December Election to Treat a Qualified Revocable Trust as Part of an Estate 2020-2026

IRS Guidelines

The IRS provides specific guidelines for completing Form 5329, which is used to report additional taxes on qualified retirement plans and IRAs. Understanding these guidelines is essential for compliance and accurate reporting. The form is primarily used to report missed required minimum distributions (RMDs) and excess contributions, among other tax-related issues. Taxpayers should refer to the IRS instructions for Form 5329 to ensure they meet all reporting requirements and deadlines.

Filing Deadlines / Important Dates

Filing deadlines for Form 5329 align with the standard tax return due dates. Typically, individual tax returns are due on April 15 of each year. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties and interest. It is crucial to keep track of these dates to ensure timely filing and compliance.

Required Documents

To complete Form 5329 accurately, taxpayers should gather relevant documents, including records of their retirement accounts, contribution statements, and any notices received from the IRS regarding missed RMDs or excess contributions. Having these documents on hand will facilitate the completion of the form and help ensure that all necessary information is reported correctly.

Eligibility Criteria

Eligibility for filing Form 5329 depends on specific circumstances related to retirement accounts. Individuals who have failed to take RMDs, contributed more than the allowable limits to their IRAs, or are subject to additional taxes on retirement plans must file this form. Understanding the eligibility criteria is crucial for determining whether Form 5329 needs to be submitted.

Steps to Complete the Form

Completing Form 5329 involves several key steps. First, taxpayers should read the instructions carefully to understand the requirements. Next, they must fill out the form with accurate information regarding their retirement accounts and any applicable taxes. After completing the form, it should be reviewed for accuracy before submission. Finally, taxpayers should retain a copy of the completed form for their records.

Penalties for Non-Compliance

Failure to file Form 5329 when required can result in significant penalties. The IRS may impose a penalty for not taking RMDs, which can be as high as fifty percent of the amount that should have been withdrawn. Additionally, excess contributions to IRAs may incur penalties if not corrected in a timely manner. Understanding these penalties highlights the importance of compliance with IRS regulations.

Digital vs. Paper Version

Taxpayers have the option to file Form 5329 either digitally or via paper submission. Filing electronically can streamline the process and reduce the likelihood of errors, as tax software often includes checks for common mistakes. Conversely, some individuals may prefer to file a paper version for personal record-keeping. Regardless of the method chosen, ensuring the form is completed accurately is essential for compliance.

Quick guide on how to complete form 8855 rev december 2020 election to treat a qualified revocable trust as part of an estate

Complete Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate on any platform using airSlate SignNow Android or iOS applications and simplify your document-centric processes today.

The easiest way to alter and eSign Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate with ease

- Find Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form: by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and eSign Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8855 rev december 2020 election to treat a qualified revocable trust as part of an estate

Create this form in 5 minutes!

How to create an eSignature for the form 8855 rev december 2020 election to treat a qualified revocable trust as part of an estate

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What are the form 5329 instructions?

The form 5329 instructions guide you through the process of reporting additional taxes on IRAs and other qualified retirement plans. It's important to follow these instructions carefully to ensure compliance with IRS regulations and avoid penalties. You can find detailed information on filling out the form on the IRS website or through your tax professional.

-

How can airSlate SignNow help with form 5329 instructions?

airSlate SignNow streamlines the document eSigning process, making it easy to manage your form 5329 instructions digitally. With our platform, you can easily share the form with your tax advisor for signatures or feedback. This ensures that your paperwork is handled swiftly and securely.

-

Are there any costs associated with using airSlate SignNow for form 5329 instructions?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including features tailored for handling form 5329 instructions. Each plan provides a range of eSignature options, document storage, and collaboration tools. You can select the one that best fits your budget and requirements.

-

What features does airSlate SignNow offer for processing form 5329?

Our platform comes with advanced features like customizable templates and the ability to send reminders for form completion, which are perfect for managing form 5329 instructions. Additionally, you can track the status of your documents to ensure everything is completed on time. These features enhance your overall efficiency during tax season.

-

Can airSlate SignNow integrate with other software for form 5329 management?

Yes, airSlate SignNow offers integration capabilities with popular software platforms, making it easy to manage your form 5329 instructions alongside other tools you may be using. Whether you're utilizing accounting software or cloud storage services, our integrations help streamline your workflow and improve productivity. Check our integration options for more details.

-

What benefits does airSlate SignNow provide for businesses dealing with form 5329?

Using airSlate SignNow for your form 5329 instructions offers numerous benefits, such as saving time and reducing errors. Our electronic signature solution simplifies the entire process, making it faster and more efficient. Additionally, the secure cloud storage ensures that your important tax documents are protected and easily accessible.

-

Is airSlate SignNow secure for handling sensitive documents like form 5329?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your sensitive documents, including form 5329 instructions. We prioritize data security to ensure that your information remains confidential and secure throughout the signing process. You can trust us with your important documents.

Get more for Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate

- Colonoscopy report format

- Professional responsibility concern united nurses of alberta form

- Consent to disclose personal health information form st josephamp39s

- Form iprc 3s secondary

- Attestation de service la barre wwwappstcgcca form

- Mohawk college residence cancellation withdrawal request form

- Room change request form name student id building room phone all the following steps must be done to complete the move 1

- Financial petition yorku form

Find out other Form 8855 Rev December Election To Treat A Qualified Revocable Trust As Part Of An Estate

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple