W1q 2020-2026

What is the W1q

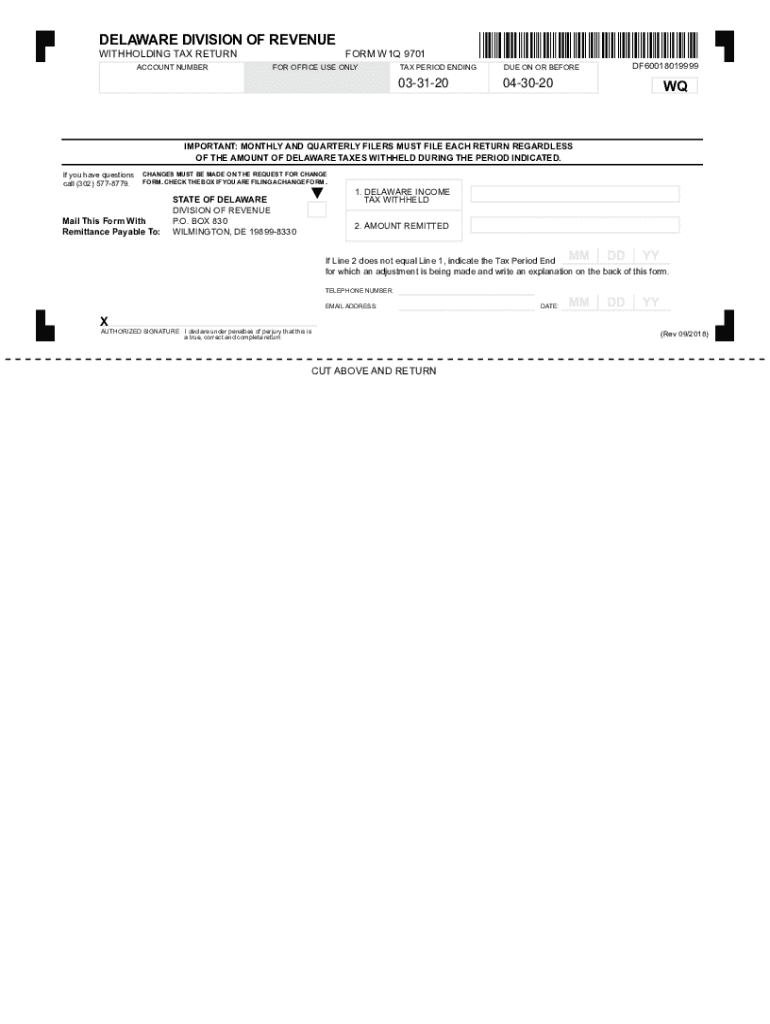

The W1q form, officially known as the Delaware W-1Q, is a crucial document used for reporting withholding tax in the state of Delaware. This form is specifically designed for employers to report the amount of tax withheld from employee wages and other payments. Understanding the W1q is essential for compliance with state tax regulations, ensuring that employers fulfill their obligations regarding employee tax withholdings.

How to use the W1q

Using the W1q involves several steps to ensure accurate reporting. Employers must gather all relevant payroll information, including employee wages and the amounts withheld for state taxes. The form requires detailed entries, such as the employer's identification number, the total wages paid, and the total tax withheld. Once the information is compiled, the form can be completed either digitally or in paper format, depending on the employer's preference.

Steps to complete the W1q

Completing the W1q involves the following steps:

- Gather necessary payroll records, including employee names, Social Security numbers, and wages.

- Calculate the total amount of state tax withheld from each employee's wages.

- Fill out the W1q form with the required information, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form to the Delaware Division of Revenue by the designated deadline.

Legal use of the W1q

The W1q form is legally binding when completed accurately and submitted on time. Compliance with state tax laws is essential to avoid penalties. Employers must ensure that they follow all legal requirements associated with the W1q, including maintaining accurate records and submitting the form as mandated by Delaware law. Failure to comply can result in fines or other legal consequences.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines for the W1q to ensure compliance. Typically, the W1q must be submitted quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter is April 30, the second quarter is July 31, the third quarter is October 31, and the fourth quarter is January 31 of the following year. Staying informed about these dates is crucial for timely submissions.

Required Documents

To complete the W1q, employers need to gather several key documents, including:

- Employee payroll records detailing wages and withholdings.

- The employer identification number (EIN).

- Any previous W1q forms submitted for reference.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete w1q

Prepare W1q effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage W1q on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign W1q with ease

- Find W1q and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign W1q and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w1q

Create this form in 5 minutes!

How to create an eSignature for the w1q

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is w1q and how does it work with airSlate SignNow?

The term w1q refers to our document signing solutions that streamline the eSigning process. With airSlate SignNow, w1q enables users to send and sign documents efficiently, ensuring all signatures are legally binding and secure.

-

How much does airSlate SignNow cost for using w1q?

airSlate SignNow offers flexible pricing plans suitable for any business size. With options that cater to different needs, you can utilize the w1q feature within these plans without hidden fees, ensuring a cost-effective solution.

-

What features are included in the w1q package?

The w1q package includes essential features like document templates, advanced eSigning capabilities, and real-time tracking. Additionally, users benefit from customizable workflows that enhance their productivity while using airSlate SignNow.

-

What are the benefits of using airSlate SignNow with w1q?

Using airSlate SignNow with w1q signNowly reduces the time it takes to get documents signed. Businesses experience improved efficiency and enhanced client satisfaction as documents are processed quickly and securely.

-

Can I integrate w1q with other software applications?

Yes, airSlate SignNow allows for seamless integration with various applications through its w1q feature. This capability ensures that you can streamline your workflows and connect with tools your team already uses, enhancing productivity.

-

Is airSlate SignNow with w1q secure for sensitive documents?

Absolutely! airSlate SignNow with w1q prioritizes the security of your documents with advanced encryption and compliance measures. This ensures that your sensitive information remains protected while being shared and signed electronically.

-

How does airSlate SignNow with w1q improve the signing process?

airSlate SignNow with w1q simplifies the signing process by allowing users to sign documents from any device, at any time. This flexibility not only saves time but also eliminates the need for physical document handling.

Get more for W1q

- Summer camp employment application camp atwater form

- Woof love rescue application form

- A o smith warranty claim form

- Sunscreen permission form 376140021

- Institution housing unit post order housing unit effective date form

- Biology sol review form

- Form deq 50 12 waste motor oil burning equipment certification

- Hunting permission form 143153

Find out other W1q

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe