Form 943 a Rev December Agricultural Employer's Record of Federal Tax Liability

Understanding the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

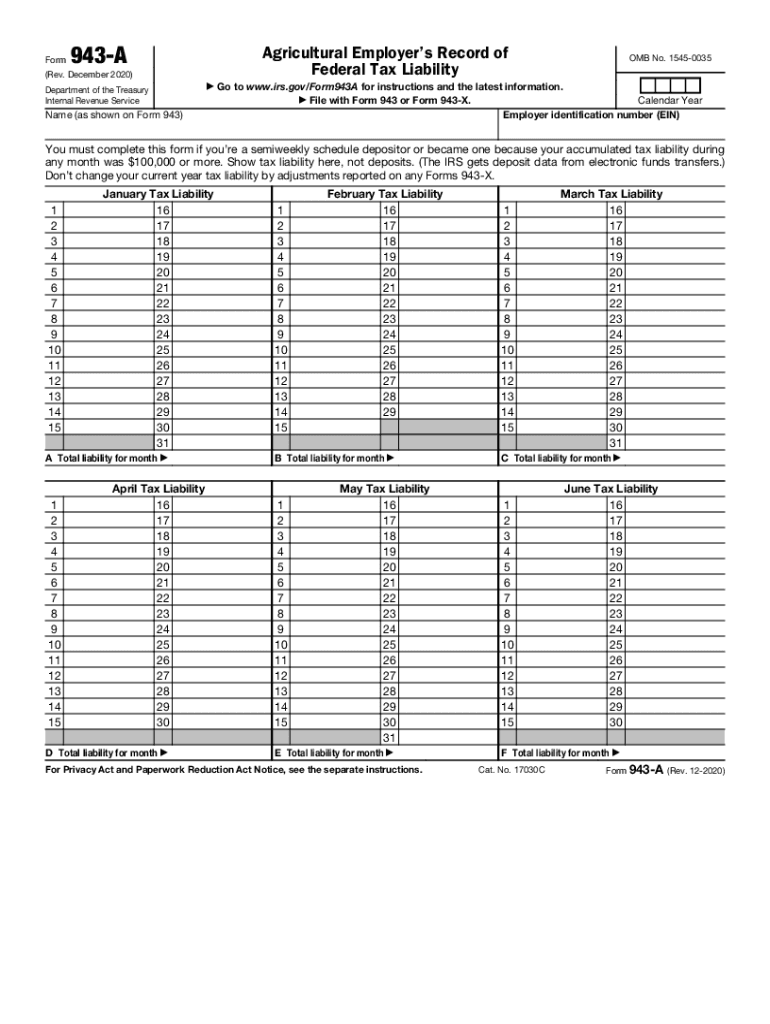

The Form 943 A Rev December serves as a crucial document for agricultural employers in the United States to report their federal tax liability. This form is specifically designed for employers who pay wages to farmworkers and need to report the associated tax obligations. It captures essential information regarding the wages paid and the corresponding federal taxes withheld, ensuring compliance with IRS regulations. Understanding this form is vital for maintaining accurate records and meeting federal tax requirements.

Steps to Complete the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

Completing the Form 943 A Rev December involves several key steps:

- Gather Necessary Information: Collect all relevant data regarding employee wages and tax withholdings.

- Fill Out the Form: Accurately enter the required information, including total wages paid and federal tax liability.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: Choose your preferred submission method, whether online or by mail, and ensure it is sent by the deadline.

Following these steps can help ensure that the form is filled out correctly, reducing the risk of errors that could lead to penalties or compliance issues.

Legal Use of the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

The legal use of the Form 943 A Rev December is essential for agricultural employers to fulfill their tax obligations. This form is recognized by the IRS as a valid means to report federal tax liabilities related to agricultural wages. Proper completion and timely submission of this form help employers avoid legal complications and ensure adherence to federal tax laws. It is important for employers to understand that failure to file this form accurately can lead to penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates for the Form 943 A Rev December

Timely filing of the Form 943 A Rev December is crucial. Employers must be aware of the specific deadlines to avoid penalties. Typically, the form is due on January 31 of the year following the tax year being reported. It is advisable to keep track of any changes in IRS deadlines, as they may vary from year to year. Marking these dates on a calendar can help ensure compliance and timely submission.

Penalties for Non-Compliance with the Form 943 A Rev December

Non-compliance with the requirements of the Form 943 A Rev December can result in significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to file altogether. These penalties can accumulate quickly, leading to substantial financial burdens for employers. Understanding these potential consequences emphasizes the importance of accurate and timely submission of the form.

Examples of Using the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

Employers can encounter various scenarios where the Form 943 A Rev December is essential. For instance, an agricultural business that hires seasonal workers must report the wages paid during the harvest season. Another example includes an employer who needs to adjust prior submissions due to errors found in wage reporting. In both cases, the Form 943 A Rev December is the appropriate document for reporting the federal tax liability accurately.

Quick guide on how to complete form 943 a rev december 2020 agricultural employers record of federal tax liability

Complete Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability without hassle

- Locate Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your amendments.

- Select how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 943 a rev december 2020 agricultural employers record of federal tax liability

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is federal liability in the context of electronic signatures?

Federal liability refers to the legal responsibilities businesses have when using electronic signatures under federal law. Using a reliable eSignature solution like airSlate SignNow can help businesses comply with federal regulations, minimizing the risk of federal liability. Understanding federal liability is crucial for ensuring your signed documents hold up in court.

-

How does airSlate SignNow help mitigate federal liability?

airSlate SignNow provides a secure and compliant platform for electronic signatures, reducing the risk of federal liability. By offering features like audit trails and encryption, the tool ensures all signed documents meet federal standards. This compliance helps protect businesses from potential legal challenges.

-

What features of airSlate SignNow address federal liability concerns?

Key features of airSlate SignNow that directly address federal liability include customizable workflows, multi-factor authentication, and compliance tracking. These features ensure that your document signing process adheres to federal requirements, reducing the chance of legal complications. By leveraging these capabilities, businesses can effectively manage their federal liability.

-

Is airSlate SignNow cost-effective for managing federal liability?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage federal liability. With scalable pricing plans, organizations can choose an option that fits their budget while still accessing essential features. Investing in airSlate SignNow ultimately reduces costs associated with potential legal issues related to federal liability.

-

Can I integrate airSlate SignNow with other tools to handle federal liability?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your ability to manage federal liability efficiently. By connecting with tools like CRM systems and project management software, you can create a streamlined workflow that keeps federal liability concerns top-of-mind.

-

What are the benefits of using airSlate SignNow regarding federal liability?

Using airSlate SignNow for your eSignature needs offers several benefits in relation to federal liability. It ensures compliance with federal laws, minimizes risk, and simplifies the contract signing process. This streamlined approach not only enhances productivity but also provides peace of mind knowing you're protected against federal liability.

-

How secure is airSlate SignNow in relation to federal liability?

airSlate SignNow prioritizes security, which is vital for addressing federal liability. With bank-level encryption and secure storage, your signed documents are protected against unauthorized access. This level of security not only safeguards your data but also helps ensure compliance with federal requirements.

Get more for Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

- Sf234 fire extinguisher license registration and test information

- Food service permit form

- Rc form 252 2 application for a radioactive material

- Newfairvieworglocationnew fairview city hall 2new fairview city hall new fairview tx form

- Sub final form

- Sale nomination form

- Special event venue contract boulevard flower gardens form

- Creek nation citizenship application form

Find out other Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template