VAT1A Application for VAT Registration the VAT1A Form is Used by Distance Selling Businesses to Apply for VAT Registration 2020-2026

Understanding the VAT1A Application for VAT Registration

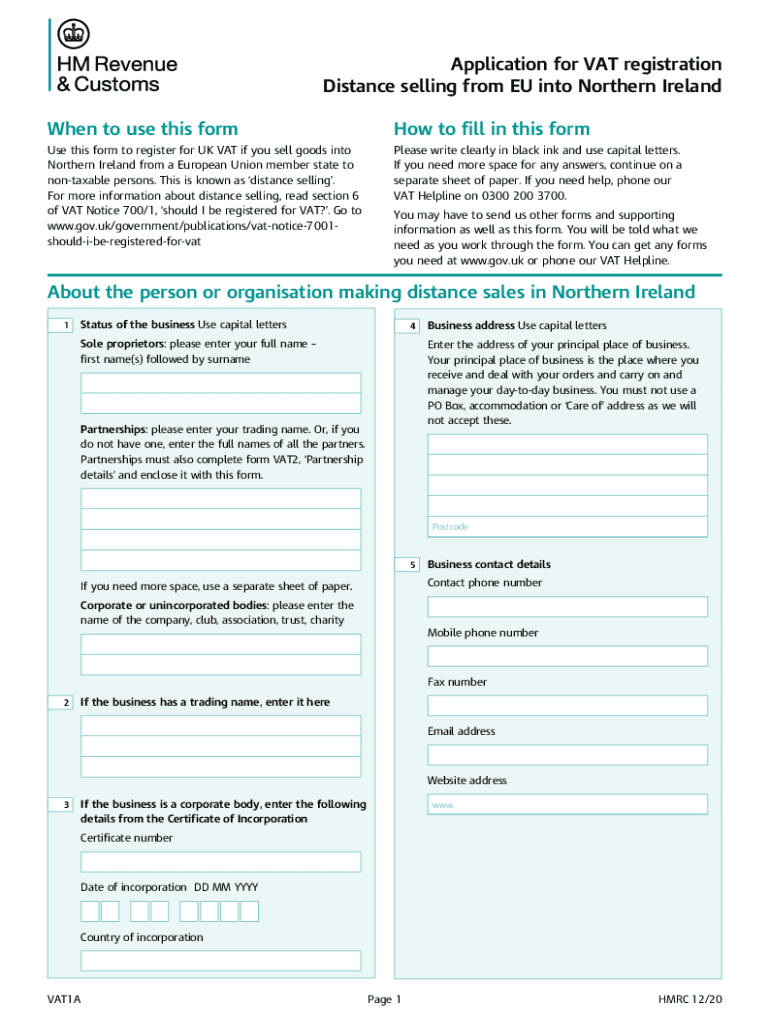

The VAT1A application is specifically designed for businesses engaged in distance selling to apply for VAT registration. This form is crucial for companies that sell goods or services to customers in the United States and need to comply with tax regulations. By completing the VAT1A application, businesses can ensure they are registered correctly for VAT, allowing them to charge and collect the appropriate taxes on their sales.

Steps to Complete the VAT1A Application for VAT Registration

Completing the VAT1A application involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary business information, including your business name, address, and contact details.

- Provide details about your business activities and the nature of goods or services sold.

- Include information on your expected turnover to determine the appropriate VAT rate.

- Review the application for completeness and accuracy before submission.

Required Documents for the VAT1A Application

When submitting the VAT1A application, certain documents are typically required to support your registration. These may include:

- Proof of business registration, such as articles of incorporation or a business license.

- Financial statements or tax returns to demonstrate expected turnover.

- Identification documents for the business owner or authorized signatory.

Legal Use of the VAT1A Application for VAT Registration

The VAT1A application must be used in accordance with U.S. tax laws to be considered legally binding. This means that all information provided must be truthful and accurate. Misrepresentation or failure to comply with VAT regulations can lead to penalties or legal consequences. Therefore, it is essential to understand the legal implications of submitting this application.

Eligibility Criteria for the VAT1A Application

To be eligible for the VAT1A application, businesses must meet specific criteria. These typically include:

- Engaging in distance selling activities within the United States.

- Meeting the minimum turnover threshold set by tax authorities.

- Having a valid business entity registered in the U.S.

Form Submission Methods for the VAT1A Application

The VAT1A application can be submitted through various methods, ensuring convenience for businesses. Options include:

- Online submission through the appropriate tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete vat1a application for vat registration the vat1a form is used by distance selling businesses to apply for vat registration

Complete VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration effortlessly on any device

Digital document management has gained immense popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration seamlessly

- Find VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors requiring you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat1a application for vat registration the vat1a form is used by distance selling businesses to apply for vat registration

Create this form in 5 minutes!

How to create an eSignature for the vat1a application for vat registration the vat1a form is used by distance selling businesses to apply for vat registration

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the vat1a application registration process?

The vat1a application registration process is straightforward with airSlate SignNow. Users can easily complete and submit their VAT1A forms electronically, ensuring a faster approval time. Our platform provides step-by-step guidance to help streamline the registration process.

-

How can airSlate SignNow assist with vat1a application registration?

airSlate SignNow helps businesses manage their vat1a application registration by allowing users to fill, sign, and send documents securely. Our intuitive interface simplifies the process, making it easier for businesses to comply with VAT regulations.

-

Are there any costs associated with vat1a application registration on airSlate SignNow?

Yes, there may be costs involved in using airSlate SignNow for your vat1a application registration. However, our pricing is competitive and designed to provide a cost-effective solution suitable for businesses of all sizes, maximizing value and efficiency.

-

What are the key features for vat1a application registration on airSlate SignNow?

Key features of airSlate SignNow for vat1a application registration include electronic signatures, document templates, and real-time collaboration. Additionally, our platform ensures compliance with legal standards, which enhances the reliability of your VAT applications.

-

Is airSlate SignNow secure for vat1a application registration?

Absolutely, airSlate SignNow prioritizes security for all transactions, including your vat1a application registration. We use advanced encryption and data protection measures to ensure that your sensitive information remains safe throughout the registration process.

-

Can I integrate airSlate SignNow with other applications for vat1a application registration?

Yes, airSlate SignNow offers seamless integration with a variety of applications. This makes managing your vat1a application registration even more efficient by allowing you to connect with tools you already use, streamlining the entire process.

-

What are the benefits of using airSlate SignNow for vat1a application registration?

Using airSlate SignNow for your vat1a application registration brings multiple benefits, including enhanced speed, improved accuracy, and better document tracking. Our platform simplifies the registration process, which helps businesses save time and reduce potential errors.

Get more for VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration

- Diving place official diving score sheet kshsaa form

- Inspection and expiration of building permits form

- Iowa residential rental lease agreement legal templates form

- Ia residential lease or month to month rental agreement form

- Free idaho rental lease agreement templatespdfword form

- Job 757 life membership application lmindd form

- State of maryland lease agreement legal templates form

- Connecticut commercial lease agreement legal form

Find out other VAT1A Application For VAT Registration The VAT1A Form Is Used By Distance Selling Businesses To Apply For VAT Registration

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement