Articles of Revival Form 15 Centro Legal Works Inc

What is the Articles of Revival Form 15?

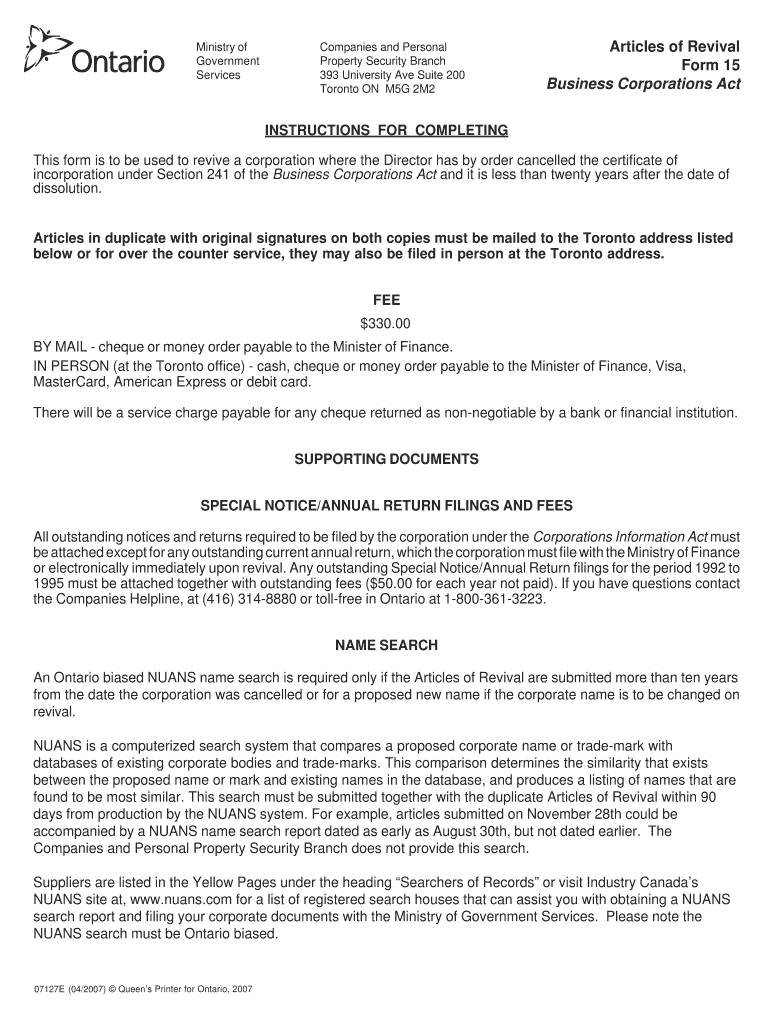

The Articles of Revival Form 15 is a legal document used in the United States to reinstate a corporation that has been dissolved or is inactive. This form is essential for businesses that wish to regain their legal status and continue operations. It typically includes information about the corporation, such as its name, the date of dissolution, and the purpose of revival. The form serves as a formal request to the appropriate state authority to recognize the corporation's revival, allowing it to resume its business activities legally.

Steps to Complete the Articles of Revival Form 15

Completing the Articles of Revival Form 15 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary information about the corporation, including its name, identification number, and details regarding its dissolution. Next, accurately fill out the form, ensuring that all fields are completed. It is crucial to review the form for any errors or omissions before submission. Once the form is completed, it may need to be signed by an authorized officer of the corporation. Finally, submit the form to the appropriate state agency, either online or via mail, depending on the state’s requirements.

Legal Use of the Articles of Revival Form 15

The Articles of Revival Form 15 is legally binding and must be used in accordance with state laws. This form reinstates a corporation's legal standing, allowing it to conduct business, enter contracts, and engage in legal proceedings. It is important to ensure that the corporation complies with any outstanding obligations, such as taxes or fees, before filing the form. Failure to properly complete or submit the Articles of Revival could result in delays or denial of the revival request.

Key Elements of the Articles of Revival Form 15

Several key elements must be included in the Articles of Revival Form 15 to ensure its validity. These include:

- Corporation Name: The legal name of the corporation as registered with the state.

- Date of Dissolution: The date when the corporation was officially dissolved.

- Purpose of Revival: A brief explanation of why the corporation is seeking to revive its status.

- Authorized Signatures: Signatures from individuals authorized to act on behalf of the corporation.

How to Obtain the Articles of Revival Form 15

The Articles of Revival Form 15 can typically be obtained from the website of the state agency responsible for business registrations. Many states provide downloadable PDF versions of the form, which can be filled out electronically or printed for manual completion. Additionally, some states may offer the option to complete the form online through their business registration portal. It is advisable to check the specific requirements and procedures for obtaining the form in your state to ensure compliance.

Form Submission Methods

Submitting the Articles of Revival Form 15 can be done through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states allow for electronic filing through their official business registration websites.

- Mail: Completed forms can often be mailed to the designated state office, along with any required fees.

- In-Person: Some states permit in-person submissions at local offices or business registration centers.

Quick guide on how to complete articles of revival form 15 centro legal works inc

Effortlessly prepare Articles Of Revival Form 15 Centro Legal Works Inc on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without any delays. Manage Articles Of Revival Form 15 Centro Legal Works Inc on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and eSign Articles Of Revival Form 15 Centro Legal Works Inc with ease

- Obtain Articles Of Revival Form 15 Centro Legal Works Inc and click on Obtain Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Completed button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Articles Of Revival Form 15 Centro Legal Works Inc to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When someone is working for sweat equity what type of legal forms need to be filled out so that it can be paid later?

My recommendations for a Sweat Equity deal done right would be as follows:Background - Read all about what Sweat Equity is and the various types of Sweat Equity at Sweat Equity 101The Terms - Most Sweat Equity arrangements get off to a bad start without full clarity on exactly what the deliverables are going to be by the person contributing sweat equity (the “Consultant”), the value of that contribution by the Consultant, and how that value will be compensated by the Company (there are many different forms of paying for sweat equity). Once the Terms are clarified, then we can move on to the Documentation.The Documentation - The proper documentation in terms of the legal forms should include the following:Sweat Equity Agreement - The core consulting agreement between the Company and the Consultant that spells out the overall arrangement and refers to each individual Statement of WorkStatement of Work - The agreement that clearly outlines the specific work to be done by the Consultant in exchange for the Sweat Equity or a combination of Cash and Sweat Equity. This should be very clear on the deliverables and the specific value of those deliverables in very small chunks of work to avoid the vague “I’ll build the app in exchange for owning 25% of the company”Proprietary Information and Inventions Agreement - The detailed confidentiality agreement that also makes clear that the Consultant’s work is owned by the CompanyThe proper form of agreement that covers the specific type of Sweat Equity, which may be one of many forms:Amendment to the Organization Documents - If issuing additional founder’s equity, then the Operating Agreement or Charter should be amended to cover the issuance of additional equity and adding a shareholder or memberStock Warrant - If issuing equity under a warrant with an agreed upon strike priceSAFE Agreement - If the sweat equity will be granted in a SAFE (Simple Agreement for Future Equity) whereby the Consultant gets the equity as part of the next investment roundConvertible Note Agreement - If the sweat equity will be granted in a Convertible Note whereby the Consultant holds a note that converts into equity as part of the next investment roundRoyalty Agreement - If the sweat equity will be paid through a Royalty or revenue share agreement where the Consultant gets paid via a revenue royaltyStock Purchase Agreement - If the sweat equity will be paid through a stock purchase agreement and Bill of Sale (be careful of the notion of just “granting equity” in exchange for sweat equity as it creates a taxable event)I would generally recommend avoiding stock options or unit appreciation rights at the sweat equity stage since the Consultant is usually an independent contractor and not an employee. (That’s why I recommend a Warrant as one of the forms of payment instead of Options.)Here’s an easy-to-use app to quickly put together an iron-clad Sweat Equity agreement at SweatEquity.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

Create this form in 5 minutes!

How to create an eSignature for the articles of revival form 15 centro legal works inc

How to make an electronic signature for the Articles Of Revival Form 15 Centro Legal Works Inc online

How to make an electronic signature for the Articles Of Revival Form 15 Centro Legal Works Inc in Chrome

How to create an eSignature for signing the Articles Of Revival Form 15 Centro Legal Works Inc in Gmail

How to make an eSignature for the Articles Of Revival Form 15 Centro Legal Works Inc right from your smart phone

How to generate an eSignature for the Articles Of Revival Form 15 Centro Legal Works Inc on iOS

How to create an electronic signature for the Articles Of Revival Form 15 Centro Legal Works Inc on Android devices

People also ask

-

What is form 15 articles of revival?

The form 15 articles of revival is a legal document that allows a corporation to revive its status after it has been dissolved or discontinued under applicable laws. By completing this form, businesses can re-establish their rights and operations legally. Using airSlate SignNow, signing and submitting this form becomes seamless and efficient.

-

How can airSlate SignNow help with form 15 articles of revival?

airSlate SignNow provides businesses with an easy-to-use platform for electronically signing and sending the form 15 articles of revival. This streamlined process ensures that your document is completed accurately and submitted promptly. Our solution also enhances compliance by keeping track of all signatures and submissions.

-

What are the pricing options for using airSlate SignNow to file form 15 articles of revival?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, allowing you to complete tasks like filing the form 15 articles of revival without breaking the bank. Pricing varies based on number of users and features, making our solution accessible to startups and large enterprises alike. Additionally, we offer a free trial so you can explore the features before committing.

-

Can I track the status of my form 15 articles of revival after submission?

Yes, with airSlate SignNow, you can effortlessly track the status of your form 15 articles of revival after submission. Our platform provides notifications and updates, ensuring you are always informed about the progress of your document. This feature is crucial for maintaining compliance and ensuring a smooth revival process.

-

What features does airSlate SignNow offer for electronic signing of legal documents?

airSlate SignNow offers robust features for electronic signing, including legally binding signatures, customizable templates, and advanced authentication options. When handling documents like the form 15 articles of revival, these features enhance security and efficiency. You can also integrate with other business tools to streamline your workflow.

-

Is airSlate SignNow compliant with legal standards for signing form 15 articles of revival?

Absolutely! airSlate SignNow is fully compliant with the eSign Act and other relevant legal standards for electronic signatures. This means that your form 15 articles of revival will hold legal weight and be accepted by government authorities. We ensure the highest level of security and compliance for all transactions.

-

What are the benefits of using airSlate SignNow for form 15 articles of revival?

The primary benefits of using airSlate SignNow for the form 15 articles of revival include convenience, speed, and enhanced document tracking. Our platform simplifies the signing process, reduces turnaround time, and minimizes the risk of error. This contributes to a smoother revival process, allowing your business to focus on its core operations.

Get more for Articles Of Revival Form 15 Centro Legal Works Inc

Find out other Articles Of Revival Form 15 Centro Legal Works Inc

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed