Register Rules AvoidTheScam Net Fill Out and Sign 2020-2026

IRS Guidelines

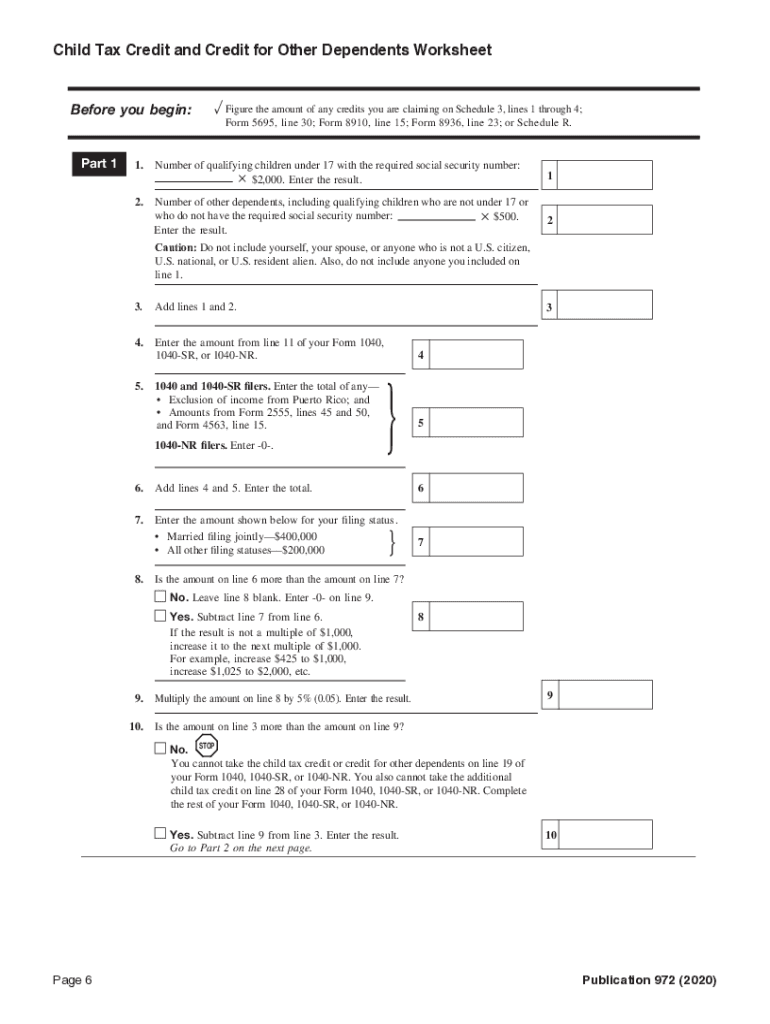

The IRS provides specific guidelines for completing the IRS child tax credit form. Understanding these guidelines is crucial for ensuring compliance and maximizing your tax benefits. The guidelines cover eligibility requirements, income thresholds, and the necessary documentation needed to support your claim. It is important to review IRS publications related to the child tax credit to stay informed about any changes or updates that may affect your filing.

Eligibility Criteria

To qualify for the child tax credit, you must meet certain eligibility criteria established by the IRS. Generally, the child must be under the age of 17 at the end of the tax year and must be your dependent. Additionally, there are income limits that determine the amount of credit you can receive. Families with higher incomes may see a reduced credit amount, while those below the threshold may qualify for the full credit. It is essential to verify your eligibility before filing to avoid potential issues with your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the IRS child tax credit form align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due by April 15 of the following year. However, if you require additional time, you can file for an extension, which may give you until October 15. It is crucial to be aware of these dates to ensure timely submission and avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

You can submit the IRS child tax credit form through various methods, including online, by mail, or in-person. Filing online is often the fastest and most efficient method, allowing for quicker processing times. If you choose to file by mail, ensure that you send your form to the correct IRS address to avoid delays. In-person filing is less common but may be available at certain IRS offices, especially for those needing assistance with their forms.

Required Documents

When completing the IRS child tax credit form, you will need to gather several required documents. These may include your Social Security number, your child's Social Security number, and proof of income, such as W-2 forms or 1099s. Additionally, any documentation that verifies your relationship to the child, such as birth certificates or adoption papers, may be necessary. Having these documents ready can streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the child tax credit can result in penalties. Common issues include claiming a credit for ineligible dependents or failing to provide necessary documentation. The IRS may disallow the credit, leading to a higher tax liability. In some cases, penalties may also apply for late filing or underreporting income. Understanding these risks can help you navigate the filing process more effectively.

Digital vs. Paper Version

When deciding between the digital and paper versions of the IRS child tax credit form, consider the benefits of each method. Digital filing typically offers faster processing times and immediate confirmation of receipt. It also allows for easier corrections if errors occur. Conversely, paper filing may be preferable for those who are less comfortable with technology or who wish to keep a physical copy of their submission. Weighing these options can help you choose the best method for your situation.

Quick guide on how to complete register rules avoidthescam net fill out and sign

Effortlessly prepare Register Rules AvoidTheScam Net Fill Out And Sign on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Register Rules AvoidTheScam Net Fill Out And Sign on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Register Rules AvoidTheScam Net Fill Out And Sign with ease

- Locate Register Rules AvoidTheScam Net Fill Out And Sign and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Register Rules AvoidTheScam Net Fill Out And Sign and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct register rules avoidthescam net fill out and sign

Create this form in 5 minutes!

How to create an eSignature for the register rules avoidthescam net fill out and sign

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is the 2018 child tax credit and who qualifies for it?

The 2018 child tax credit is a tax benefit offered to families with qualifying children, aimed at providing financial support. To qualify for the 2018 child tax credit, parents must have dependent children under the age of 17 at the end of the tax year and meet specific income requirements.

-

How much is the 2018 child tax credit worth?

For the tax year 2018, the child tax credit was increased to $2,000 per eligible child. However, only $1,400 of this amount is refundable, meaning families may receive a portion as a refund even if they owe no taxes.

-

How can families claim the 2018 child tax credit?

Families can claim the 2018 child tax credit by filing their federal tax return and completing the appropriate tax forms. It's essential to include the details of all qualified children to ensure that the credit is accurately calculated.

-

What are the income limits for the 2018 child tax credit?

To benefit from the full 2018 child tax credit, families must have a modified adjusted gross income (MAGI) below $200,000 ($400,000 for married couples filing jointly). As income rises above these thresholds, the credit begins to phase out.

-

Are there any new features in the 2018 child tax credit compared to previous years?

Yes, the 2018 child tax credit introduced a higher credit amount per child and increased eligibility thresholds compared to previous years. These enhancements aimed to provide greater financial support for families, particularly those with multiple dependents.

-

Can I use the 2018 child tax credit if I am a single parent?

Yes, single parents can still benefit from the 2018 child tax credit as long as they meet the criteria of having qualifying children and are within the income limits. The credit is designed to aid families, regardless of their marital status.

-

How does the 2018 child tax credit affect state taxes?

The impact of the 2018 child tax credit on state taxes varies, as some states may conform to federal tax benefits while others do not. It’s recommended to check state-specific regulations or consult a tax professional for accurate details.

Get more for Register Rules AvoidTheScam Net Fill Out And Sign

- The circuit or district court through a trialwaiver hearing notice setting the date time and place to appear form

- The bureau requires that all requests for public records be in writing form

- To the family court new york state unified court system form

- South dakota division of human rights charging party intake form south dakota division of human rights charging party intake

- Trs forms 609876131

- Com to submit your claim electronically with uploaded documentation form

- Application for residence permit for citizens of switzerland and their family members form

- Archives records transfer sheet form

Find out other Register Rules AvoidTheScam Net Fill Out And Sign

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now