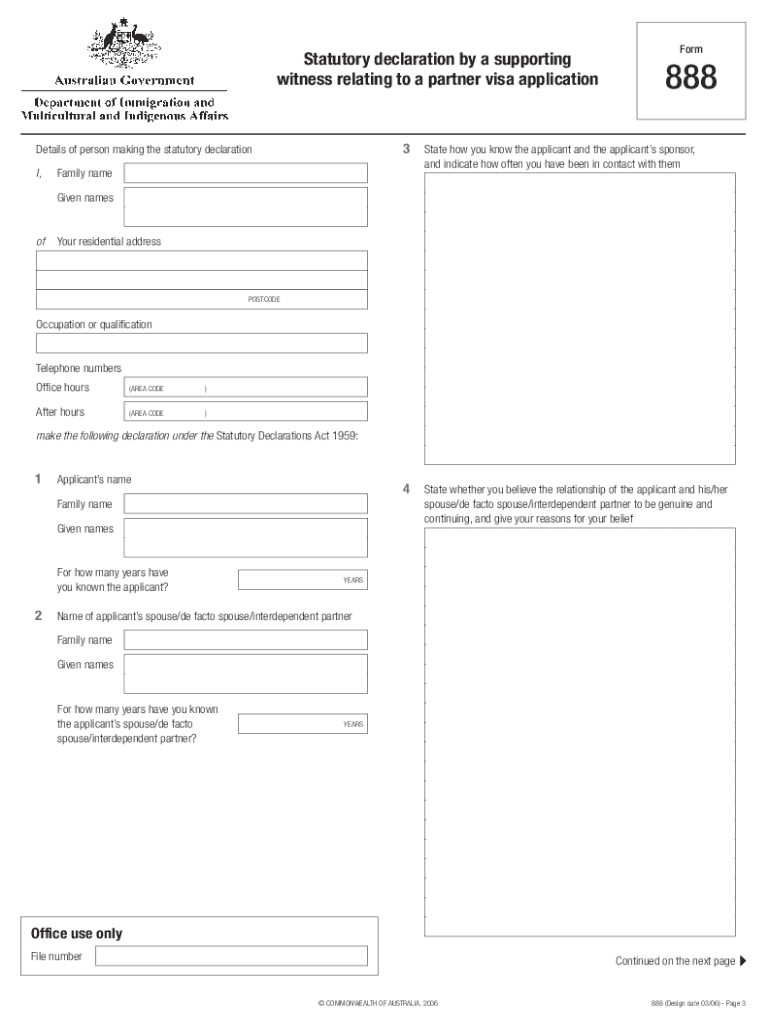

Form 888

What is the Form 888

The Form 888 is a document used primarily for specific tax-related purposes in the United States. It serves as a means for individuals to report certain information to the Internal Revenue Service (IRS). This form is particularly relevant for those who need to provide details regarding various tax exemptions or credits. Understanding its purpose is essential for accurate tax reporting and compliance.

Steps to complete the Form 888

Completing the Form 888 requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary information, including your Social Security number, income details, and any relevant tax documents.

- Begin filling out the form by entering your personal information in the designated fields.

- Provide accurate financial data as required, ensuring it matches your records.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form to validate your submission.

Legal use of the Form 888

The legal use of the Form 888 is governed by IRS regulations. To ensure that your submission is valid, it is important to adhere to the following:

- Ensure that all information provided is truthful and accurate, as false information can lead to penalties.

- Submit the form within the required deadlines to avoid any legal repercussions.

- Maintain a copy of the completed form for your records, as it may be needed for future reference or audits.

Examples of using the Form 888

There are various scenarios where the Form 888 may be applicable. Here are a few examples:

- A self-employed individual reporting their income and claiming deductions.

- A student applying for education-related tax credits.

- A retired person who needs to report pension income and related tax obligations.

Required Documents

When preparing to fill out the Form 888, certain documents are necessary to ensure accuracy and compliance. These may include:

- Social Security card or number.

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any tax credits or deductions you plan to claim.

Form Submission Methods

The Form 888 can be submitted through various methods, allowing for flexibility based on individual preferences:

- Online submission through the IRS e-file system.

- Mailing a printed copy of the completed form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete form 888

Complete Form 888 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the necessary tools for you to create, alter, and eSign your documents swiftly and without complications. Handle Form 888 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 888 effortlessly

- Find Form 888 and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow.

- Craft your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for submitting your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Form 888 while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 888

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a form 888 example pdf?

A form 888 example pdf is a standardized document that serves various legal and administrative purposes. It is often utilized for applications, claims, and requests within different governmental and organizational settings. Having an example in PDF format can streamline the process of completing and submitting important paperwork.

-

How can airSlate SignNow help with form 888 example pdf?

airSlate SignNow provides a user-friendly platform to quickly fill out and electronically sign a form 888 example pdf. With its intuitive interface, businesses can easily manage document workflows, ensuring that all necessary signatures and approvals are obtained efficiently. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for form 888 example pdf?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Each plan provides access to features that enable users to manage their documents, including the ability to handle form 888 example pdfs. You can choose a plan that best suits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 888 example pdf?

airSlate SignNow offers features such as document templates, electronic signatures, and real-time tracking for form 888 example pdfs. Users can easily upload their documents, customize templates, and send them out for signature with just a few clicks. These features enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other applications for form 888 example pdf handling?

Yes, airSlate SignNow provides seamless integrations with various applications like Google Drive, Dropbox, and Salesforce, making it easy to manage your form 888 example pdfs alongside your regular business tools. These integrations help you streamline your workflow and maintain organization across all platforms.

-

What are the benefits of using airSlate SignNow for form 888 example pdf?

Using airSlate SignNow for managing form 888 example pdfs offers several benefits, including enhanced efficiency, improved collaboration, and reduced paper usage. The platform allows multiple users to edit and sign documents simultaneously, facilitating faster processing times. This can lead to increased productivity for your business.

-

How secure is airSlate SignNow when handling form 888 example pdf?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. When managing your form 888 example pdf and other sensitive documents, you can trust that your data is protected from unauthorized access. Their commitment to security ensures peace of mind for all users.

Get more for Form 888

- Saondeduassets420600university of notre dame standard form entertainment contract

- Nbea call for effective strategies form 2013 business amp public

- Grant deed definition form

- Lic form no 680 rev 87 pdf download

- Pay or quit notice pdf form

- Nj state pba scholarship form

- Department of health and human services center for cms form

- Medicaid questionnaire and assignment north dakota form

Find out other Form 888

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien