Kra Clearance Certificate Form

What is the KRA Clearance Certificate?

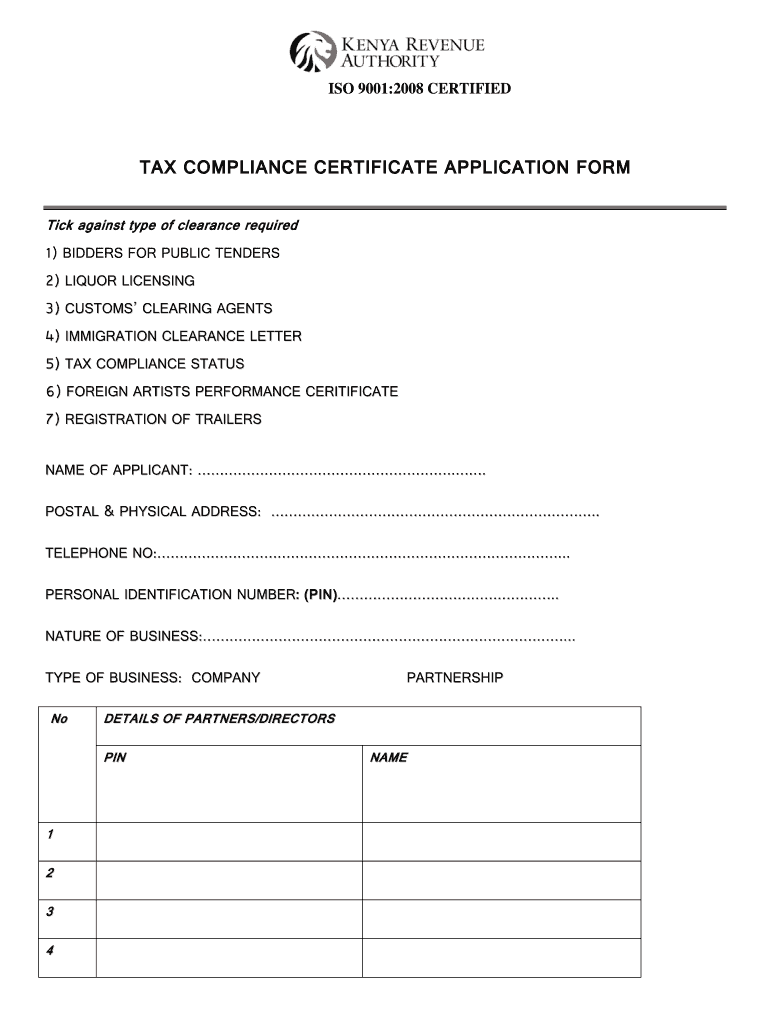

The KRA Clearance Certificate, also known as the tax compliance certificate, is an official document issued by the Kenya Revenue Authority (KRA). It serves as proof that an individual or business has fulfilled all tax obligations and is compliant with Kenyan tax laws. This certificate is essential for various transactions, including securing loans, bidding for government contracts, and conducting business operations within Kenya. It indicates that the taxpayer is in good standing with the KRA, ensuring that there are no outstanding tax liabilities.

How to Obtain the KRA Clearance Certificate

To obtain the KRA Clearance Certificate, taxpayers must follow a structured process. This includes:

- Registering for a KRA PIN if not already done.

- Ensuring all tax returns are filed and up-to-date.

- Paying any outstanding taxes or penalties.

- Visiting the KRA online portal or a local KRA office to apply for the certificate.

Once the application is submitted, the KRA will review the taxpayer's compliance status and issue the certificate if all requirements are met.

Steps to Complete the KRA Clearance Certificate

Completing the KRA Clearance Certificate involves several key steps:

- Gather necessary documents, including your KRA PIN, tax returns, and payment receipts.

- Access the KRA online portal and navigate to the clearance certificate section.

- Fill out the required application form, providing accurate information.

- Submit the application and await confirmation from the KRA.

It is important to ensure that all information provided is correct to avoid delays in processing.

Legal Use of the KRA Clearance Certificate

The KRA Clearance Certificate is legally recognized and can be used in various situations. It is often required for:

- Government tenders and contracts.

- Opening bank accounts or applying for loans.

- Conducting business transactions with other companies.

Having this certificate demonstrates compliance with tax regulations, which can enhance credibility and trust in business dealings.

Required Documents for the KRA Clearance Certificate

When applying for the KRA Clearance Certificate, certain documents are necessary to facilitate the process. These typically include:

- KRA PIN certificate.

- Recent tax returns for the past financial year.

- Proof of tax payments, such as receipts or bank statements.

- Identification documents, such as a national ID or passport.

Having these documents ready can streamline the application process and help ensure timely issuance of the certificate.

Penalties for Non-Compliance

Failure to obtain a KRA Clearance Certificate or to comply with tax obligations can lead to significant penalties. These may include:

- Fines imposed by the KRA for late filing or non-filing of tax returns.

- Legal action taken against the taxpayer for tax evasion.

- Ineligibility for government contracts or loans.

It is crucial for individuals and businesses to maintain compliance to avoid these consequences and ensure smooth operations.

Quick guide on how to complete kra clearance certificate

Complete Kra Clearance Certificate effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Kra Clearance Certificate on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Kra Clearance Certificate without hassle

- Find Kra Clearance Certificate and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Kra Clearance Certificate and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kra clearance certificate

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the Kenya tax form, and why is it important?

The Kenya tax form is an official document required by the Kenya Revenue Authority for tax compliance. It is essential for both individuals and businesses to accurately report their income and calculate their tax liabilities. Failing to submit the correct Kenya tax form can result in penalties and interest charges.

-

How can airSlate SignNow help with filling the Kenya tax form?

airSlate SignNow offers an easy-to-use platform that allows you to fill out and eSign your Kenya tax form electronically. This streamlines the process and ensures that all signatures are captured accurately and securely. With its user-friendly interface, you can complete your tax forms quickly and without hassle.

-

Is there a cost associated with using airSlate SignNow for the Kenya tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that simplify the completion of the Kenya tax form and other documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Kenya tax form?

airSlate SignNow provides features such as customizable templates, eSigning, and automated reminders to ensure that your Kenya tax form is processed seamlessly. You can easily track the status of your documents and receive alerts when signatures are needed. These tools help you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for the Kenya tax form?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive and Dropbox. This allows you to import or export your Kenya tax form and other related documents easily. Seamless integration enhances your workflow and improves document management efficiency.

-

What are the benefits of eSigning the Kenya tax form with airSlate SignNow?

eSigning the Kenya tax form with airSlate SignNow offers numerous benefits, including faster processing times and enhanced security. It eliminates the need for printing and scanning, making the entire process more efficient. Additionally, eSigning provides a legally binding record, giving you peace of mind.

-

Is airSlate SignNow compliant with Kenya's regulations regarding tax forms?

Absolutely, airSlate SignNow adheres to the regulations and standards required for processing the Kenya tax form. The platform ensures that all signatures are legally binding and that your documents are managed securely. This compliance helps you avoid legal issues and maintain accurate records.

Get more for Kra Clearance Certificate

- Boc online banking registration form

- Ltfrb online confirmation form

- New patta application form pdf

- United india insurance satisfaction voucher form

- Personal property addendum to real estate contract form

- Same name affidavit format pdf

- Food stamp change of address form

- Ta6 form download 2022 100262180

Find out other Kra Clearance Certificate

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now