Annual Return Form Iii Rule 21 4a

What is the Annual Return Form III Rule 21 4a

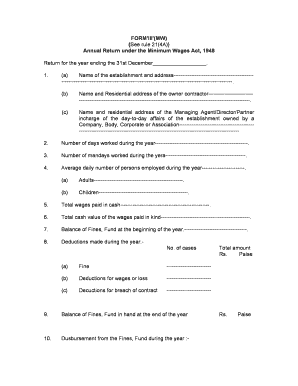

The Annual Return Form III Rule 21 4a is a document required under the Minimum Wages Act of 1948 in the United States. This form is essential for employers to report the wages paid to their employees and to ensure compliance with minimum wage laws. It serves as a formal declaration of the wages and working conditions provided to employees within a specific reporting period. The form must be filled out accurately to reflect the true wages and hours worked, ensuring transparency and adherence to legal standards.

Steps to Complete the Annual Return Form III Rule 21 4a

Completing the Annual Return Form III Rule 21 4a involves several key steps:

- Gather necessary information, including employee names, wages paid, and hours worked.

- Ensure all data is accurate and reflects the reporting period.

- Fill out the form, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to the appropriate authority.

Taking these steps carefully helps avoid penalties and ensures compliance with applicable wage laws.

Legal Use of the Annual Return Form III Rule 21 4a

The legal use of the Annual Return Form III Rule 21 4a is crucial for maintaining compliance with wage regulations. This form must be completed and submitted in accordance with federal and state laws. It serves as a legal document that can be audited or reviewed by labor authorities. Proper completion and submission demonstrate an employer’s commitment to fair labor practices and adherence to minimum wage laws, thereby protecting both the employer and employees from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Annual Return Form III Rule 21 4a vary by state and should be closely monitored to ensure compliance. Typically, employers are required to submit this form annually, with specific due dates often falling at the end of the fiscal year or within a designated period following the conclusion of the reporting year. It is essential to check local regulations for the exact deadlines to avoid penalties for late submissions.

Required Documents

To complete the Annual Return Form III Rule 21 4a, several documents may be required:

- Employee payroll records detailing wages and hours worked.

- Tax identification numbers for the business and employees.

- Previous year's annual return for reference.

- Any additional documentation required by state labor departments.

Having these documents ready can facilitate a smoother completion process and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the requirements of the Annual Return Form III Rule 21 4a can result in significant penalties. Employers may face fines, legal action, or other repercussions for not submitting the form on time or for providing inaccurate information. It is vital to understand the potential consequences and to ensure timely and accurate submissions to avoid these risks.

Quick guide on how to complete annual return form iii rule 21 4a

Complete Annual Return Form Iii Rule 21 4a effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Annual Return Form Iii Rule 21 4a on any device using airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Annual Return Form Iii Rule 21 4a with ease

- Locate Annual Return Form Iii Rule 21 4a and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature employing the Sign feature, which takes mere moments and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Annual Return Form Iii Rule 21 4a and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual return form iii rule 21 4a

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the annual return form iii rule 21 4a?

The annual return form iii rule 21 4a is a document required by various regulatory bodies that businesses must submit to report their financial activities annually. This form ensures that organizations remain compliant with legal obligations and maintain transparent records of their operations.

-

How can airSlate SignNow help with the annual return form iii rule 21 4a?

airSlate SignNow simplifies the process of preparing and submitting the annual return form iii rule 21 4a. With our user-friendly eSignature solution, you can easily fill out, sign, and send this form to relevant authorities without hassle, ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for the annual return form iii rule 21 4a?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our solutions are cost-effective, enabling you to manage and submit your annual return form iii rule 21 4a efficiently without overspending on administrative tasks.

-

What features does airSlate SignNow offer for managing documents like the annual return form iii rule 21 4a?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and advanced eSignature capabilities. These tools empower you to manage your annual return form iii rule 21 4a and other important documents seamlessly and securely.

-

Can I integrate airSlate SignNow with other software for handling the annual return form iii rule 21 4a?

Absolutely! airSlate SignNow supports numerous integrations with popular business applications, which allows you to streamline your workflow. This interoperability ensures that handling the annual return form iii rule 21 4a can be as efficient as possible within your existing systems.

-

What are the benefits of using airSlate SignNow for my annual return form iii rule 21 4a?

The primary benefits of using airSlate SignNow include increased efficiency, reduced paperwork, and enhanced compliance for your annual return form iii rule 21 4a. With our platform, you can save time and resources while ensuring that your submissions are accurate and legally binding.

-

Is airSlate SignNow user-friendly for completing the annual return form iii rule 21 4a?

Yes, airSlate SignNow is designed with an intuitive interface that makes it easy for users to complete the annual return form iii rule 21 4a. Whether you are tech-savvy or a beginner, our platform ensures a straightforward experience for everyone.

Get more for Annual Return Form Iii Rule 21 4a

Find out other Annual Return Form Iii Rule 21 4a

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy