P45 Form

What is the P45 Form

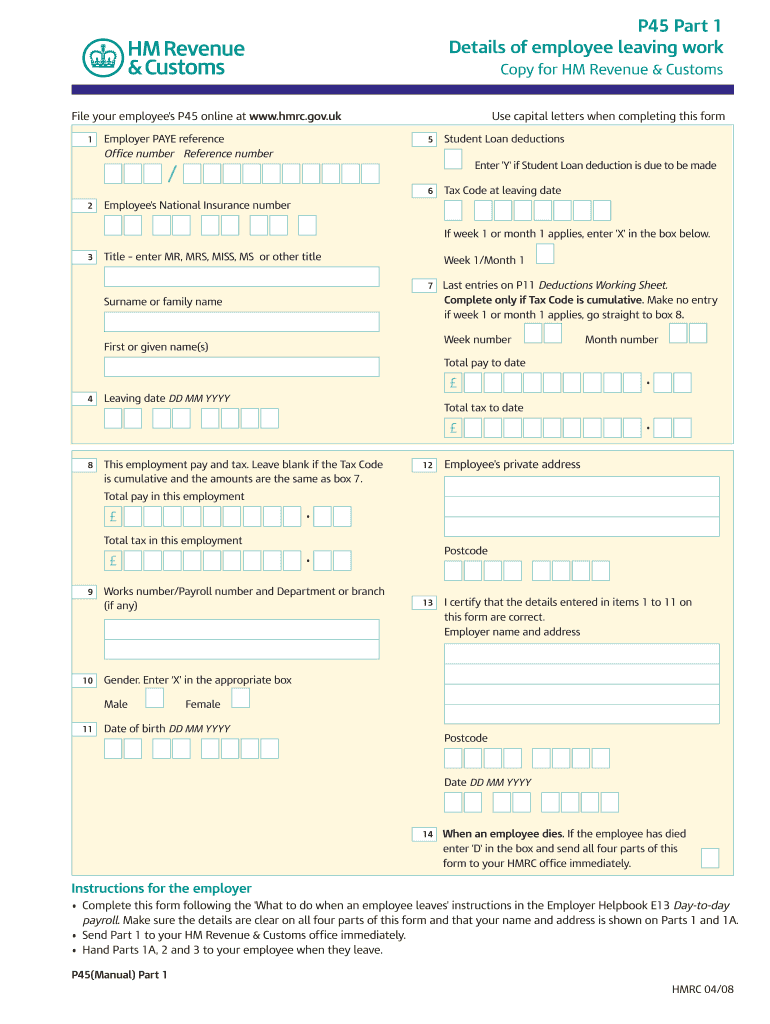

The P45 form is a document issued by employers in the United Kingdom when an employee leaves their job. It provides essential information about the employee's tax status, including their earnings and the taxes deducted during their employment. The P45 form is divided into three parts: Part 1 is sent to HM Revenue and Customs (HMRC), Part 1A is given to the employee, and Parts 2 and 3 are provided to the new employer if applicable. While the P45 is not commonly used in the United States, understanding its purpose can be beneficial for individuals dealing with international employment situations.

How to use the P45 Form

The P45 form serves multiple purposes. It is primarily used for tax purposes, allowing the employee to provide their new employer with accurate tax information. When starting a new job, the employee presents their P45 to ensure that the correct amount of tax is deducted from their salary. Additionally, the P45 can be used when applying for benefits, as it verifies previous earnings and tax contributions. It is crucial to keep the P45 form safe, as losing it may complicate tax matters.

Steps to complete the P45 Form

Completing the P45 form involves several key steps. First, the employer must gather the employee's personal information, including their name, address, and National Insurance number. Next, the employer records the employee's total earnings and the total taxes deducted during the employment period. It is essential to ensure that all information is accurate to avoid issues with HMRC. Finally, the employer must provide the employee with Parts 1A, 2, and 3 while retaining Part 1 for submission to HMRC.

Legal use of the P45 Form

The P45 form is legally binding and must be completed accurately to comply with tax regulations. Employers are required by law to issue a P45 when an employee leaves their job, ensuring that the employee's tax records are updated. Failure to provide a P45 can lead to penalties for the employer and complications for the employee regarding their tax status. It is important for both parties to understand the legal implications of the P45 form to maintain compliance with tax laws.

Who Issues the Form

The P45 form is issued by employers in the UK when an employee leaves their position. It is the employer's responsibility to ensure that the form is completed accurately and promptly. The form is part of the employer's obligations under UK tax law, and it must be provided to the employee on their last working day or as soon as possible thereafter. Understanding the role of the employer in issuing the P45 is essential for employees transitioning between jobs.

Examples of using the P45 Form

There are several scenarios where the P45 form is utilized. For instance, when an employee starts a new job, they present their P45 to the new employer to ensure the correct tax code is applied. Another example is when an employee applies for unemployment benefits; the P45 can serve as proof of previous earnings and tax contributions. Additionally, if an employee is moving abroad, the P45 may be required for tax purposes in their new country of residence.

Quick guide on how to complete p45 form 100065364

Prepare P45 Form effortlessly on any device

Managing documents online has gained immense popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without unnecessary delays. Handle P45 Form on any device using the airSlate SignNow apps for Android or iOS and simplify any paper-related task today.

How to modify and eSign P45 Form with ease

- Obtain P45 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal value as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Adjust and eSign P45 Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p45 form 100065364

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is a P45 template Word?

A P45 template Word is a document format used in the UK to inform employees about their earnings and tax contributions when they leave a job. It can be easily customized to suit different business needs and is compatible with popular word processing software, making it simple to edit and print.

-

How do I create a P45 template Word using airSlate SignNow?

Creating a P45 template Word with airSlate SignNow is straightforward. Users can either create a new document from scratch or upload an existing template, customize it to include necessary fields, and then save it as a P45 template for future use.

-

Is there a cost associated with using the P45 template Word feature?

Yes, there is a subscription fee to access the full range of features provided by airSlate SignNow, including the P45 template Word functionality. However, the pricing is competitive and offers various plans to meet diverse business requirements.

-

What are the benefits of using the P45 template Word in airSlate SignNow?

Using the P45 template Word in airSlate SignNow streamlines the document creation process, ensuring compliance and accuracy. It also saves time with eSigning capabilities, providing added convenience for both employer and employee during the offboarding process.

-

Can I integrate the P45 template Word function with other software?

Yes, airSlate SignNow offers integrations with various applications and services, enabling users to streamline workflows. This allows businesses to connect their P45 template Word with accounting or HR software, enhancing their document management processes.

-

Is it easy to customize the P45 template Word for my business needs?

Absolutely! airSlate SignNow supports easy customization of the P45 template Word to reflect your company branding or specific requirements. Users can modify text fields, add logos, and adjust layouts to create a unique document that meets their business standards.

-

How secure is the P45 template Word processing in airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform ensures that all P45 template Word documents are protected through robust encryption methods and compliance with data protection regulations, giving you peace of mind during document handling.

Get more for P45 Form

- Hbse duplicate marksheet form download pdf

- Docplayer downloader form

- Atoms vs ions worksheet form

- Printable puppy health guarantee template form

- Calculus 10th edition by ron larson and bruce edwards pdf download form

- Safaricom jobs for form four leavers 2022

- Health certificate for cardiovascular intensive sport activity cycling races events form

- Digital art commission contract form

Find out other P45 Form

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF