Nj Form Tax 2013-2026

What is the NJ Form Tax?

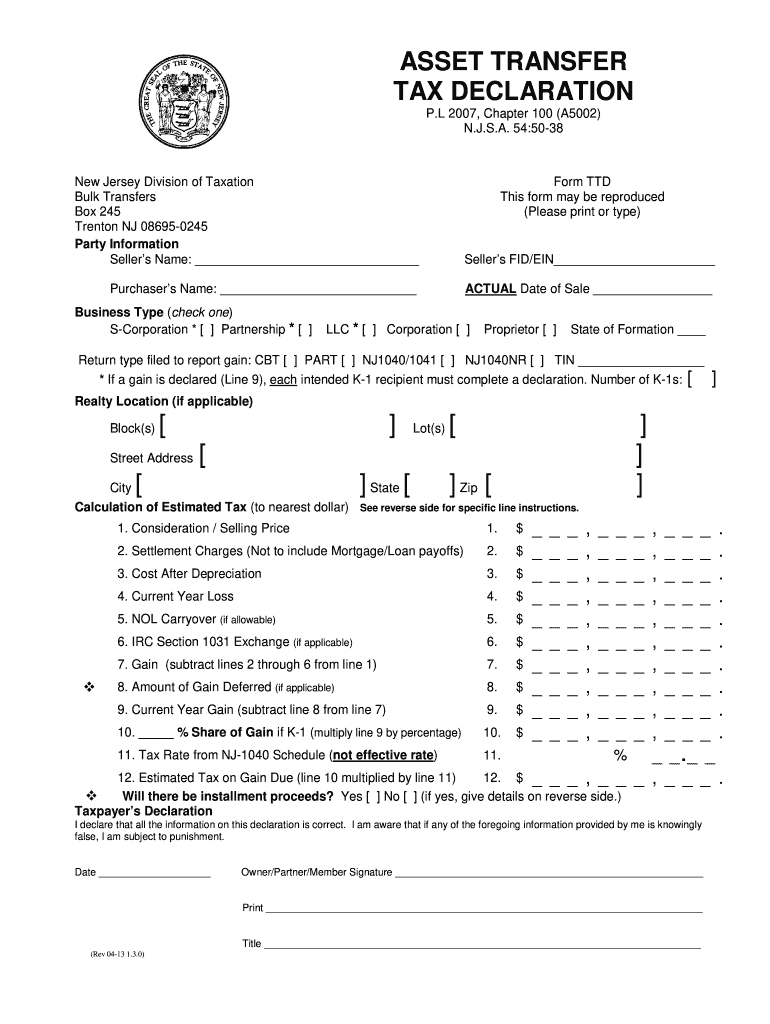

The NJ Form TTD, also known as the asset transfer tax declaration, is a crucial document used in New Jersey for reporting the transfer of real property. This form is essential for ensuring compliance with state tax regulations during property transactions. The form captures details about the transfer, including the parties involved, the nature of the transfer, and the assessed value of the property. Proper completion of the NJ Form TTD is vital for accurate tax assessment and to avoid potential penalties associated with non-compliance.

Steps to Complete the NJ Form Tax

Completing the NJ Form TTD involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as the property description, the names of the transferor and transferee, and the sale price or value of the property. Next, fill out the form carefully, ensuring all sections are completed. It is important to review the form for any errors or omissions before submission. Finally, sign and date the form to validate it. If you are submitting the form electronically, ensure that you use a reliable eSignature tool that meets legal requirements.

Legal Use of the NJ Form Tax

The NJ Form TTD holds legal significance as it serves as an official record of property transfers in New Jersey. When filled out correctly, it provides a legally binding declaration of the transaction, which is recognized by state authorities. To ensure the form's legal validity, it must be completed in accordance with New Jersey state laws, including adherence to eSignature regulations under the ESIGN and UETA acts. Using an approved electronic signing platform can enhance the form's legal standing and ensure compliance with all necessary legal frameworks.

Required Documents

To complete the NJ Form TTD, several supporting documents may be required. These typically include proof of identity for both the transferor and transferee, a copy of the property deed, and any relevant sales agreements. If the property is being transferred as part of a larger transaction, additional documentation may be necessary to substantiate the transfer. Having all required documents ready will facilitate a smoother completion process and help avoid delays in the submission and processing of the form.

Form Submission Methods

The NJ Form TTD can be submitted through various methods, including online, by mail, or in person. For online submissions, it is recommended to use a secure eSignature platform to ensure compliance with state laws. If opting for mail, the completed form should be sent to the appropriate state office, ensuring it is postmarked by any relevant deadlines. In-person submissions can be made at designated state offices, where staff can assist with any questions regarding the form. Each submission method has its own timeline and requirements, so it is important to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the NJ Form TTD can vary based on the nature of the property transfer. Generally, the form must be submitted within a specific timeframe following the completion of the property transfer. It is crucial to be aware of these deadlines to avoid penalties or issues with tax compliance. Checking the New Jersey Division of Taxation website or consulting with a tax professional can provide up-to-date information on filing deadlines and any changes to regulations that may affect your submission.

Quick guide on how to complete nj form tax

Effortlessly Prepare Nj Form Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Nj Form Tax on any device using airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to Modify and eSign Nj Form Tax Easily

- Locate Nj Form Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nj Form Tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj form tax

Create this form in 5 minutes!

How to create an eSignature for the nj form tax

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the nj form ttd and how can airSlate SignNow help with it?

The nj form ttd is a specific document used for requesting temporary disability benefits in New Jersey. airSlate SignNow streamlines the process of filling, signing, and submitting this form electronically, ensuring that you can complete your documentation quickly and easily from anywhere.

-

Are there any costs associated with using airSlate SignNow for nj form ttd?

Yes, while airSlate SignNow offers various pricing plans, the cost will depend on the features you require. These plans provide access to essential tools that can help you manage the nj form ttd efficiently, making it a valuable investment for your business.

-

What features does airSlate SignNow offer for managing nj form ttd?

AirSlate SignNow provides a range of features designed to help users manage the nj form ttd, including secure eSigning, document templates, and automated workflows. These features ensure that your document process is efficient, legally compliant, and easy to track.

-

How does airSlate SignNow enhance the user experience for the nj form ttd?

With its user-friendly interface, airSlate SignNow simplifies the process of completing the nj form ttd. Users can easily navigate through document signing and sharing, reducing the time spent on paperwork and increasing overall productivity.

-

Can airSlate SignNow integrate with other software for managing nj form ttd?

Yes, airSlate SignNow offers integration with various applications and platforms, enabling seamless management of the nj form ttd alongside your existing workflows. This connectivity helps you streamline your document processes and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the nj form ttd?

The benefits of using airSlate SignNow for the nj form ttd include time savings, reduced paperwork, and enhanced security. By using an electronic solution, you can complete required documents faster while ensuring compliance and protecting sensitive information.

-

Is airSlate SignNow secure for handling sensitive nj form ttd information?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your sensitive information related to the nj form ttd. This commitment to security ensures that your documents remain confidential and are safe from unauthorized access.

Get more for Nj Form Tax

Find out other Nj Form Tax

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation