Nj it R Form

What is the NJ IT-R?

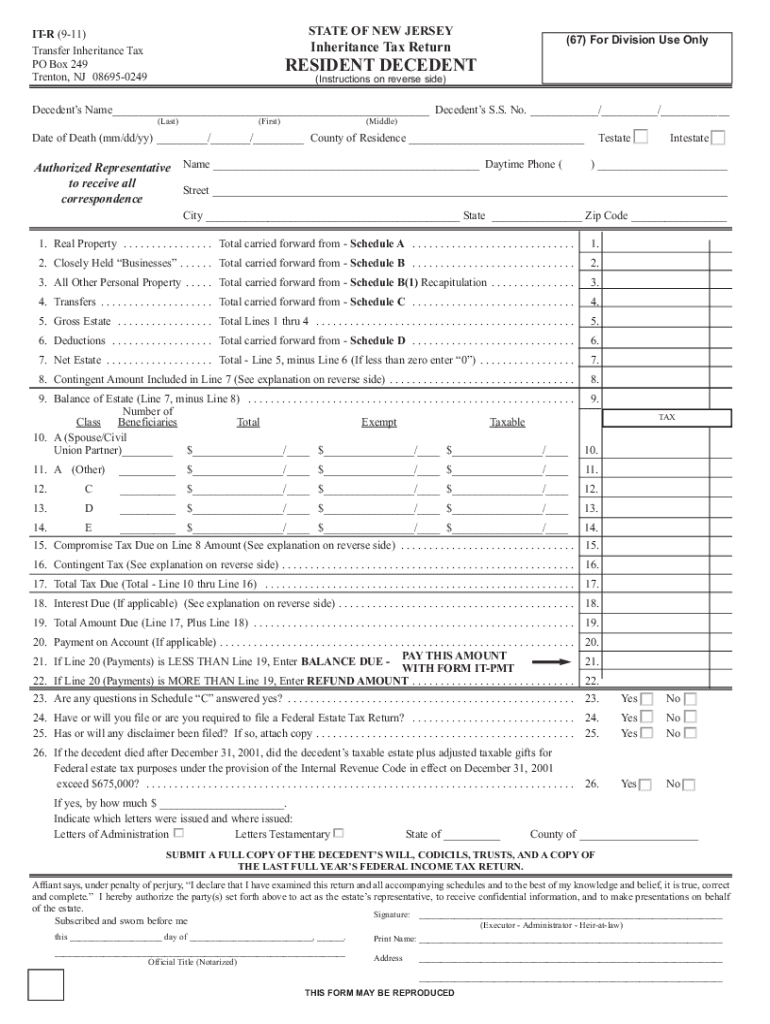

The NJ IT-R, or New Jersey Inheritance Tax Return, is a crucial document required for reporting the inheritance received by beneficiaries from a deceased individual. This form is essential for calculating any potential inheritance tax owed to the state of New Jersey. The NJ IT-R outlines the assets inherited, the relationship of the beneficiary to the decedent, and any applicable deductions or exemptions under New Jersey law. Understanding the NJ IT-R is vital for ensuring compliance with state tax regulations and for accurately assessing tax obligations.

Steps to complete the NJ IT-R

Completing the NJ IT-R involves several important steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary documentation, including the decedent's will, death certificate, and a list of all assets and liabilities.

- Identify the beneficiaries and their relationship to the decedent, as this will affect the tax rate.

- Complete the NJ IT-R form, providing detailed information about the inherited assets and any applicable deductions.

- Calculate the inheritance tax based on the value of the assets and the relationship of the beneficiaries.

- Review the completed form for accuracy before submission.

- Submit the NJ IT-R to the New Jersey Division of Taxation, either online or by mail, along with any required payments.

Legal use of the NJ IT-R

The NJ IT-R serves a legal purpose in the estate settlement process. It is required by law for reporting inheritance and ensuring that any taxes owed are accurately calculated and paid. The completion and submission of this form are essential for fulfilling legal obligations to the state. Failure to file the NJ IT-R can result in penalties and interest on unpaid taxes, making it crucial for beneficiaries to understand their responsibilities under New Jersey law.

Required Documents

When completing the NJ IT-R, several documents are necessary to support the information provided on the form. These include:

- The decedent's death certificate.

- A copy of the will, if available.

- A list of all assets and liabilities of the decedent.

- Documentation of the relationship between the beneficiaries and the decedent.

- Any appraisals or valuations of inherited property.

Form Submission Methods

The NJ IT-R can be submitted through various methods, ensuring flexibility for beneficiaries. The available submission methods include:

- Online submission through the New Jersey Division of Taxation's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the NJ IT-R to avoid penalties. Generally, the NJ IT-R must be filed within nine months of the decedent's date of death. If the form is not filed by this deadline, interest and penalties may accrue on any taxes owed. Additionally, beneficiaries should keep track of any changes in tax laws that may affect deadlines or requirements.

Quick guide on how to complete nj it r

Effortlessly Manage Nj It R on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle Nj It R on any device using airSlate SignNow's Android or iOS applications and streamline your document operations today.

How to Modify and Electronically Sign Nj It R with Ease

- Locate Nj It R and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Nj It R and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj it r

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is an example of completed nj it r?

An example of completed nj it r refers to finalized forms that adhere to New Jersey's requirements for income tax returns. These completed forms ensure that all necessary information, such as income and deductions, is accurately recorded. Using tools like airSlate SignNow can streamline this process, making it easier to complete and submit your nj it r.

-

How does airSlate SignNow help with creating an example of completed nj it r?

airSlate SignNow simplifies the process of creating an example of completed nj it r by providing customizable templates and eSigning options. Users can fill in required fields electronically, ensuring that all information is correct and up to date. This not only saves time but also reduces errors in the submission process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you're an individual seeking to submit an example of completed nj it r or a larger organization handling multiple documents, there’s a suitable plan for you. By providing cost-effective solutions, airSlate SignNow helps users save both time and resources.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides essential features such as document templates, eSigning, and automated workflows for tax document management. These features allow users to easily create an example of completed nj it r and securely store them. The platform also facilitates seamless collaboration and tracking, enhancing the overall efficiency of tax filing.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various popular software options used for tax preparation. This integration allows for easy access to your documents and helps in the efficient creation of an example of completed nj it r. By combining functionalities, users can ensure an organized and cohesive workflow without switching between platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including enhanced security, faster processing times, and improved document tracking. For example, when finalizing your example of completed nj it r, electronic signatures streamline closing processes. This not only accelerates approval times but also complies with legal standards for document signing.

-

Is there customer support available for airSlate SignNow users?

Absolutely, airSlate SignNow provides excellent customer support for its users. Whether you need assistance with creating an example of completed nj it r or have questions about features, the support team is ready to help. They offer resources such as live chat, email support, and extensive FAQs to ensure users have a smooth experience.

Get more for Nj It R

Find out other Nj It R

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile