Ifta Maryland Form

What is the IFTA Maryland

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The Maryland IFTA is specifically designed for commercial motor vehicles that travel through Maryland and other member jurisdictions. By consolidating fuel tax reporting, IFTA helps streamline the process for businesses, ensuring compliance while minimizing administrative burdens.

Steps to complete the IFTA Maryland

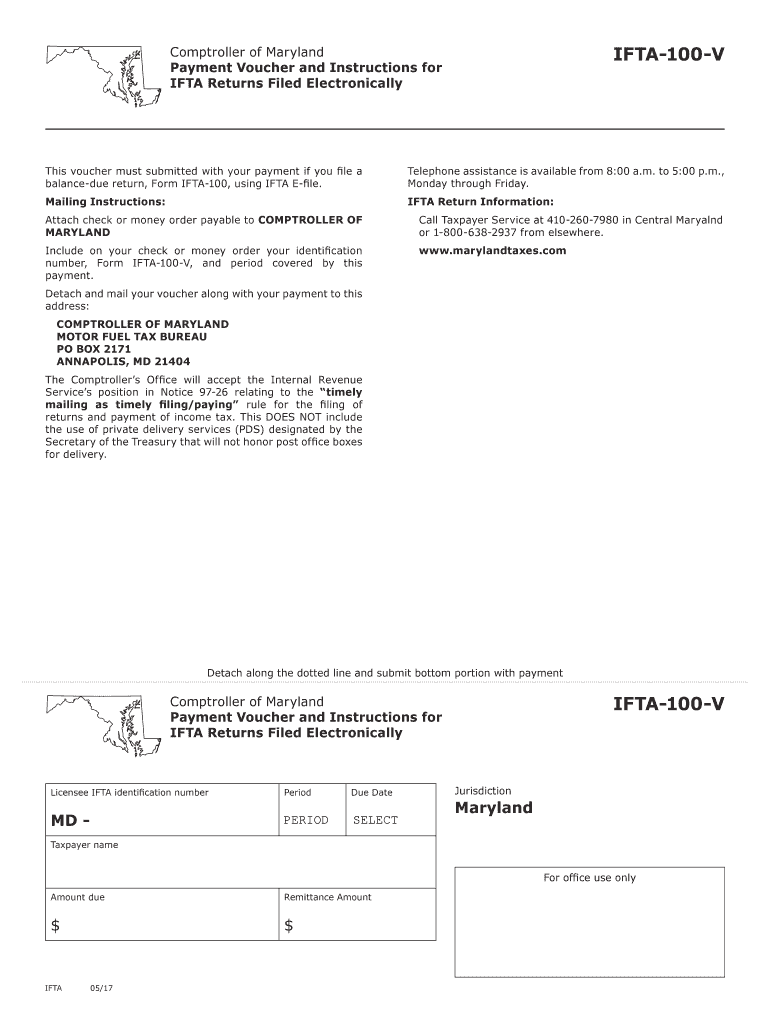

Completing the Maryland form IFTA 100 involves several key steps:

- Gather necessary information, including total miles traveled and fuel purchased in each jurisdiction.

- Calculate the total fuel consumed and the miles driven in each state or province.

- Fill out the IFTA 100 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal use of the IFTA Maryland

The Maryland IFTA 100 form is legally binding when completed and submitted in accordance with the regulations set forth by the IFTA agreement. To ensure its legality, the form must be signed by an authorized representative of the business. Additionally, the use of electronic signatures is acceptable, provided that the signature meets the requirements of the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 100 form are crucial for compliance. Typically, the form is due quarterly, with specific deadlines falling on the last day of the month following the end of each quarter. For example:

- First quarter: due by April 30

- Second quarter: due by July 31

- Third quarter: due by October 31

- Fourth quarter: due by January 31 of the following year

Required Documents

To complete the Maryland IFTA 100 form, certain documents are necessary:

- Records of mileage traveled in each jurisdiction.

- Receipts for fuel purchases in each state or province.

- Previous IFTA filings, if applicable, for reference.

Form Submission Methods (Online / Mail / In-Person)

The Maryland IFTA 100 form can be submitted through various methods:

- Online: Most carriers prefer to file electronically through the Maryland IFTA portal, which allows for quicker processing.

- Mail: Completed forms can be sent via postal service to the Maryland IFTA office.

- In-Person: Carriers may also choose to deliver forms directly to the Maryland IFTA office.

Quick guide on how to complete ifta maryland

Prepare Ifta Maryland effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary template and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ifta Maryland on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ifta Maryland with ease

- Find Ifta Maryland and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive content with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ifta Maryland and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta maryland

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the md ifta login process for airSlate SignNow?

To access your airSlate SignNow account, use the md ifta login portal where you will enter your credentials. This streamlined process ensures secure access to your signed documents and eSignature features. If you encounter issues, you can reset your password or contact customer support for assistance.

-

Are there any costs associated with using the md ifta login feature?

The md ifta login itself does not incur any charges; however, subscribing to airSlate SignNow comes with various pricing plans designed to fit different business needs. These plans include features like document eSigning, templates, and integrations. Review our pricing page for detailed information on subscription costs.

-

What are the key features accessed via md ifta login?

Once you complete the md ifta login, you gain access to a range of features including document management, team collaboration tools, and secure eSigning capabilities. Users can also utilize templates for repeat documents and track the signing process. These features empower businesses to enhance their document workflows efficiently.

-

How does airSlate SignNow enhance security for md ifta login?

airSlate SignNow prioritizes security with its md ifta login by employing advanced encryption and secure data storage practices. Authentication measures are also in place, ensuring that only authorized users can access sensitive documents. This commitment to security helps protect your business's critical information.

-

What are the benefits of using airSlate SignNow with md ifta login for businesses?

Using airSlate SignNow with md ifta login streamlines the document signing process, reducing turnaround times and improving productivity. The platform offers user-friendly tools that simplify eSigning, allowing businesses to focus on their core activities. This results in greater efficiency and cost savings over traditional paper-based methods.

-

Can I integrate other applications with airSlate SignNow after md ifta login?

Yes, airSlate SignNow supports various integrations that can be accessed once you complete the md ifta login. This allows businesses to connect their eSigning workflows with CRM systems, cloud storage, and other productivity tools. These integrations enhance the overall efficiency of document management.

-

Is there customer support available for md ifta login issues?

Absolutely! If you experience any problems with your md ifta login or have questions about usage, airSlate SignNow offers robust customer support. You can signNow out via live chat, email, or phone, and our team is ready to assist you promptly with any concerns related to your account.

Get more for Ifta Maryland

- Wms form a 44796434

- Wilson fundations store form

- Mega cavern waiver form

- Pork cut sheet template form

- Housekeeping plan for construction site pdf form

- Human rights tulip nomination form government nl

- Instructions la tulipe des droits de lhomme est un prix form

- Aanvraag voor een gecombineerde vergunning voor verblijf en arbeid gvva erkend referent form

Find out other Ifta Maryland

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast