941vi Form

What is the 941vi?

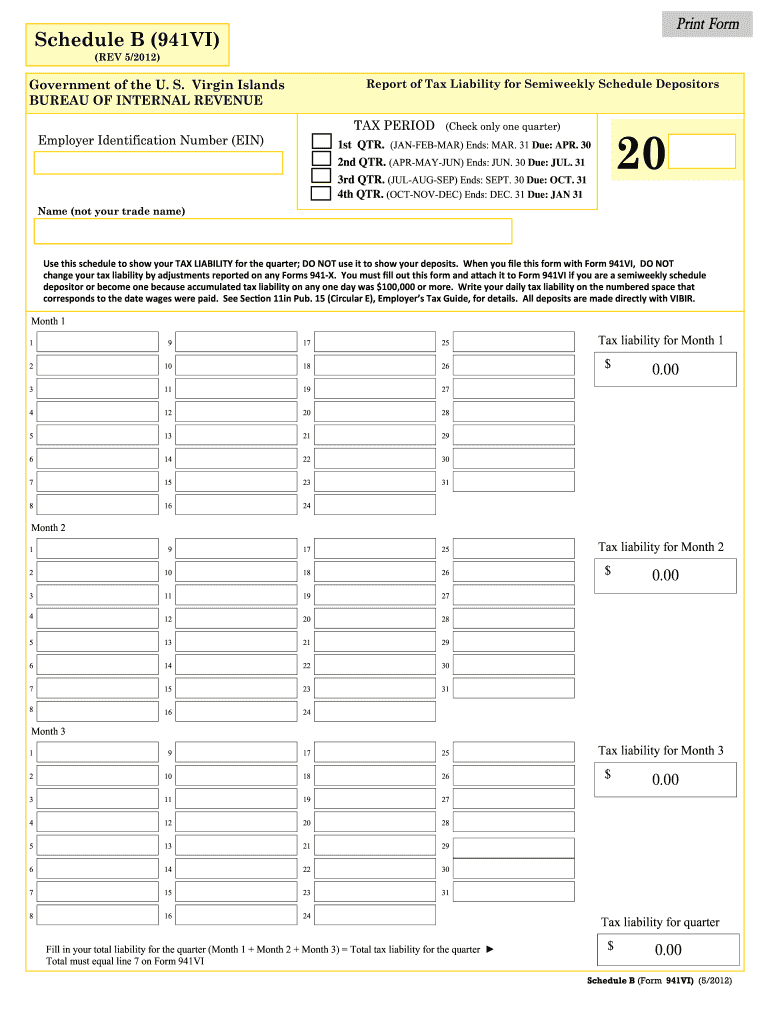

The 941vi is a specific form used for reporting certain tax liabilities related to employment. It is primarily utilized by employers in the United States to report income taxes, Social Security taxes, and Medicare taxes withheld from employees' paychecks. This form is essential for ensuring compliance with federal tax regulations and is part of the broader IRS tax reporting framework.

How to use the 941vi

Using the 941vi involves several steps to ensure accurate reporting of tax information. First, gather all necessary information regarding employee wages, tax withholdings, and any applicable credits. Next, fill out the form with precise details, including the total number of employees and the amounts withheld for federal income tax, Social Security, and Medicare. Once completed, the form can be submitted electronically or via mail to the appropriate IRS address, ensuring that all deadlines are met to avoid penalties.

Steps to complete the 941vi

Completing the 941vi requires careful attention to detail. Follow these steps:

- Gather employee payroll records, including wages and tax withholdings.

- Fill in the employer identification information at the top of the form.

- Report the total number of employees and the wages paid during the reporting period.

- Calculate and enter the amounts withheld for federal income tax, Social Security, and Medicare.

- Include any applicable tax credits and adjustments.

- Review the form for accuracy and completeness before submission.

Legal use of the 941vi

The 941vi must be used in accordance with IRS guidelines to ensure its legal validity. Employers are required to file this form quarterly, and it serves as a declaration of the taxes withheld from employees. Compliance with the IRS regulations surrounding this form is crucial, as failure to file accurately or on time can result in penalties and interest charges. Additionally, the form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 941vi are critical for compliance. Employers must submit this form on a quarterly basis, with the following deadlines:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

It is important to adhere to these deadlines to avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The 941vi can be submitted in various ways to accommodate different preferences and business needs. Employers can choose to file electronically through the IRS e-file system, which is often faster and allows for immediate confirmation of receipt. Alternatively, the form can be mailed to the designated IRS address based on the employer's location. In-person submission is generally not an option for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 941vi

Prepare 941vi effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly, without any delays. Manage 941vi on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign 941vi with ease

- Obtain 941vi and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign 941vi and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941vi

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is 941vi and how does it relate to airSlate SignNow?

941vi refers to a specific integration or module within the airSlate SignNow platform. This powerful feature streamlines document management processes, allowing businesses to send and eSign documents efficiently. By leveraging 941vi, users can enhance their workflow and improve overall productivity.

-

What are the key features of airSlate SignNow associated with 941vi?

The 941vi functionality within airSlate SignNow includes customizable templates, secure electronic signatures, and real-time tracking of document statuses. These features ensure that users can manage their documents with confidence and transparency while minimizing errors and delays.

-

Is there a trial available for the 941vi features of airSlate SignNow?

Yes, airSlate SignNow offers a free trial for users interested in exploring the benefits of the 941vi features. This allows prospective customers to experience how the platform can enhance their document signing processes without any initial investment.

-

What pricing plans are available for airSlate SignNow with 941vi functionalities?

airSlate SignNow offers various pricing plans that include access to 941vi features, catering to businesses of different sizes. Each plan is designed to provide flexibility and affordability, ensuring users can choose the best option that meets their needs.

-

How does the 941vi module improve document workflows?

The 941vi module enhances document workflows by automating repetitive tasks, enabling seamless collaboration among team members. It reduces the time spent on manual entry and approvals, allowing businesses to focus on their core operations.

-

Can I integrate 941vi with other software solutions?

Absolutely! The 941vi features of airSlate SignNow can be integrated with various third-party applications, enhancing your existing tech ecosystem. This ensures that users can leverage their favorite tools in conjunction with airSlate SignNow for optimal efficiency.

-

What are the security measures in place for 941vi within airSlate SignNow?

Security is a top priority for airSlate SignNow, especially with functionalities like 941vi. The platform offers robust encryption, secure cloud storage, and compliance with industry standards, ensuring that all documents are protected from unauthorized access.

Get more for 941vi

- Kansas marriage license worksheet form

- Wced resignation forms

- Johnstone warranty claim form

- Paycheck plus 29513013 form

- Parts of speech matching worksheet form

- Hyresavtal form

- Report of suspected adverse reaction to medicines or vaccines reporting problems form

- Application for the purpose of residence of 39european blue card39 ind form

Find out other 941vi

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online