Alabama Sales Tax Return Form 2016

What is the Alabama Sales Tax Return Form

The Alabama Sales Tax Return Form is a document used by businesses to report and remit sales tax collected on taxable sales within the state of Alabama. This form is essential for ensuring compliance with state tax regulations. It provides a structured way for businesses to disclose their sales figures, calculate the amount of tax owed, and submit payments to the Alabama Department of Revenue. Understanding the purpose and requirements of this form is crucial for maintaining good standing with state tax authorities.

How to use the Alabama Sales Tax Return Form

Using the Alabama Sales Tax Return Form involves several key steps. First, businesses need to gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any deductions applicable. Next, the form must be completed accurately, ensuring that all figures are entered correctly. After filling out the form, businesses can submit it either electronically or by mail, depending on their preference and the guidelines set by the Alabama Department of Revenue. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Alabama Sales Tax Return Form

Completing the Alabama Sales Tax Return Form requires careful attention to detail. The following steps outline the process:

- Gather sales records for the reporting period, including total sales and exempt sales.

- Calculate the total sales tax collected during the period.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form along with any payment due to the Alabama Department of Revenue.

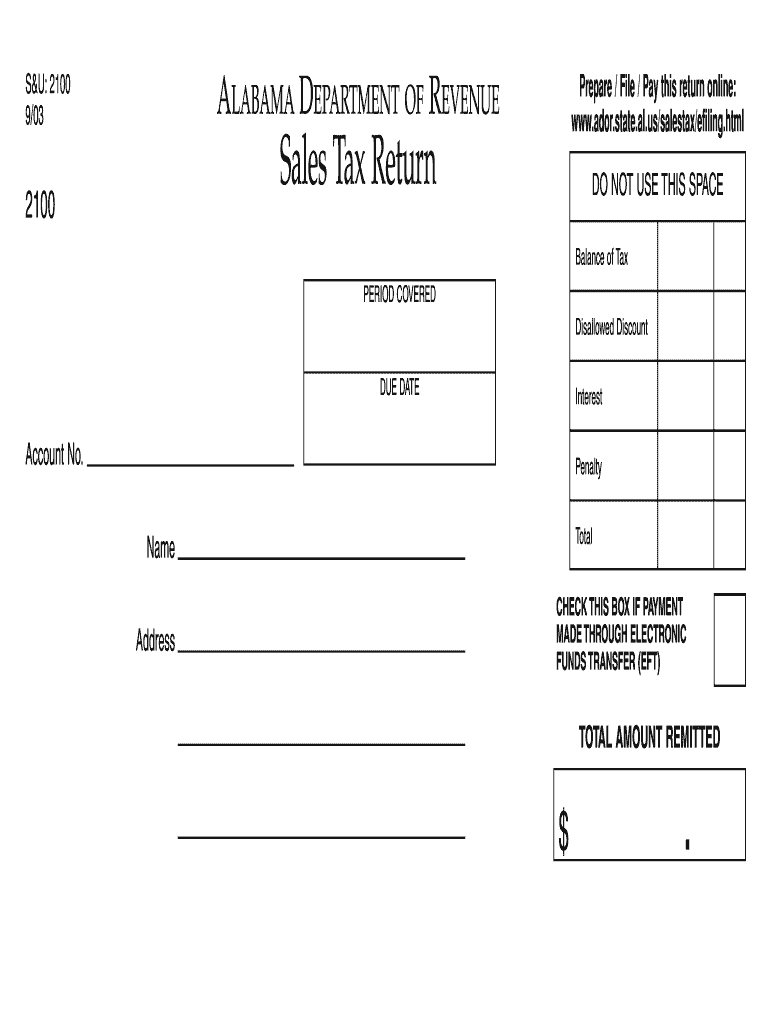

Key elements of the Alabama Sales Tax Return Form

The Alabama Sales Tax Return Form includes several key elements that must be completed. These elements typically consist of:

- Business name and address

- Sales tax account number

- Reporting period

- Total sales

- Exempt sales

- Total sales tax collected

- Signature of the authorized representative

Each of these elements plays a crucial role in accurately reporting sales tax and ensuring compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Sales Tax Return Form are critical for businesses to adhere to in order to avoid penalties. Generally, the form must be filed monthly, quarterly, or annually, depending on the business's sales volume. The specific due dates can vary, so it is essential for businesses to check the Alabama Department of Revenue's calendar for the exact deadlines applicable to their reporting period. Timely submission is key to maintaining compliance and avoiding late fees.

Penalties for Non-Compliance

Failure to file the Alabama Sales Tax Return Form on time can result in significant penalties. Businesses may incur late fees, which can accumulate over time, leading to increased financial burdens. Additionally, non-compliance can trigger audits by the Alabama Department of Revenue, which may result in further penalties or legal action. It is essential for businesses to understand these consequences and prioritize timely and accurate submissions of their sales tax returns.

Quick guide on how to complete alabama sales tax return 2003 form

Complete Alabama Sales Tax Return Form effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers a superb eco-conscious alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents rapidly without interruption. Manage Alabama Sales Tax Return Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Alabama Sales Tax Return Form without any hassle

- Find Alabama Sales Tax Return Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Alabama Sales Tax Return Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama sales tax return 2003 form

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Alabama Sales Tax Return Form?

The Alabama Sales Tax Return Form is a document that businesses in Alabama are required to file to report and pay state sales taxes collected from customers. This form helps ensure compliance with state tax laws and assists businesses in maintaining accurate records of their sales tax obligations.

-

How does airSlate SignNow facilitate the completion of the Alabama Sales Tax Return Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out the Alabama Sales Tax Return Form electronically. With efficient eSignature capabilities, businesses can streamline the approval process for their tax documents, making it quicker and simpler to submit.

-

Is there a fee to use airSlate SignNow for filing the Alabama Sales Tax Return Form?

Yes, airSlate SignNow operates on a subscription-based pricing model, which varies based on the features you need. This cost-effective solution provides businesses with the tools necessary to manage and eSign documents, including the Alabama Sales Tax Return Form, without breaking the bank.

-

What features does airSlate SignNow offer that assist with the Alabama Sales Tax Return Form?

airSlate SignNow offers robust features including customizable templates, eSignatures, document tracking, and cloud storage that enhance the process of managing the Alabama Sales Tax Return Form. These features allow businesses to work efficiently and remain organized while complying with state tax regulations.

-

Can I integrate airSlate SignNow with other software to manage the Alabama Sales Tax Return Form?

Yes, airSlate SignNow supports integrations with various accounting and business management software, allowing users to streamline their workflow concerning the Alabama Sales Tax Return Form. This integration capability helps businesses connect their existing tools without interrupting their processes.

-

What benefits does eSigning the Alabama Sales Tax Return Form provide?

Signing the Alabama Sales Tax Return Form electronically through airSlate SignNow ensures faster transactions and maintains a legally binding agreement. This method not only speeds up the signing process but also improves security and accessibility, allowing for a more convenient filing experience.

-

How can airSlate SignNow help with keeping track of deadlines for the Alabama Sales Tax Return Form?

airSlate SignNow includes features like reminders and alerts which help to keep users informed about upcoming deadlines for the Alabama Sales Tax Return Form. This ensures that businesses can file their documents on time and avoid penalties associated with late submissions.

Get more for Alabama Sales Tax Return Form

Find out other Alabama Sales Tax Return Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document