F 1120 R 01 19 Indd 2020

What is the F 1120 R 01 19 indd

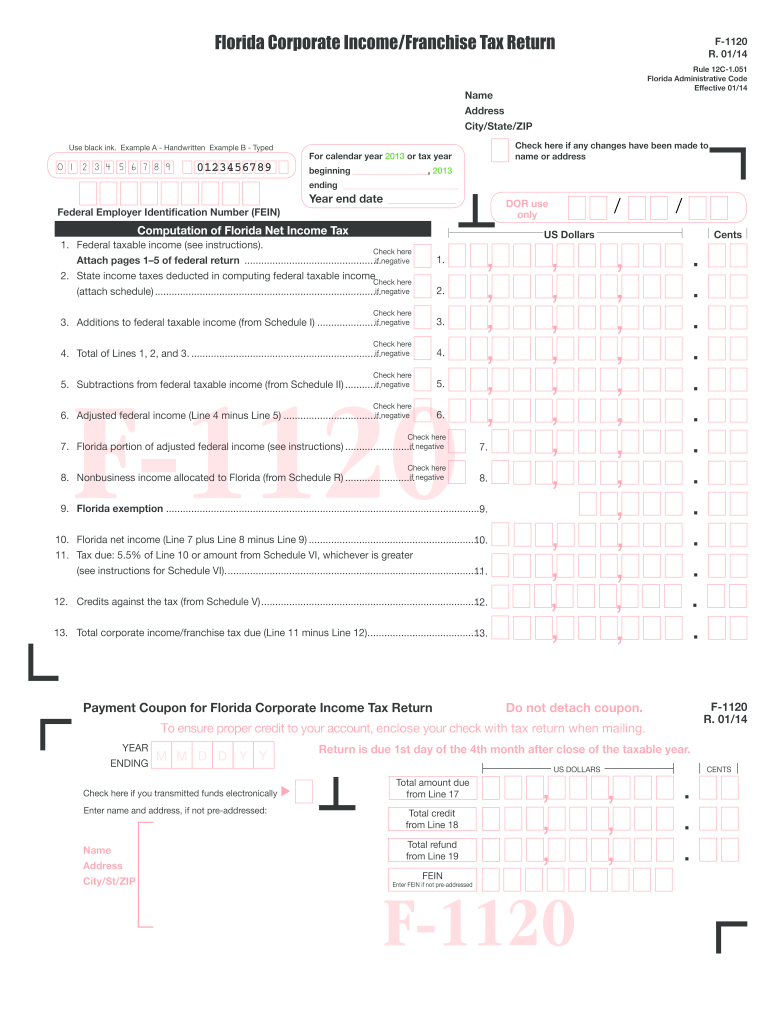

The F 1120 R 01 19 indd form is a specific tax document used by certain entities in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is particularly relevant for corporations and partnerships that are subject to federal income tax. It serves as a comprehensive overview of the entity's financial activities for the tax year, ensuring compliance with federal tax regulations.

How to use the F 1120 R 01 19 indd

Using the F 1120 R 01 19 indd form involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation for deductions and credits. Next, carefully complete each section of the form, ensuring that all figures are accurate and reflect the entity's financial status. After completing the form, review it for any errors or omissions before submission to the IRS.

Steps to complete the F 1120 R 01 19 indd

Completing the F 1120 R 01 19 indd form requires a systematic approach:

- Collect all relevant financial documents, including income and expense records.

- Fill out the identification section with the entity's name, address, and Employer Identification Number (EIN).

- Report total income, including all sources of revenue.

- Detail allowable deductions, ensuring to include all eligible expenses.

- Calculate the taxable income and any applicable credits.

- Sign and date the form, confirming the accuracy of the information provided.

Legal use of the F 1120 R 01 19 indd

The F 1120 R 01 19 indd form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, the form must be signed by an authorized representative of the entity. Additionally, it must be filed by the designated deadline to avoid penalties. Compliance with all IRS guidelines is essential to maintain the integrity of the submitted information.

Filing Deadlines / Important Dates

Filing deadlines for the F 1120 R 01 19 indd form are critical for compliance. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the entity's tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. Entities should also be aware of any extensions that may be available, which can provide additional time for submission.

Form Submission Methods (Online / Mail / In-Person)

The F 1120 R 01 19 indd form can be submitted through various methods to accommodate different preferences. Entities may choose to file electronically through the IRS e-file system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed directly to the IRS at the designated address based on the entity's location. In-person submission is generally not an option for tax forms, but entities can contact IRS offices for assistance if needed.

Quick guide on how to complete f 1120 r 01 19indd

Complete F 1120 R 01 19 indd seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle F 1120 R 01 19 indd on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign F 1120 R 01 19 indd effortlessly

- Locate F 1120 R 01 19 indd and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign F 1120 R 01 19 indd and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 1120 r 01 19indd

Create this form in 5 minutes!

How to create an eSignature for the f 1120 r 01 19indd

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is F 1120 R 01 19 indd used for?

The F 1120 R 01 19 indd form is typically utilized for corporate tax filings. Businesses often rely on airSlate SignNow to securely send and eSign this document, ensuring compliance and accuracy. Using our platform streamlines the submission process, saving time and resources.

-

How does airSlate SignNow simplify the F 1120 R 01 19 indd process?

With airSlate SignNow, you can easily create, edit, and send the F 1120 R 01 19 indd form. The platform enables users to add eSignature fields, making document signing straightforward and efficient. This user-friendly approach helps eliminate paperwork bottlenecks, enhancing overall productivity.

-

Is there a cost associated with using airSlate SignNow for F 1120 R 01 19 indd?

Yes, airSlate SignNow offers competitive pricing tailored to business needs. You can start with a free trial, allowing you to explore features related to F 1120 R 01 19 indd without an upfront commitment. Various pricing plans are available, catering to different sizes and requirements.

-

What features does airSlate SignNow offer for handling F 1120 R 01 19 indd?

Our platform offers an intuitive interface for managing the F 1120 R 01 19 indd forms, along with features like document templates, automated workflows, and secure cloud storage. These capabilities ensure that businesses can effortlessly handle all aspects from creation to signing. Advanced tracking features also keep you updated on document statuses.

-

Can I integrate airSlate SignNow with other software for F 1120 R 01 19 indd?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM systems, cloud storage solutions, and productivity tools. These integrations enhance the efficiency of managing the F 1120 R 01 19 indd form by allowing data synchronization and workflow automation across platforms.

-

What benefits does airSlate SignNow provide for businesses using F 1120 R 01 19 indd?

By using airSlate SignNow for the F 1120 R 01 19 indd form, businesses experience reduced processing times and increased accuracy in submissions. The ability to eSign documents eliminates the need for physical signatures, promoting a quicker turnaround. Ultimately, this enhances both client satisfaction and operational efficiency.

-

How secure is airSlate SignNow when handling F 1120 R 01 19 indd documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure access controls to protect your F 1120 R 01 19 indd forms and sensitive data. Regular audits and compliance with industry standards ensure a trustworthy environment for document management.

Get more for F 1120 R 01 19 indd

Find out other F 1120 R 01 19 indd

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template