Tangible Personal Property Tax Return R 1211 Confidential Miami Form 2018

What is the Tangible Personal Property Tax Return R 1211 Confidential Miami Form

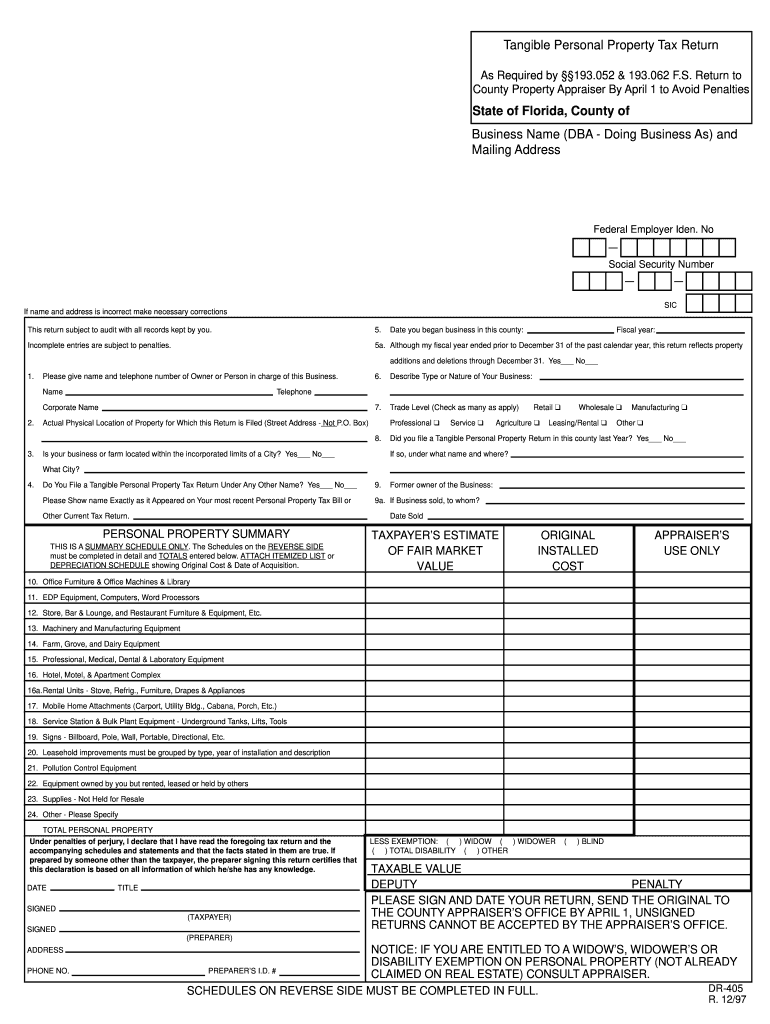

The Tangible Personal Property Tax Return R 1211 Confidential Miami Form is a document used by property owners in Miami-Dade County to report their tangible personal property for tax assessment purposes. This form is essential for ensuring that the property is accurately valued for taxation. Tangible personal property includes items such as machinery, equipment, and furniture that are not classified as real estate. Filing this form helps local authorities determine the appropriate tax liability for the property owner.

How to use the Tangible Personal Property Tax Return R 1211 Confidential Miami Form

Using the Tangible Personal Property Tax Return R 1211 Confidential Miami Form involves several steps. First, you need to gather all relevant information regarding your tangible personal property, including descriptions, values, and acquisition dates. Once you have this information, you can fill out the form either digitally or on paper. Ensure that all fields are completed accurately to avoid delays or penalties. After completing the form, submit it to the appropriate local tax authority, following the submission guidelines provided.

Steps to complete the Tangible Personal Property Tax Return R 1211 Confidential Miami Form

Completing the Tangible Personal Property Tax Return R 1211 Confidential Miami Form involves a systematic approach:

- Gather necessary documentation, including purchase receipts and previous tax returns.

- List all tangible personal property owned as of January first of the tax year.

- Provide accurate valuations for each item based on current market conditions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to the local tax authority.

Legal use of the Tangible Personal Property Tax Return R 1211 Confidential Miami Form

The legal use of the Tangible Personal Property Tax Return R 1211 Confidential Miami Form is governed by local tax laws. Filing this form is a legal requirement for property owners to report their tangible assets to the county. Failure to submit this form can result in penalties, including fines and increased tax assessments. It is crucial to adhere to the regulations set forth by the Miami-Dade County tax authority to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Tangible Personal Property Tax Return R 1211 Confidential Miami Form are typically set by the local tax authority. Generally, the form must be submitted by April first of each tax year. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties. Property owners should mark their calendars and prepare their documentation well in advance to ensure timely filing.

Required Documents

To complete the Tangible Personal Property Tax Return R 1211 Confidential Miami Form, property owners must provide several key documents:

- Purchase receipts or invoices for tangible personal property.

- Previous tax returns related to tangible personal property.

- Any relevant appraisals or valuations for the property.

- Documentation of any changes in ownership or property status.

Form Submission Methods

The Tangible Personal Property Tax Return R 1211 Confidential Miami Form can be submitted through various methods. Property owners may choose to file online using the local tax authority's website, which often provides a streamlined process. Alternatively, the form can be mailed to the appropriate office or submitted in person. It is recommended to verify the submission method that best suits your needs and to keep a copy of the submitted form for your records.

Quick guide on how to complete tangible personal property tax return r 1211 confidential miami 1997 form

Complete Tangible Personal Property Tax Return R 1211 Confidential Miami Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling users to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tangible Personal Property Tax Return R 1211 Confidential Miami Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Tangible Personal Property Tax Return R 1211 Confidential Miami Form with ease

- Obtain Tangible Personal Property Tax Return R 1211 Confidential Miami Form and then select Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign Tangible Personal Property Tax Return R 1211 Confidential Miami Form while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tangible personal property tax return r 1211 confidential miami 1997 form

Create this form in 5 minutes!

How to create an eSignature for the tangible personal property tax return r 1211 confidential miami 1997 form

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

The Tangible Personal Property Tax Return R 1211 Confidential Miami Form is a document used to report tangible personal property assets for tax purposes in Miami. This form helps ensure compliance with local tax laws, enabling accurate assessment and taxation of business assets.

-

How can the airSlate SignNow solution simplify filing the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

airSlate SignNow streamlines the process of filling out and submitting the Tangible Personal Property Tax Return R 1211 Confidential Miami Form by providing an easy-to-use platform for eSigning and document management. Users can effortlessly complete the form online and securely submit it, saving time and reducing errors.

-

What features does airSlate SignNow offer for completing the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

airSlate SignNow offers various features such as customizable templates, electronic signatures, and document tracking that enhance the process of completing the Tangible Personal Property Tax Return R 1211 Confidential Miami Form. These features ensure that users can manage their tax documents efficiently and with confidence.

-

Is the airSlate SignNow solution affordable for small businesses needing the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

Yes, airSlate SignNow is a cost-effective solution designed for businesses of all sizes. By offering competitive pricing plans, it enables small businesses to manage and eSign documents like the Tangible Personal Property Tax Return R 1211 Confidential Miami Form without breaking the bank.

-

What are the benefits of using airSlate SignNow for the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

Using airSlate SignNow for the Tangible Personal Property Tax Return R 1211 Confidential Miami Form provides several benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform greatly simplifies the eSigning process, allowing users to complete their tax returns quickly and securely.

-

Does airSlate SignNow integrate with other software for tax management related to the Tangible Personal Property Tax Return R 1211 Confidential Miami Form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This compatibility allows users to effortlessly incorporate their filing of the Tangible Personal Property Tax Return R 1211 Confidential Miami Form while maintaining a cohesive workflow.

-

Can I store my completed Tangible Personal Property Tax Return R 1211 Confidential Miami Form securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure storage options for all completed documents, including the Tangible Personal Property Tax Return R 1211 Confidential Miami Form. With robust data encryption measures, users can rest assured that their sensitive information is protected.

Get more for Tangible Personal Property Tax Return R 1211 Confidential Miami Form

Find out other Tangible Personal Property Tax Return R 1211 Confidential Miami Form

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form