Georgia Form Tax 2016

What is the Georgia Form Tax

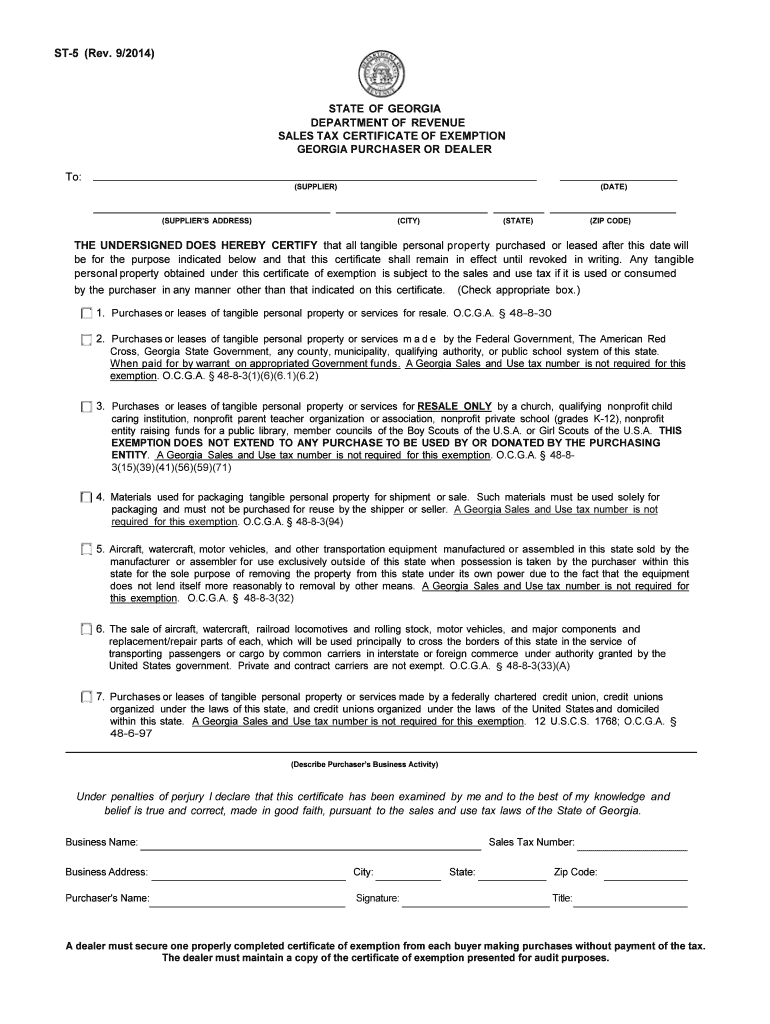

The Georgia Form Tax is a crucial document used by residents and businesses in Georgia to report their income and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws and is part of the broader tax filing process. It collects information on income, deductions, and credits that are applicable under Georgia tax regulations. Understanding this form is vital for accurate tax reporting and minimizing potential penalties.

How to obtain the Georgia Form Tax

The Georgia Form Tax can be obtained through several methods. Individuals can access the form directly from the Georgia Department of Revenue's official website, where it is available for download in PDF format. Additionally, taxpayers may request a physical copy by contacting their local tax office. It is advisable to ensure that you are using the most current version of the form to avoid any discrepancies during filing.

Steps to complete the Georgia Form Tax

Completing the Georgia Form Tax involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submitting it according to the filing instructions provided.

Legal use of the Georgia Form Tax

The legal use of the Georgia Form Tax is governed by state tax laws, which require accurate reporting of income and compliance with filing deadlines. Submitting this form is a legal obligation for residents and businesses earning income in Georgia. Failure to file or inaccuracies in the form can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia Form Tax are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any extensions that may be available and the specific dates associated with them to avoid late filing penalties.

Required Documents

When completing the Georgia Form Tax, several documents are required to ensure accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the completion of the form and help ensure compliance with state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Georgia Form Tax can be submitted through various methods to accommodate different preferences. Taxpayers can file online through the Georgia Department of Revenue's e-filing system, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate tax office, ensuring it is postmarked by the filing deadline. For those who prefer in-person submissions, visiting a local tax office is also an option, allowing for immediate assistance if needed.

Quick guide on how to complete 2014 georgia form tax

Effortlessly Complete Georgia Form Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Georgia Form Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Georgia Form Tax with Ease

- Find Georgia Form Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Georgia Form Tax and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 georgia form tax

Create this form in 5 minutes!

How to create an eSignature for the 2014 georgia form tax

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Georgia Form Tax and how can airSlate SignNow assist with it?

Georgia Form Tax refers to the specific tax forms used in the state of Georgia. airSlate SignNow simplifies the process by allowing users to electronically sign, send, and manage these forms efficiently. With our user-friendly platform, businesses can ensure all their tax documentation is completed accurately and on time.

-

How much does airSlate SignNow cost for managing Georgia Form Tax?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. With our cost-effective solution, you can manage Georgia Form Tax without overspending, ensuring that your budget remains intact while accessing essential document management features.

-

What features does airSlate SignNow offer for Georgia Form Tax processing?

Our platform includes features such as eSignature capabilities, customizable templates, and the ability to store documents securely. Additionally, airSlate SignNow provides tools that streamline the completion and submission of Georgia Form Tax, making the entire process more efficient for users.

-

Can I integrate airSlate SignNow with other software for Georgia Form Tax?

Yes, airSlate SignNow seamlessly integrates with various software applications, including accounting and tax software. This capability allows businesses to manage their Georgia Form Tax more effectively by syncing data across platforms, reducing the likelihood of errors and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Georgia Form Tax documentation?

Using airSlate SignNow for Georgia Form Tax documentation provides several benefits, such as faster processing times and enhanced accuracy. Additionally, our platform helps reduce the reliance on paper documents, which can be time-consuming and cumbersome to handle, ultimately leading to a more streamlined tax filing experience.

-

Is airSlate SignNow secure for handling sensitive Georgia Form Tax information?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect sensitive Georgia Form Tax information. With features such as encryption, secure storage, and user authentication, businesses can trust that their data is handled safely and securely.

-

How can airSlate SignNow enhance my remote work process for Georgia Form Tax?

airSlate SignNow enhances remote work by allowing teams to collaborate easily on Georgia Form Tax documentation from anywhere. With features like electronic signatures and document sharing, users can complete and submit tax forms without being physically present, making remote work seamless and efficient.

Get more for Georgia Form Tax

- For state and local government employees etf wisconsin form

- How to claim potential private retirement benefit form

- The secret language of relationships pdf online form

- Uniform issue form template excel

- Writing equations worksheet pdf form

- Tadi loans whatsapp number form

- T table pdf form

- State of florida job application fillable form

Find out other Georgia Form Tax

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form