XI 18 D Sales and Compensating Use Tax Documentation 2015

What is the XI 18 D Sales And Compensating Use Tax Documentation

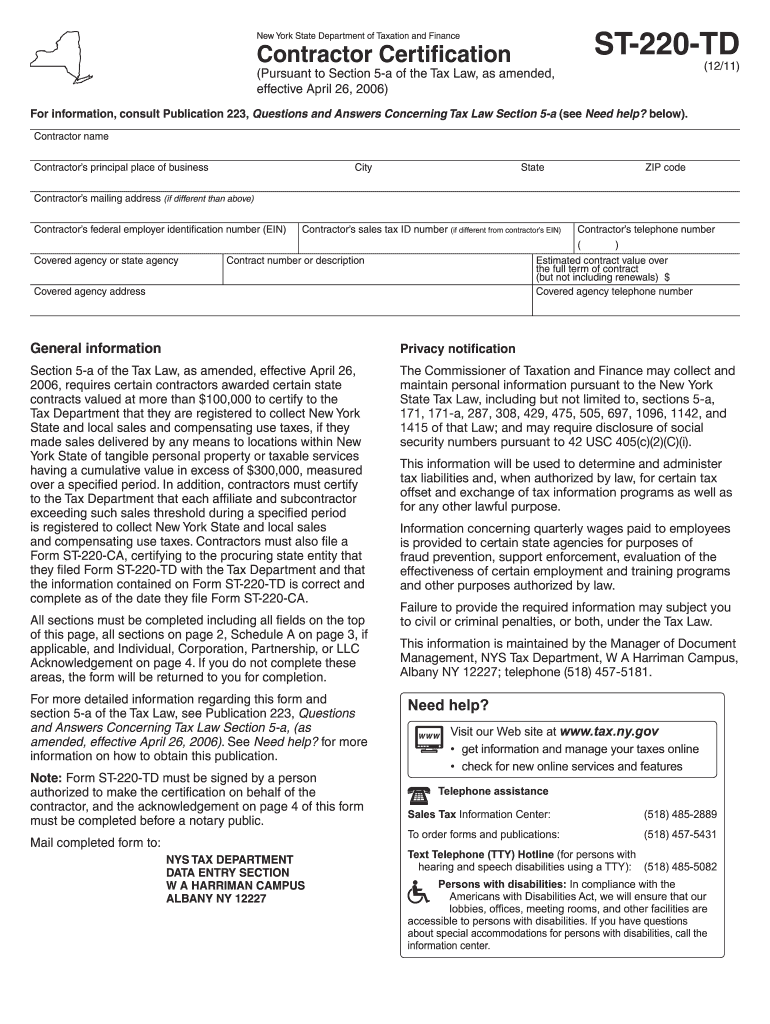

The XI 18 D Sales And Compensating Use Tax Documentation is a specific form used to report and document sales and compensating use taxes in the United States. This form is essential for businesses that engage in taxable sales or purchases, ensuring compliance with state tax regulations. It provides a structured way to declare sales tax collected from customers and compensating use tax owed on purchases made without payment of sales tax. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the XI 18 D Sales And Compensating Use Tax Documentation

Using the XI 18 D Sales And Compensating Use Tax Documentation involves several steps. First, gather all relevant sales and purchase records for the reporting period. This includes invoices, receipts, and any documentation related to tax-exempt sales. Next, accurately fill out the form by entering the total sales tax collected and the compensating use tax owed. It is important to ensure that all figures are correct to prevent discrepancies. Once completed, the form can be submitted to the appropriate state tax authority, either electronically or through traditional mail.

Steps to complete the XI 18 D Sales And Compensating Use Tax Documentation

Completing the XI 18 D Sales And Compensating Use Tax Documentation requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary documentation, including sales records and purchase invoices.

- Determine the total amount of sales tax collected during the reporting period.

- Calculate any compensating use tax owed for purchases made without sales tax.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate state tax authority by the specified deadline.

Legal use of the XI 18 D Sales And Compensating Use Tax Documentation

The legal use of the XI 18 D Sales And Compensating Use Tax Documentation is governed by state tax laws. This form serves as a formal declaration of sales and use taxes, making it a critical document for compliance. When filled out correctly, it provides legal protection for businesses against audits or disputes regarding tax obligations. It is important to keep copies of submitted forms and related documentation for record-keeping and potential future reference.

Key elements of the XI 18 D Sales And Compensating Use Tax Documentation

Several key elements must be included in the XI 18 D Sales And Compensating Use Tax Documentation to ensure its validity:

- Taxpayer Information: Name, address, and tax identification number of the business.

- Sales Tax Collected: Total amount of sales tax collected from customers.

- Compensating Use Tax Owed: Total amount of compensating use tax for taxable purchases.

- Reporting Period: The specific time frame for which the taxes are being reported.

- Signature: Authorized signature confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the XI 18 D Sales And Compensating Use Tax Documentation vary by state. It is essential to be aware of these deadlines to avoid late fees or penalties. Most states require this form to be filed on a monthly, quarterly, or annual basis, depending on the volume of sales. Mark your calendar with the relevant dates for your state to ensure timely submission and compliance with tax regulations.

Quick guide on how to complete xi18d sales and compensating use tax documentation

Complete XI 18 D Sales And Compensating Use Tax Documentation seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage XI 18 D Sales And Compensating Use Tax Documentation on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign XI 18 D Sales And Compensating Use Tax Documentation effortlessly

- Find XI 18 D Sales And Compensating Use Tax Documentation and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign XI 18 D Sales And Compensating Use Tax Documentation and ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the xi18d sales and compensating use tax documentation

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is XI 18 D Sales And Compensating Use Tax Documentation?

XI 18 D Sales And Compensating Use Tax Documentation refers to the necessary paperwork and guidelines for accurately assessing and documenting sales and use taxes for specific transactions. Understanding this documentation is crucial for compliance and financial tracking. Our platform simplifies this process, enabling users to easily manage and send such documents.

-

How does airSlate SignNow help with XI 18 D Sales And Compensating Use Tax Documentation?

airSlate SignNow streamlines the XI 18 D Sales And Compensating Use Tax Documentation process by providing customizable templates and eSignature capabilities. Users can quickly prepare, send, and sign necessary documents, ensuring they are prepared for audits or compliance reviews. This efficiency reduces the time spent on administrative tasks.

-

What features does airSlate SignNow offer for managing tax documentation?

With airSlate SignNow, users can access advanced features for managing XI 18 D Sales And Compensating Use Tax Documentation, including automated workflows, document templates, and real-time tracking of signatures. These tools enhance collaboration and ensure that all parties are informed throughout the documentation process. Additionally, documents are securely stored for future reference.

-

Is airSlate SignNow cost-effective for managing tax documentation?

Yes, airSlate SignNow is a cost-effective solution for managing XI 18 D Sales And Compensating Use Tax Documentation. Our flexible pricing plans cater to businesses of all sizes, allowing them to choose a plan that best fits their needs without sacrificing essential features. This affordability makes it an attractive option for organizations looking to optimize their documentation processes.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers seamless integrations with various popular accounting and tax management software, helping businesses handle their XI 18 D Sales And Compensating Use Tax Documentation effectively. This connectivity allows for automatic data transfer and reduces the risk of errors, making tax management more efficient.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive XI 18 D Sales And Compensating Use Tax Documentation. Our platform employs state-of-the-art encryption and compliance with industry standards to protect your documents. Users can trust that their data is safe and secure while leveraging our eSignature services.

-

What types of businesses can benefit from airSlate SignNow for tax documentation?

Any business dealing with sales and compensating use tax can benefit from using airSlate SignNow for XI 18 D Sales And Compensating Use Tax Documentation. This includes retailers, service providers, and eCommerce businesses. Our platform is designed to meet the needs of diverse industries, providing them with an efficient way to manage their tax paperwork.

Get more for XI 18 D Sales And Compensating Use Tax Documentation

- Fha real estate certification form

- Sprint com esign 5463958 form

- Past continuous tense story pdf form

- Oakview vet form

- Surrender indian passport in canada form

- Domicile letter form

- Non collusive bidding certification required bysection 139 d of the state finance law form

- Az public school enrollment verification form

Find out other XI 18 D Sales And Compensating Use Tax Documentation

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form