Nys Sales Tax Form Dtf 17 R 2010

What is the Nys Sales Tax Form Dtf 17 R

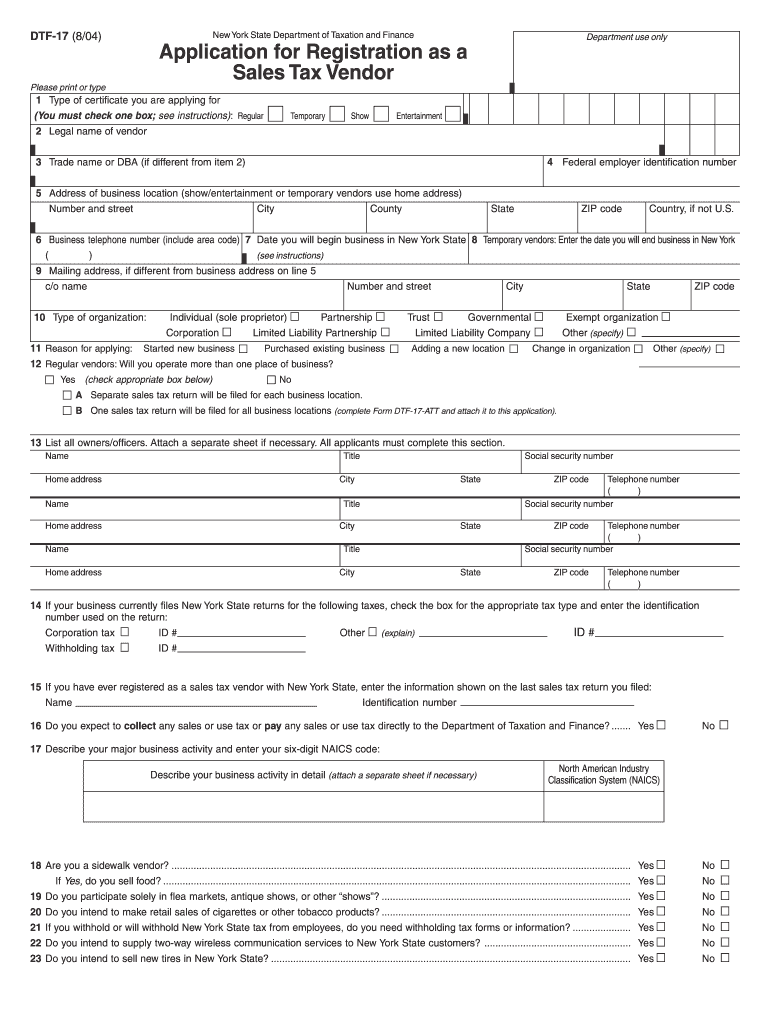

The Nys Sales Tax Form Dtf 17 R is an official document used in New York State for claiming a refund of sales tax paid on certain purchases. This form is essential for businesses and individuals who have overpaid sales tax or have made exempt purchases. It allows taxpayers to request a refund from the New York State Department of Taxation and Finance. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for recovering any excess taxes paid.

How to use the Nys Sales Tax Form Dtf 17 R

Using the Nys Sales Tax Form Dtf 17 R involves several steps to ensure accurate completion and submission. First, gather all relevant documentation that supports your claim for a refund, such as receipts and invoices. Next, fill out the form with the required information, including your name, address, and details of the sales tax paid. Be sure to provide a clear explanation of the reason for the refund request. After completing the form, review it for accuracy before submitting it to the appropriate state department.

Steps to complete the Nys Sales Tax Form Dtf 17 R

Completing the Nys Sales Tax Form Dtf 17 R requires careful attention to detail. Follow these steps:

- Obtain the form from the New York State Department of Taxation and Finance website or by visiting a local office.

- Fill in your personal information, including your taxpayer identification number.

- Detail the sales tax amounts you are claiming for a refund, ensuring you include the correct figures.

- Attach any supporting documents, such as receipts or proof of payment.

- Review the completed form for accuracy and completeness.

- Submit the form via the preferred method: online, by mail, or in person.

Legal use of the Nys Sales Tax Form Dtf 17 R

The legal use of the Nys Sales Tax Form Dtf 17 R is governed by New York State tax laws. To be considered valid, the form must be completed accurately and submitted within the specified time frame. It is important to ensure that all claims for refunds are legitimate and supported by appropriate documentation. Misuse of the form or submission of false information can lead to penalties, including fines or legal action.

Form Submission Methods (Online / Mail / In-Person)

The Nys Sales Tax Form Dtf 17 R can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online: Submit the form electronically through the New York State Department of Taxation and Finance's online portal.

- Mail: Print the completed form and send it to the designated address provided on the form.

- In-Person: Deliver the form directly to a local office of the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Sales Tax Form Dtf 17 R are critical to ensure timely processing of refund requests. Generally, taxpayers should submit the form within three years from the date of the original purchase or payment of sales tax. It is advisable to stay updated on any changes to deadlines or requirements by checking the New York State Department of Taxation and Finance’s official announcements.

Quick guide on how to complete nys sales tax form dtf 17 r 2004

Easily prepare Nys Sales Tax Form Dtf 17 R on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly option to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Nys Sales Tax Form Dtf 17 R on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Nys Sales Tax Form Dtf 17 R effortlessly

- Find Nys Sales Tax Form Dtf 17 R and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark signNow parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nys Sales Tax Form Dtf 17 R to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys sales tax form dtf 17 r 2004

Create this form in 5 minutes!

How to create an eSignature for the nys sales tax form dtf 17 r 2004

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Nys Sales Tax Form Dtf 17 R?

The Nys Sales Tax Form Dtf 17 R is a document required by businesses in New York to report and pay sales tax. It is essential for maintaining compliance with state tax regulations. Using airSlate SignNow makes it easy to fill out and eSign this form securely.

-

How can I complete the Nys Sales Tax Form Dtf 17 R using airSlate SignNow?

To complete the Nys Sales Tax Form Dtf 17 R with airSlate SignNow, simply upload the form to our platform. You can then fill in the required fields and utilize our eSigning feature to ensure a valid submission. This streamlines your filing process and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the Nys Sales Tax Form Dtf 17 R?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing packages are flexible and cater to various needs, allowing you to efficiently manage forms like the Nys Sales Tax Form Dtf 17 R without breaking the bank.

-

What are the benefits of using airSlate SignNow for tax forms like the Nys Sales Tax Form Dtf 17 R?

By using airSlate SignNow for your tax forms, including the Nys Sales Tax Form Dtf 17 R, you can enhance accuracy and reduce processing time. Our platform provides a user-friendly interface, enables tracking of document status, and ensures compliance with eSignature laws, benefiting your business operations.

-

Does airSlate SignNow offer integrations for filing the Nys Sales Tax Form Dtf 17 R?

Yes, airSlate SignNow offers integrations with various accounting and tax software solutions that make it easier to file the Nys Sales Tax Form Dtf 17 R. These integrations simplify the data entry process, allowing for seamless transfer of information between platforms.

-

Can I save my information for future use when completing the Nys Sales Tax Form Dtf 17 R on airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your information securely for future use. This feature enables you to efficiently reuse your details when completing tax forms like the Nys Sales Tax Form Dtf 17 R again, saving time and effort in subsequent filings.

-

How secure is the submission of the Nys Sales Tax Form Dtf 17 R via airSlate SignNow?

The security of your documents, including the Nys Sales Tax Form Dtf 17 R, is our top priority at airSlate SignNow. We implement industry-leading encryption protocols and offer secure access controls to ensure that your information remains protected throughout the submission process.

Get more for Nys Sales Tax Form Dtf 17 R

Find out other Nys Sales Tax Form Dtf 17 R

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement