it 203 D Form 2017-2026

What is the It 203 D Form

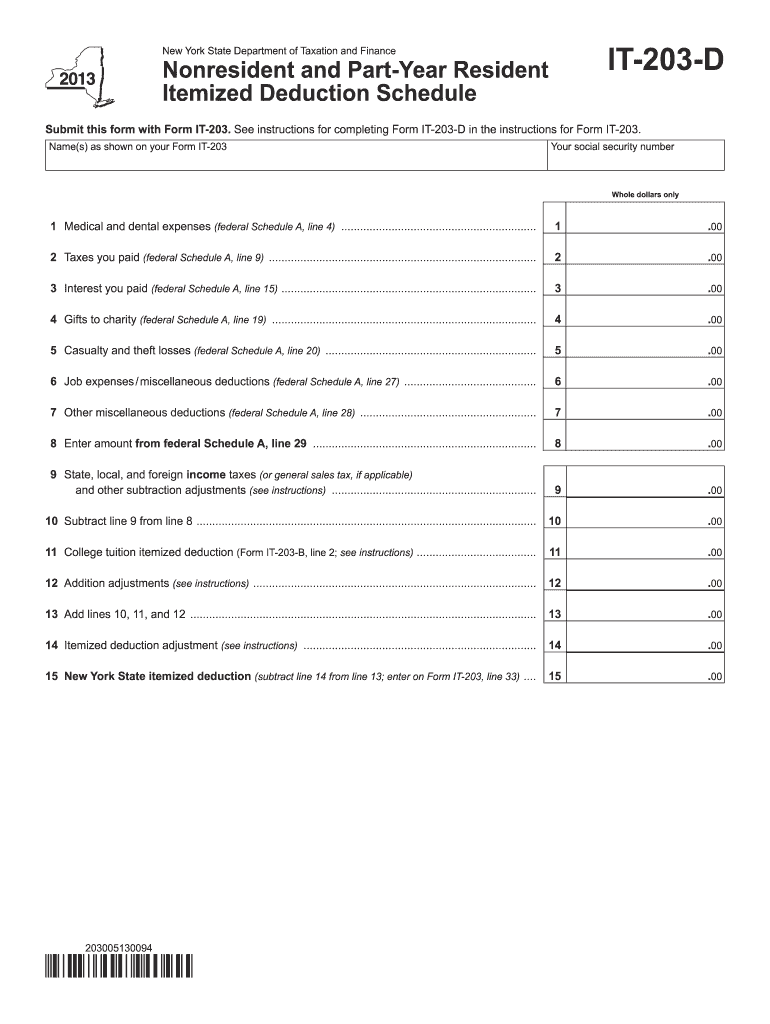

The It 203 D Form is a tax document used in the State of New York, specifically designed for non-residents and part-year residents to report income earned within the state. This form allows individuals to calculate their New York State tax liability based on their earnings while residing outside of New York for part of the year or not residing there at all. It is essential for ensuring compliance with state tax regulations and for accurately determining the amount of tax owed or refunded.

How to use the It 203 D Form

To effectively use the It 203 D Form, individuals should first gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. The form requires detailed information about income earned in New York, as well as personal identification information. After completing the form, it should be submitted to the New York State Department of Taxation and Finance either electronically or by mail, depending on the preferred submission method.

Steps to complete the It 203 D Form

Completing the It 203 D Form involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Fill out personal identification information, including your name, address, and Social Security number.

- Report your total income earned in New York State.

- Calculate any deductions or credits you may qualify for.

- Determine your total tax liability based on the provided instructions.

- Review the form for accuracy before submission.

Legal use of the It 203 D Form

The It 203 D Form is legally binding when completed accurately and submitted in compliance with New York State tax laws. It is crucial for individuals to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed by the designated deadline to avoid any late fees or additional charges.

Filing Deadlines / Important Dates

Filing deadlines for the It 203 D Form typically align with the federal tax filing dates. Generally, the form must be submitted by April fifteenth of the year following the tax year in question. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these dates each tax year.

Required Documents

When completing the It 203 D Form, individuals must provide several key documents to support their income claims. Required documents typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Proof of residency status, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The It 203 D Form can be submitted through various methods to accommodate different preferences. Individuals may choose to file electronically using the New York State Department of Taxation and Finance online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, or in certain cases, submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your situation.

Quick guide on how to complete 2013 it 203 d form

Compile It 203 D Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage It 203 D Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign It 203 D Form with ease

- Find It 203 D Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Recheck the information and then click the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign It 203 D Form and guarantee effective communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 it 203 d form

Create this form in 5 minutes!

How to create an eSignature for the 2013 it 203 d form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the It 203 D Form and why is it important?

The It 203 D Form is a crucial document used for tax purposes in New York State. It allows taxpayers to claim credits for their investments in certain qualified facilities. Understanding how to properly fill out and submit the It 203 D Form can help ensure you maximize your tax benefits.

-

How can airSlate SignNow help with the It 203 D Form?

airSlate SignNow simplifies the process of completing the It 203 D Form by allowing users to fill, sign, and send documents seamlessly. Its user-friendly interface ensures that important tax documents like the It 203 D Form can be managed efficiently. You can securely store and retrieve your forms, making tax season stress-free.

-

Is there a cost associated with using airSlate SignNow for the It 203 D Form?

airSlate SignNow offers a range of pricing plans that cater to various business needs, making it a cost-effective solution for managing documents, including the It 203 D Form. You can choose a plan that suits your requirements, and there may even be free trial options available to explore the platform before committing.

-

What features does airSlate SignNow provide for managing the It 203 D Form?

airSlate SignNow includes features such as document templates, electronic signatures, secure sharing options, and cloud storage, streamlining the handling of the It 203 D Form. These features ensure that your documents are not only easy to manage but also secure. Additionally, the platform allows real-time collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for the It 203 D Form?

Yes, airSlate SignNow supports integration with various applications that can enhance your workflow when dealing with the It 203 D Form. These integrations may include popular CRM systems, cloud storage services, and productivity tools. Connecting your essential applications can improve efficiency in managing your tax-related documentation.

-

What are the benefits of using airSlate SignNow over traditional methods for the It 203 D Form?

Using airSlate SignNow for your It 203 D Form offers several advantages over traditional methods, such as faster processing times and reduced paper usage. The electronic signature feature eliminates the need for printing and scanning, making the filing process much simpler. Additionally, you'll have easier access to your documents anytime, anywhere.

-

Is airSlate SignNow secure for submitting the It 203 D Form?

airSlate SignNow takes security seriously, implementing advanced encryption and secure data storage to protect your information while handling the It 203 D Form. They comply with industry standards to ensure that your data remains confidential and secure. Users can confidently submit sensitive documents without worrying about data bsignNowes.

Get more for It 203 D Form

- Homestead exemption bexar county form

- Tenant pre screening form pdf

- Contrato para eventos form

- Linear equations in one variable worksheet form

- Bsnl rule 8 transfer form pdf

- Zip hydrotap service manual form

- Technetprofessional com claim form

- Www nysed govoasoffice of audit servicesnew york state education department form

Find out other It 203 D Form

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement