Current Nys Form Ft 500 2011

What is the Current Nys Form Ft 500

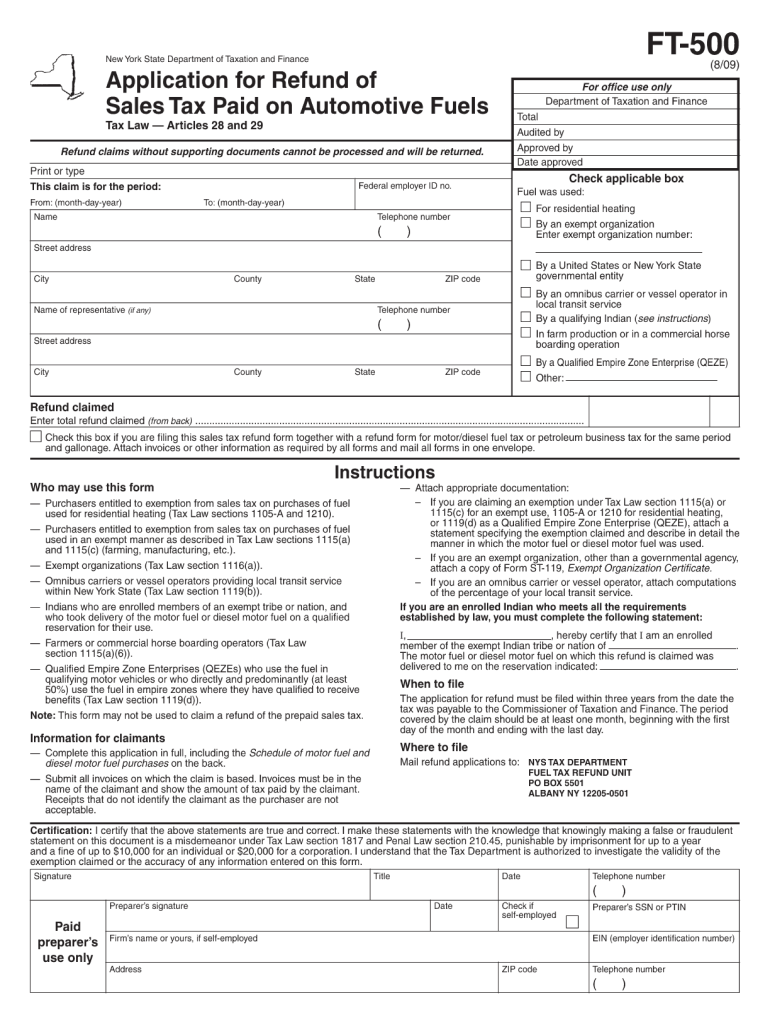

The Current Nys Form Ft 500 is a tax form used by businesses operating in New York State. It is primarily designed for corporations to report their franchise tax liability. This form plays a crucial role in ensuring compliance with state tax laws and helps determine the amount of tax owed based on the corporation's income and other relevant factors. Understanding the specifics of this form is essential for accurate tax reporting and compliance.

How to use the Current Nys Form Ft 500

Using the Current Nys Form Ft 500 involves several steps. First, gather all necessary financial documents that reflect the corporation's income, deductions, and credits. Next, accurately fill out the form by providing the required information, including business identification details and financial data. Once completed, the form can be submitted either electronically or via mail, depending on the chosen submission method. It is important to ensure that all information is accurate to avoid penalties.

Steps to complete the Current Nys Form Ft 500

Completing the Current Nys Form Ft 500 requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary financial records, including income statements and balance sheets.

- Provide your corporation's name, address, and identification number at the top of the form.

- Fill in the income and deduction sections accurately, ensuring all figures are correct.

- Calculate the tax owed based on the provided information.

- Review the form for any errors or omissions before submission.

Legal use of the Current Nys Form Ft 500

The Current Nys Form Ft 500 is legally binding when completed and submitted according to New York State tax regulations. To ensure its legal validity, it must be filled out accurately and submitted by the designated deadline. Compliance with all relevant tax laws is essential to avoid potential penalties or legal issues. The form must also be signed by an authorized representative of the corporation, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Current Nys Form Ft 500 are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Current Nys Form Ft 500 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many corporations choose to file electronically through the New York State Department of Taxation and Finance website.

- Mail: The form can be printed and mailed to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-Person: Some businesses may opt to deliver the form in person to their local tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete current nys form ft 500 2009

Complete Current Nys Form Ft 500 easily on any device

Digital document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without any delays. Manage Current Nys Form Ft 500 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Current Nys Form Ft 500 effortlessly

- Locate Current Nys Form Ft 500 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Current Nys Form Ft 500 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the current nys form ft 500 2009

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Current Nys Form Ft 500?

The Current Nys Form Ft 500 is a tax form used by businesses to report various financial details to the New York State Department of Taxation and Finance. It captures essential information regarding entity income and deductions, ensuring compliance with state tax regulations. Utilizing tools like airSlate SignNow can simplify the process of filling out and submitting the Current Nys Form Ft 500.

-

How can airSlate SignNow help with the Current Nys Form Ft 500?

airSlate SignNow provides an intuitive platform for businesses to eSign and send the Current Nys Form Ft 500 effortlessly. With its user-friendly interface, users can complete the form, obtain necessary signatures, and submit it with confidence. The platform ensures that the process is secure and efficient, helping you meet tax deadlines.

-

Is there a cost associated with using airSlate SignNow for the Current Nys Form Ft 500?

Yes, airSlate SignNow operates on a subscription model, offering various plans tailored to fit different business needs. Pricing can be competitive, allowing small to large enterprises to benefit from a streamlined process for managing the Current Nys Form Ft 500. Investing in SignNow can save time and reduce the hassle of manual paperwork.

-

What features does airSlate SignNow offer for managing the Current Nys Form Ft 500?

airSlate SignNow offers a range of features to enhance the management of the Current Nys Form Ft 500, including customizable templates, automated workflows, and tracking capabilities. These features allow users to create, edit, and obtain signatures securely, ensuring that all submissions are accurate and timely. The platform's integration with various applications also enhances functionality.

-

Are there any integrations available with airSlate SignNow for filing the Current Nys Form Ft 500?

airSlate SignNow supports numerous integrations with popular business tools, enabling users to streamline their workflow when dealing with the Current Nys Form Ft 500. From CRM systems to cloud storage solutions, these integrations help simplify document management and collaboration, making the filing process more efficient.

-

What are the benefits of using airSlate SignNow for the Current Nys Form Ft 500?

Using airSlate SignNow for the Current Nys Form Ft 500 offers numerous benefits, including increased efficiency and improved accuracy in document handling. The platform minimizes the risks of lost paperwork and facilitates faster approvals, which is crucial during tax season. Additionally, the eSigning feature enhances security and compliance when submitting important tax documents.

-

Can airSlate SignNow ensure compliance while submitting the Current Nys Form Ft 500?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that users can submit the Current Nys Form Ft 500 safely and securely. With advanced encryption and audit trails, the platform provides an added layer of security, ensuring that your submissions meet legal standards. This helps businesses maintain compliance and avoid potential penalties.

Get more for Current Nys Form Ft 500

Find out other Current Nys Form Ft 500

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template