Form DTF 17 1 Tax Ny 2016

What is the Form DTF 17 1 Tax Ny

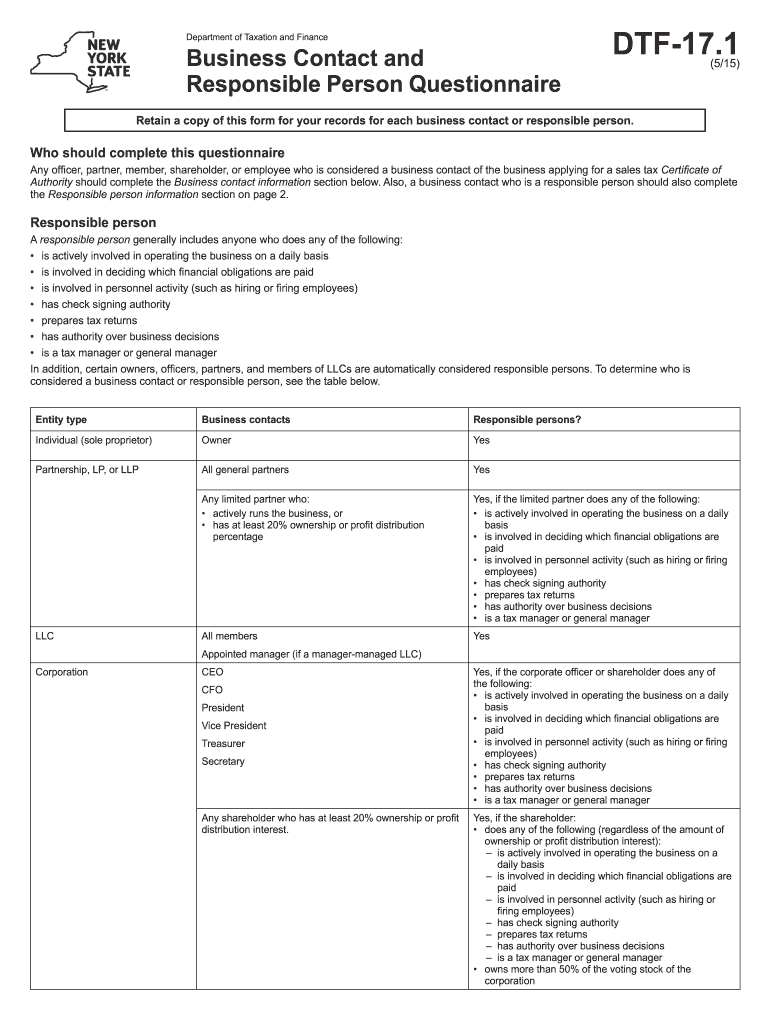

The Form DTF 17 1 Tax Ny is a tax document used in New York State for various tax-related purposes. This form is typically utilized by individuals and businesses to report specific tax information to the New York State Department of Taxation and Finance. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax laws.

How to use the Form DTF 17 1 Tax Ny

Using the Form DTF 17 1 Tax Ny involves several steps to ensure accurate completion. First, gather all necessary financial documents and information relevant to your tax situation. Next, fill out the form with the required details, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is important to follow any specific instructions provided by the New York State Department of Taxation and Finance to avoid delays or issues with your tax filing.

Steps to complete the Form DTF 17 1 Tax Ny

Completing the Form DTF 17 1 Tax Ny requires careful attention to detail. Here are the steps to follow:

- Gather all relevant tax documents, including income statements and deduction records.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Provide details regarding your income, deductions, and any applicable credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, as required.

Legal use of the Form DTF 17 1 Tax Ny

The legal use of the Form DTF 17 1 Tax Ny is governed by New York State tax laws. This form must be completed accurately and submitted on time to comply with state regulations. Failure to use the form correctly may result in penalties, including fines or additional taxes owed. It is crucial to understand the legal implications of submitting this form, ensuring that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form DTF 17 1 Tax Ny vary depending on the tax year and the specific circumstances of the taxpayer. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. It is important to stay informed about any changes to deadlines or important dates announced by the New York State Department of Taxation and Finance to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form DTF 17 1 Tax Ny can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate address specified on the form.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete form dtf 171 tax ny

Complete Form DTF 17 1 Tax Ny effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and easily. Manage Form DTF 17 1 Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form DTF 17 1 Tax Ny without hassle

- Find Form DTF 17 1 Tax Ny and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious document searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Form DTF 17 1 Tax Ny and maintain effective communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dtf 171 tax ny

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form DTF 17 1 Tax Ny?

Form DTF 17 1 Tax Ny is a New York State tax form that businesses use to claim a tax credit for certain qualifying payments. Completing this form accurately is essential for ensuring that your business can take advantage of available tax benefits. Utilizing airSlate SignNow makes filling out and submitting Form DTF 17 1 Tax Ny efficient and straightforward.

-

How can airSlate SignNow help with Form DTF 17 1 Tax Ny?

airSlate SignNow simplifies the process of completing and eSigning Form DTF 17 1 Tax Ny. Our platform allows you to fill out the form electronically, ensuring all necessary fields are completed accurately. Additionally, you can securely send and receive the signed document, streamlining your tax operations.

-

What are the pricing options for using airSlate SignNow to manage Form DTF 17 1 Tax Ny?

airSlate SignNow offers a variety of pricing plans tailored to meet the diverse needs of businesses. Depending on your requirements, you can choose a plan that offers essential features for managing forms like Form DTF 17 1 Tax Ny effectively. There is also a free trial available for you to explore our features before committing.

-

Is airSlate SignNow suitable for small businesses needing to file Form DTF 17 1 Tax Ny?

Yes, airSlate SignNow is an ideal solution for small businesses looking to manage Form DTF 17 1 Tax Ny efficiently. Our platform is designed to be user-friendly and cost-effective, making it accessible for businesses of all sizes. You'll benefit from features that simplify the signing and submission process without breaking the bank.

-

Are there any integrations available for airSlate SignNow when handling Form DTF 17 1 Tax Ny?

airSlate SignNow offers seamless integrations with various business tools and software for managing workflows. These integrations allow you to connect your tax preparation tools or accounting software with airSlate SignNow, ensuring that Form DTF 17 1 Tax Ny is processed smoothly. This interoperability enhances productivity and reduces the chances of errors.

-

Can I store completed copies of Form DTF 17 1 Tax Ny with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your completed documents, including Form DTF 17 1 Tax Ny. You can easily access and retrieve your forms whenever needed, ensuring that your records are organized and secure. This feature helps maintain compliance and makes future reference straightforward.

-

How does airSlate SignNow ensure the security of Form DTF 17 1 Tax Ny submissions?

airSlate SignNow prioritizes your security by utilizing advanced encryption protocols to safeguard your data during the transmission and storage of forms like Form DTF 17 1 Tax Ny. Our platform complies with industry standards for document security, giving you peace of mind as you handle sensitive tax information. You can trust us to keep your information safe.

Get more for Form DTF 17 1 Tax Ny

Find out other Form DTF 17 1 Tax Ny

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile