Ohio Amended Return Form 2014

What is the Ohio Amended Return Form

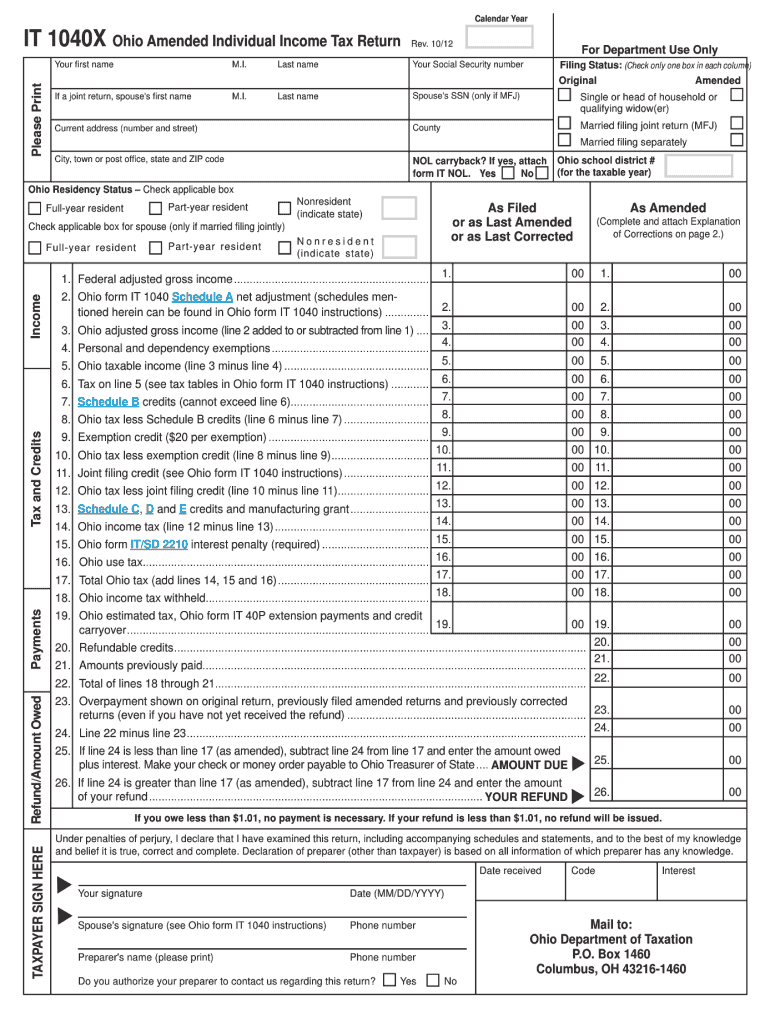

The Ohio Amended Return Form is a tax document used by individuals and businesses to correct errors or make changes to previously filed Ohio income tax returns. This form allows taxpayers to adjust their income, deductions, credits, or filing status. It is essential for ensuring that the tax records are accurate and reflect the correct financial situation of the taxpayer.

How to use the Ohio Amended Return Form

Using the Ohio Amended Return Form involves several steps to ensure accuracy and compliance with state tax regulations. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes. Next, fill out the amended return form, clearly indicating the corrections made. Be sure to provide explanations for the changes in the designated section. Finally, submit the completed form to the appropriate Ohio tax authority, either online or via mail.

Steps to complete the Ohio Amended Return Form

Completing the Ohio Amended Return Form requires careful attention to detail. Follow these steps for successful submission:

- Review your original tax return to identify errors or necessary changes.

- Obtain the Ohio Amended Return Form from the Ohio Department of Taxation website or authorized sources.

- Fill out the form, ensuring all information is accurate and complete.

- Provide explanations for any changes made in the designated section.

- Double-check all entries for accuracy before submission.

- Submit the form to the Ohio Department of Taxation by the specified deadline.

Legal use of the Ohio Amended Return Form

The Ohio Amended Return Form is legally recognized as a valid document for amending tax returns. To ensure its legal standing, it must be filled out accurately and submitted in accordance with Ohio tax laws. This form is crucial for maintaining compliance and avoiding penalties associated with incorrect tax filings.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Ohio Amended Return Form. Generally, amended returns should be filed within three years from the original due date of the tax return. Specific deadlines may vary based on individual circumstances, so it is advisable to check the Ohio Department of Taxation’s website for the most current information.

Form Submission Methods

The Ohio Amended Return Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Ohio Department of Taxation’s e-filing system.

- Mailing a paper copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Required Documents

When completing the Ohio Amended Return Form, certain documents may be required to support the changes being made. These documents can include:

- Copy of the original tax return.

- Documentation for any additional income or deductions.

- Supporting schedules or forms related to the changes.

Quick guide on how to complete 2012 ohio amended return form

Complete Ohio Amended Return Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct version and securely store it on the internet. airSlate SignNow offers you all the resources you require to create, edit, and eSign your documents swiftly without any holdups. Handle Ohio Amended Return Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Ohio Amended Return Form with ease

- Locate Ohio Amended Return Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Ohio Amended Return Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2012 ohio amended return form

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ohio Amended Return Form?

The Ohio Amended Return Form is a document used by taxpayers in Ohio to correct their previously filed state income tax returns. It allows individuals to amend errors, claim deductions, or report additional income. Completing this form ensures that your tax records are accurate and that you comply with state regulations.

-

How can I complete the Ohio Amended Return Form with airSlate SignNow?

Using airSlate SignNow, you can easily complete the Ohio Amended Return Form by uploading your existing tax documents and filling in the necessary details online. Our intuitive interface allows for smooth navigation and editing, ensuring that your amended return is accurate. Plus, with our eSignature feature, you can sign off on your document instantly.

-

Is there a cost associated with using the Ohio Amended Return Form on airSlate SignNow?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing the Ohio Amended Return Form. Depending on your needs, you can choose from plans that fit individual users or businesses. We provide a free trial, so you can explore the features before committing to a subscription.

-

Can I track my Ohio Amended Return Form after submitting it?

Yes, airSlate SignNow allows you to track the status of your Ohio Amended Return Form after submission. You will receive notifications regarding any changes or updates. This transparency keeps you informed and provides peace of mind throughout the amendment process.

-

What features does airSlate SignNow offer for Ohio Amended Return Form users?

airSlate SignNow provides a range of features for users of the Ohio Amended Return Form, including easy document editing, eSigning, and collaboration tools. You can invite others to review your document, making real-time adjustments. Our platform also supports secure sharing to protect sensitive information.

-

Can I integrate airSlate SignNow with other software for my Ohio Amended Return Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow. Whether you need to connect with accounting software or document storage solutions, our integration capabilities enhance your experience with the Ohio Amended Return Form.

-

How does airSlate SignNow ensure the security of my Ohio Amended Return Form?

Security is a priority at airSlate SignNow. We utilize advanced encryption and multiple layers of security protocols to protect your Ohio Amended Return Form and personal information. Plus, our platform is compliant with industry standards, ensuring your data remains safe at all times.

Get more for Ohio Amended Return Form

Find out other Ohio Amended Return Form

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed