Champaign Food Beverage Tax Form

What is the Champaign Food Beverage Tax

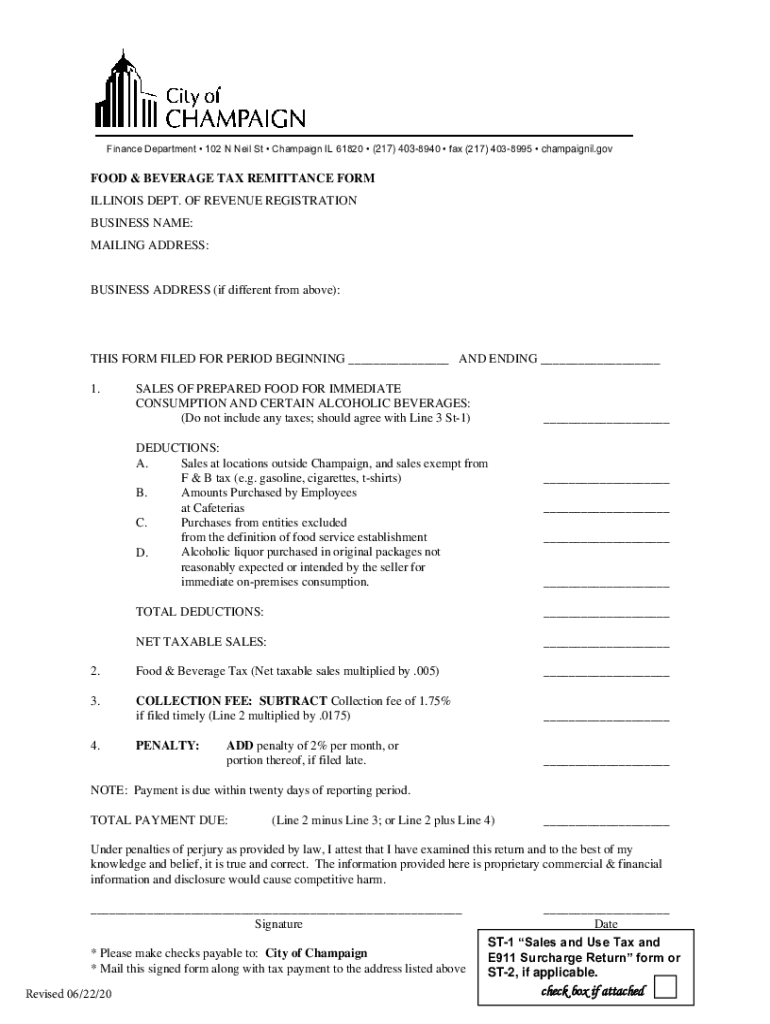

The Champaign Food Beverage Tax is a local tax imposed on the sale of food and beverages within the city of Champaign, Illinois. This tax is part of the city's efforts to generate revenue for public services and infrastructure. It applies to various establishments, including restaurants, cafes, and grocery stores, impacting both consumers and businesses. Understanding this tax is essential for compliance and effective financial planning for businesses operating in the area.

Steps to complete the Champaign Food Beverage Tax

Completing the Champaign Food Beverage Tax involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data, including total food and beverage sales for the reporting period. Next, calculate the tax owed by applying the appropriate tax rate to the total sales. After calculating the tax, fill out the required Champaign tax form with accurate information. Finally, submit the completed form along with any payment by the designated deadline to avoid penalties.

Legal use of the Champaign Food Beverage Tax

The legal use of the Champaign Food Beverage Tax is governed by local ordinances and state laws. Businesses must ensure they are collecting the correct amount of tax from customers and remitting it to the city. Compliance with these regulations is crucial, as failure to do so can result in penalties or legal repercussions. It is advisable for businesses to stay informed about any changes in tax rates or regulations to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Champaign Food Beverage Tax are critical for businesses to adhere to in order to avoid late fees. Typically, the tax must be filed quarterly, with specific due dates set by the city. It is important for businesses to keep track of these dates and plan accordingly to ensure timely submission. Missing a deadline can lead to additional penalties, so maintaining an organized calendar is beneficial.

Required Documents

To successfully file the Champaign Food Beverage Tax, businesses must prepare and submit specific documents. This includes the completed Champaign tax form, detailed sales records, and any supporting documentation that may be required by the city. Having accurate and organized records is essential for a smooth filing process and can help in case of audits or inquiries from tax authorities.

Penalties for Non-Compliance

Non-compliance with the Champaign Food Beverage Tax regulations can result in significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand their obligations and ensure timely and accurate filings to avoid these consequences. Regular training and updates on tax regulations can help businesses stay compliant.

Who Issues the Form

The Champaign Food Beverage Tax form is issued by the City of Champaign's Finance Department. This department is responsible for managing the collection of taxes and ensuring compliance with local tax laws. Businesses can obtain the form directly from the city’s official website or by contacting the Finance Department for assistance. Understanding where to access the form is an important step in the filing process.

Quick guide on how to complete champaign food beverage tax

Complete Champaign Food Beverage Tax effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Champaign Food Beverage Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Champaign Food Beverage Tax without hassle

- Locate Champaign Food Beverage Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Champaign Food Beverage Tax and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the champaign food beverage tax

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the il champaign food beverage tax and how does it affect my business?

The il champaign food beverage tax is a municipal tax that applies to food and beverage sales in Champaign, Illinois. This tax may affect pricing structures and ultimately impact your profit margins. Understanding this tax is crucial for compliance and for accurately calculating the total costs for your customers.

-

How can airSlate SignNow help me manage documents related to the il champaign food beverage tax?

With airSlate SignNow, you can easily prepare, send, and eSign documents related to the il champaign food beverage tax. Our platform streamlines the process by providing templates that ensure compliance and simplify record-keeping, allowing you to focus on your business.

-

Is airSlate SignNow cost-effective for small businesses dealing with the il champaign food beverage tax?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to manage the il champaign food beverage tax documentation. Our pricing tiers cater to various business sizes and needs, ensuring you get excellent value while remaining compliant with local tax regulations.

-

What features does airSlate SignNow provide to handle tax-related documents?

AirSlate SignNow offers features such as customizable templates, real-time collaboration, and advanced security options to manage tax-related documents effectively. These features are particularly beneficial for navigating the complexities of the il champaign food beverage tax, ensuring your documents are accurate and secure.

-

Can I integrate airSlate SignNow with my existing accounting systems for il champaign food beverage tax compliance?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and ERP systems. This integration allows for streamlined document handling and ensures that all transactions involving the il champaign food beverage tax are accurately documented and recorded.

-

How does airSlate SignNow ensure compliance with the il champaign food beverage tax regulations?

airSlate SignNow provides tools that help ensure compliance with the il champaign food beverage tax regulations by offering templates specifically designed for financial transactions. Our platform helps you maintain accurate records, making it easier to file and manage taxes associated with food and beverage sales.

-

What are the benefits of using airSlate SignNow to address the il champaign food beverage tax?

The benefits of using airSlate SignNow include enhanced efficiency and cost savings when managing the paperwork associated with the il champaign food beverage tax. Our user-friendly platform reduces time spent on document management and improves accuracy, leading to better compliance and less risk of tax-related issues.

Get more for Champaign Food Beverage Tax

Find out other Champaign Food Beverage Tax

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF