Alaska Extension Tax Form

What is the Alaska Extension Tax

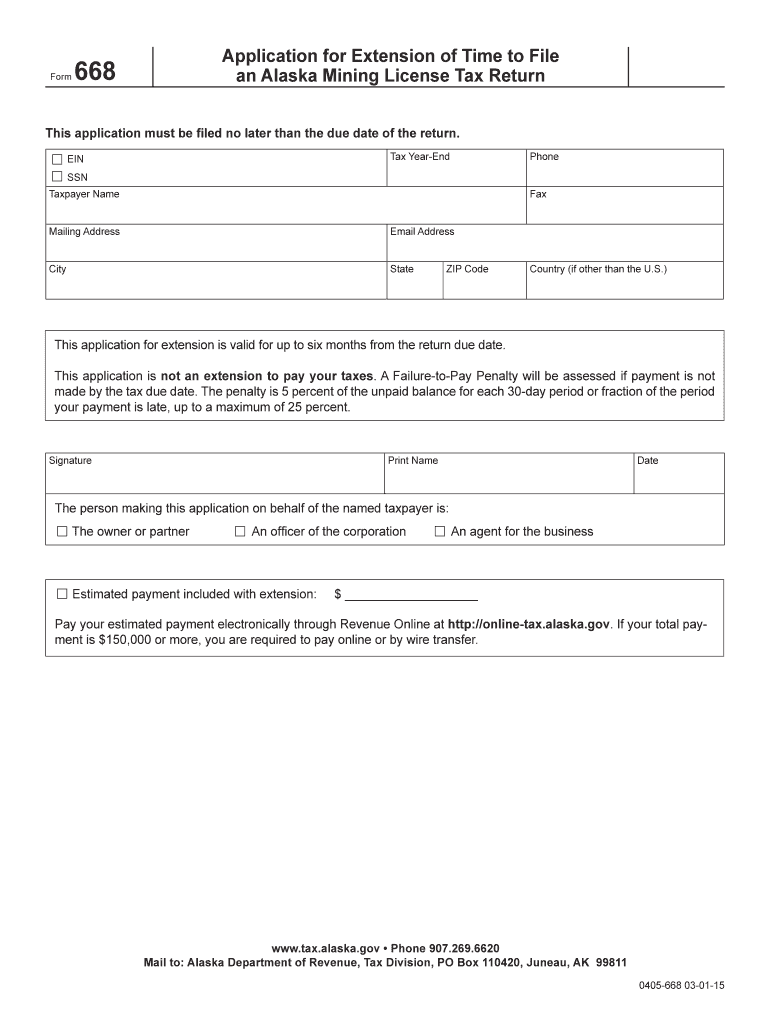

The Alaska extension tax form allows taxpayers to request an extension for filing their state income tax returns. This form is essential for individuals and businesses who need additional time to prepare their tax documentation. By submitting this form, taxpayers can avoid penalties for late filing while ensuring they have adequate time to gather necessary financial information. It is important to note that an extension to file does not extend the time to pay any taxes owed.

Steps to complete the Alaska Extension Tax

Completing the Alaska extension tax form involves several straightforward steps:

- Gather necessary information, including your Social Security number or Employer Identification Number (EIN).

- Determine your estimated tax liability for the year to ensure you pay any taxes owed by the original deadline.

- Fill out the extension form accurately, providing all required details.

- Submit the form electronically or by mail, depending on your preference and the method allowed by the state.

- Keep a copy of the submitted form for your records, along with any payment receipts.

Legal use of the Alaska Extension Tax

The Alaska extension tax form is legally recognized when it meets specific requirements. To ensure its validity, the form must be completed accurately and submitted on time. Furthermore, using a reliable platform for electronic submission can enhance the legal standing of the document. Compliance with state laws and regulations is critical, as failure to adhere to these can result in penalties or denial of the extension.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers. The Alaska extension tax form must typically be submitted by the original due date of the tax return. For most individuals, this date falls on April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to check for any updates or changes to these dates each tax year.

Required Documents

When filing the Alaska extension tax form, certain documents are necessary to ensure accurate completion. These may include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Any relevant financial statements that support your estimated tax liability.

Who Issues the Form

The Alaska extension tax form is issued by the Alaska Department of Revenue. This state agency is responsible for managing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax preparation services. It is important to use the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete alaska extension tax

Easily Prepare Alaska Extension Tax on Any Gadget

Digital document management has gained signNow traction among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage Alaska Extension Tax on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Alaska Extension Tax Effortlessly

- Obtain Alaska Extension Tax and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Alaska Extension Tax to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alaska extension tax

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the alaska extension and how does it work?

The alaska extension is an innovative feature that allows users to seamlessly eSign documents tailored for Alaskan businesses. It integrates directly into your existing workflows, enabling you to send, sign, and manage documents electronically. This helps save time and streamline operations, especially for businesses operating in Alaska.

-

How much does the alaska extension cost?

The alaska extension is available at competitive pricing tiers that cater to different business needs. Depending on the plan you choose, you can benefit from various features that enhance your document signing experience. Additionally, we offer a free trial to explore the alaska extension before making a long-term commitment.

-

What features are provided by the alaska extension?

The alaska extension offers a range of features including customizable templates, real-time tracking, and multi-signature capabilities. It's designed to simplify the eSigning process for businesses in Alaska while ensuring security and compliance. These features make managing documents more efficient and user-friendly.

-

What benefits does the alaska extension offer for businesses?

The alaska extension enhances business productivity by reducing the time spent on document handling and approvals. By facilitating quick eSigning capabilities, businesses in Alaska can improve turnaround times and boost operational efficiency. This ultimately leads to better customer service and satisfaction.

-

Can the alaska extension integrate with other software?

Yes, the alaska extension is designed to integrate seamlessly with various CRM, accounting, and project management tools used by businesses in Alaska. This integration ensures that your workflows remain uninterrupted while maximizing productivity and efficiency. You can easily manage documents without switching between different applications.

-

Is the alaska extension secure for sensitive documents?

Absolutely! The alaska extension employs advanced security measures including data encryption and secure user authentication to protect sensitive information. This ensures that all eSigned documents and personal data are kept safe, making it a reliable choice for businesses handling confidential documents in Alaska.

-

How does the alaska extension improve the document signing process?

The alaska extension streamlines the document signing process by eliminating the need for printing, scanning, and mailing. Users can eSign documents from anywhere, using any device, which signNowly reduces delays. This convenience contributes to faster transaction times, an essential factor for businesses operating in Alaska.

Get more for Alaska Extension Tax

Find out other Alaska Extension Tax

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy