Massachusetts Performing Entity

What is the Massachusetts Performing Entity

The Massachusetts Performing Entity refers to a specific classification for individuals or organizations that perform services in Massachusetts and are subject to state tax regulations. This designation is crucial for tax purposes, particularly for those who receive payments for performances, such as artists, musicians, and other entertainers. Understanding this classification helps ensure compliance with state tax laws and proper withholding of taxes from payments received.

Steps to complete the Massachusetts Performing Entity

Completing the Massachusetts Performing Entity form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information: Collect personal identification details, including your Social Security number or Employer Identification Number (EIN), and any relevant financial information related to your performances.

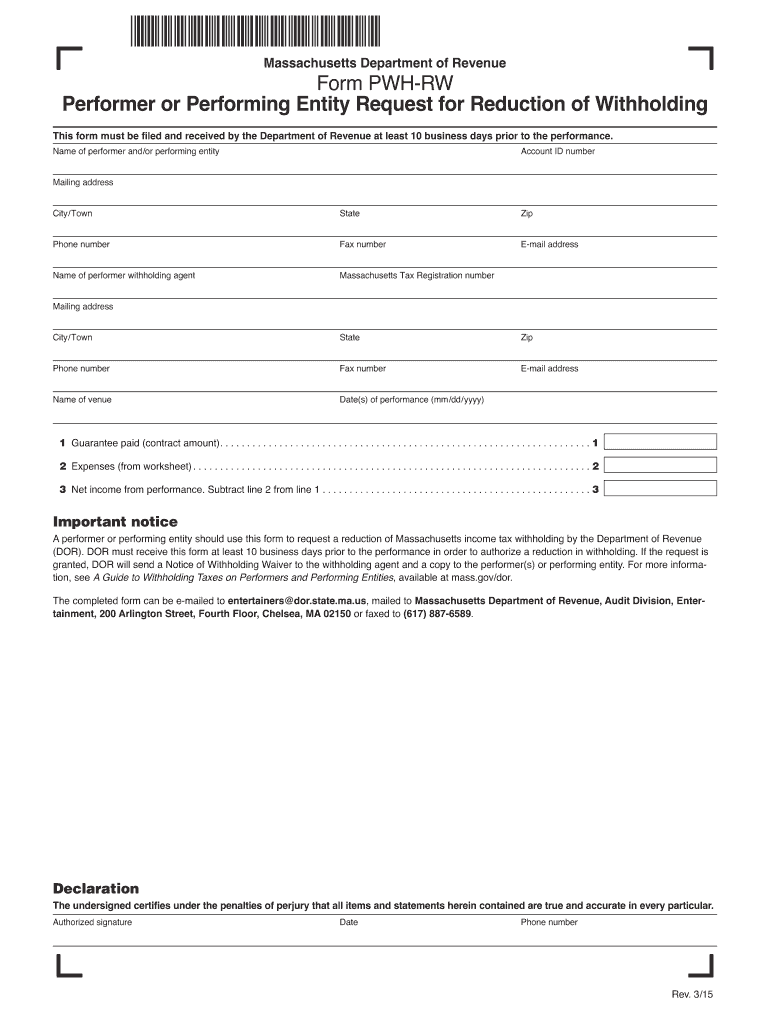

- Access the form: Obtain the Massachusetts form PWH RW, which is specifically designed for performing entities to report their income and withholding information.

- Fill out the form: Carefully complete all required fields, ensuring that the information provided is accurate and up-to-date. Pay special attention to sections related to income and deductions.

- Review and verify: Double-check all entries for accuracy to avoid potential issues with the Massachusetts Department of Revenue.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure that it is sent by the appropriate deadline.

Legal use of the Massachusetts Performing Entity

The legal use of the Massachusetts Performing Entity designation is essential for compliance with state tax laws. This form ensures that the appropriate taxes are withheld from payments made to performing entities. By using this form, performers can avoid potential legal issues related to underreporting income or failing to comply with state tax regulations. Additionally, maintaining accurate records and submitting the form correctly helps protect performers from penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Performing Entity form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by specific dates aligned with the tax year. It is essential to stay informed about these deadlines, which may vary based on the type of entity and the nature of the performances. Mark your calendar for important dates to ensure timely submission and compliance with Massachusetts tax regulations.

Required Documents

To complete the Massachusetts Performing Entity form, certain documents are required. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Financial records related to performances, including contracts and payment receipts.

- Any prior tax documents that may be relevant to your current filing.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Who Issues the Form

The Massachusetts Performing Entity form is issued by the Massachusetts Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that all entities operating within Massachusetts adhere to state tax laws. By obtaining the form from the official department, performers can ensure they are using the most current version and following the correct procedures for filing.

Quick guide on how to complete massachusetts performing entity

Complete Massachusetts Performing Entity seamlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delay. Handle Massachusetts Performing Entity on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The easiest method to modify and eSign Massachusetts Performing Entity effortlessly

- Locate Massachusetts Performing Entity and click Get Form to begin.

- Use the tools at your disposal to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Forget about misplaced or lost documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Massachusetts Performing Entity and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts performing entity

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the pwh rw feature of airSlate SignNow?

The pwh rw feature in airSlate SignNow allows users to electronically sign documents with ease, ensuring a quick and efficient signing process. This feature streamlines workflows by reducing the time and effort needed to get signatures, making it an essential tool for businesses.

-

How much does airSlate SignNow cost for pwh rw services?

Pricing for airSlate SignNow's pwh rw services varies based on the selected plan, catering to different business needs. You can choose from monthly or annual subscriptions, with competitive rates to ensure you get the best value for your eSigning requirements.

-

What benefits does the pwh rw feature provide for businesses?

Utilizing the pwh rw feature helps businesses enhance efficiency by minimizing the time it takes to obtain signatures. This not only accelerates document turnaround times but also improves overall customer satisfaction, allowing businesses to focus on core activities rather than paperwork.

-

Can I integrate pwh rw with other platforms?

Absolutely! airSlate SignNow offers seamless integrations with numerous platforms, enabling users to implement the pwh rw feature alongside tools they already use. This flexibility ensures that your document signing and management processes are as efficient as possible.

-

Is the pwh rw feature secure for sensitive documents?

Yes, the pwh rw feature of airSlate SignNow is designed with advanced security measures, including encryption and authentication processes to protect sensitive information. This ensures that your documents remain confidential and secure throughout the signing process.

-

How does pwh rw improve workflow efficiency?

The pwh rw feature simplifies and automates the document signing process, signNowly reducing the time spent on manual tasks. By allowing users to send, sign, and manage documents from a single platform, airSlate SignNow enhances overall workflow efficiency and productivity.

-

Are there mobile capabilities for the pwh rw feature?

Yes, airSlate SignNow's pwh rw feature is fully functional on mobile devices, allowing users to sign documents on the go. This mobile accessibility ensures that you can manage and send documents anytime, anywhere, making it incredibly convenient.

Get more for Massachusetts Performing Entity

Find out other Massachusetts Performing Entity

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online