Wh 4 2008-2026

What is the WH-4?

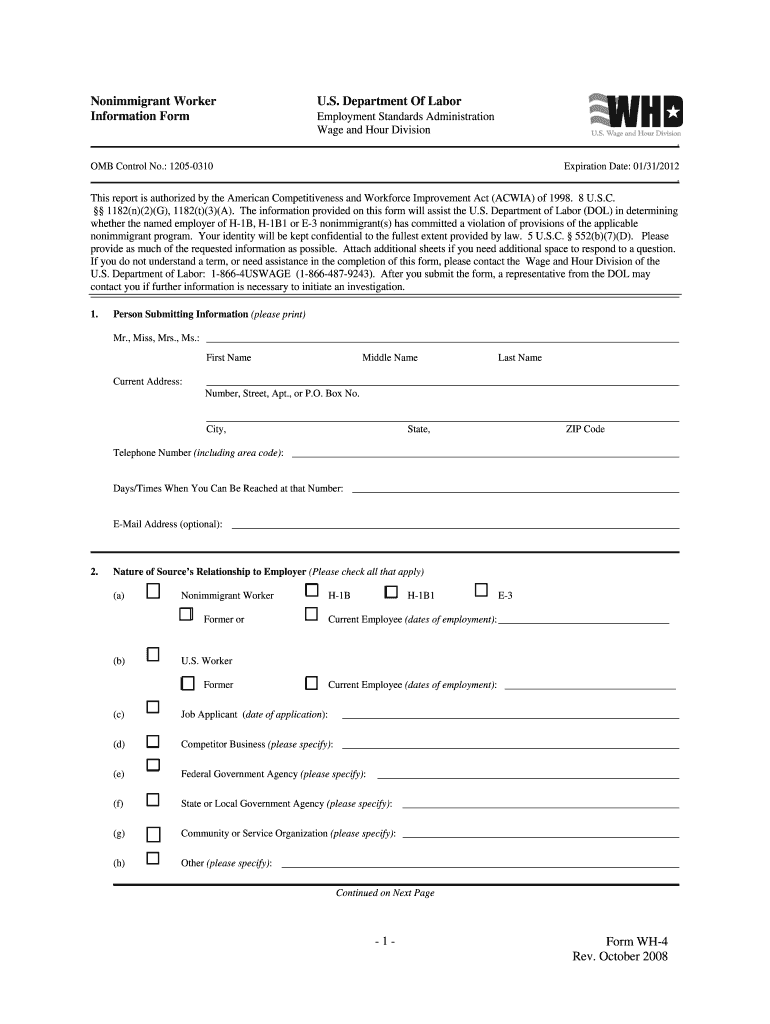

The WH-4 form is a state-specific tax form used in Indiana for withholding exemption purposes. It allows employees to claim exemptions from state income tax withholding based on their individual tax situation. This form is essential for ensuring that the correct amount of state income tax is withheld from an employee's paycheck, helping to prevent over-withholding or under-withholding throughout the tax year.

How to Use the WH-4

Using the WH-4 form involves a straightforward process. Employees must fill out the form accurately, providing necessary personal information, including their name, address, and Social Security number. Additionally, they should indicate the number of exemptions they are claiming. Once completed, the form should be submitted to the employer's payroll department, which will adjust the tax withholding accordingly. It is important to review the form annually or whenever there is a significant change in personal circumstances, such as marriage or the birth of a child.

Steps to Complete the WH-4

Completing the WH-4 form requires attention to detail. Here are the steps to follow:

- Obtain the WH-4 form from your employer or download it from the Indiana Department of Revenue website.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Determine the number of exemptions you are eligible to claim based on your personal situation.

- Sign and date the form to certify that the information provided is correct.

- Submit the completed form to your employer's payroll department.

Legal Use of the WH-4

The WH-4 form must be used in accordance with Indiana state law. Employers are required to honor the exemptions claimed on the form unless they have reason to believe the information is inaccurate. It is crucial for employees to ensure that they are eligible for the exemptions they claim to avoid potential legal issues or penalties. The form must be updated whenever there are changes in personal circumstances that affect tax withholding.

Filing Deadlines / Important Dates

While the WH-4 form itself does not have a specific filing deadline, it should be submitted to your employer as soon as possible, especially if you are starting a new job or experiencing a change in your tax situation. Employers typically need this information at the beginning of each tax year to ensure proper withholding. It is advisable to review and submit a new WH-4 form annually or whenever significant life changes occur.

Who Issues the Form

The WH-4 form is issued by the Indiana Department of Revenue. This state agency is responsible for overseeing tax regulations and ensuring compliance with state tax laws. Employers and employees can obtain the form directly from the department's website or through their employer's human resources department.

Quick guide on how to complete wh 4 form

Discover the easiest method to complete and endorse your Wh 4

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior alternative to finish and sign your Wh 4 and associated forms for public services. Our intelligent eSignature solution equips you with all you require to handle paperwork swiftly and in compliance with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing features readily available within a user-friendly interface.

Only a few steps are needed to complete to fill out and endorse your Wh 4:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Wh 4.

- Move between the sections using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Refine the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly important or Redact sections that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any method you prefer.

- Add the Date next to your signature and finalize your task with the Done button.

Store your completed Wh 4 in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your templates when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

Create this form in 5 minutes!

How to create an eSignature for the wh 4 form

How to generate an electronic signature for the Wh 4 Form online

How to create an eSignature for the Wh 4 Form in Google Chrome

How to generate an eSignature for signing the Wh 4 Form in Gmail

How to make an electronic signature for the Wh 4 Form from your mobile device

How to create an electronic signature for the Wh 4 Form on iOS

How to generate an eSignature for the Wh 4 Form on Android

People also ask

-

What is Wh 4 and how does it relate to airSlate SignNow?

Wh 4 refers to the fourth generation of workflows that enhance document management processes. With airSlate SignNow, businesses can leverage Wh 4 capabilities to streamline their eSigning and document sending, increasing efficiency and reducing errors.

-

How much does airSlate SignNow cost in relation to Wh 4 features?

airSlate SignNow offers various pricing plans that include essential Wh 4 features designed for businesses of all sizes. These plans are cost-effective, ensuring that you get advanced document management tools without breaking the bank.

-

What key features of airSlate SignNow support Wh 4 functionality?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking which all support the Wh 4 functionality. These tools work together to make document signing and management simpler and more efficient for users.

-

Can I integrate airSlate SignNow with other applications using Wh 4?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the Wh 4 experience. This allows businesses to synchronize their document workflows across platforms, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Wh 4 workflows?

Using airSlate SignNow for Wh 4 workflows provides businesses with enhanced speed, accuracy, and security in document transactions. Additionally, it reduces the reliance on paper documents, promoting a more sustainable approach to business operations.

-

Is there a free trial available for airSlate SignNow focusing on Wh 4 features?

Yes, airSlate SignNow offers a free trial that allows you to explore its Wh 4 features without any commitment. This gives prospective customers the opportunity to evaluate how these features can benefit their specific document workflows.

-

How secure is airSlate SignNow when using Wh 4?

airSlate SignNow prioritizes security, especially with Wh 4 workflows. It implements advanced encryption and compliance measures to ensure that all documents and signatures are protected from unauthorized access.

Get more for Wh 4

Find out other Wh 4

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile